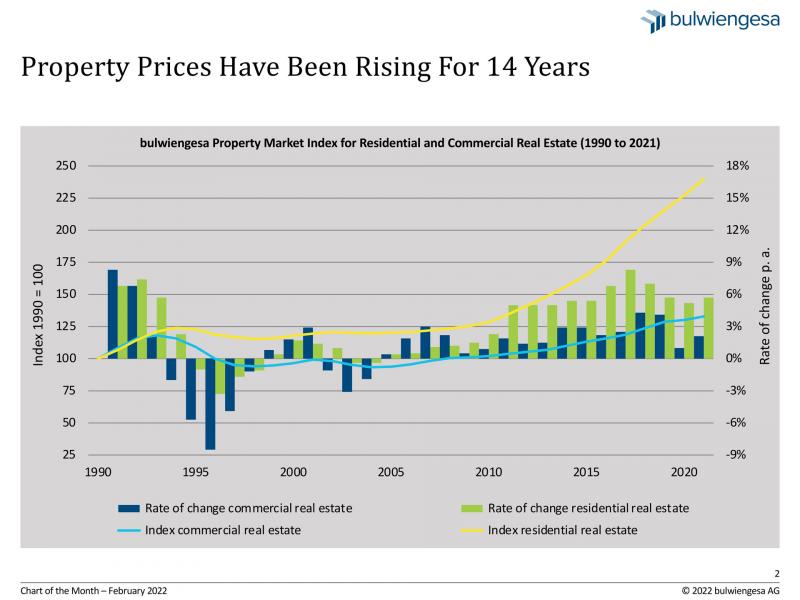

February: No bend, on the contrary

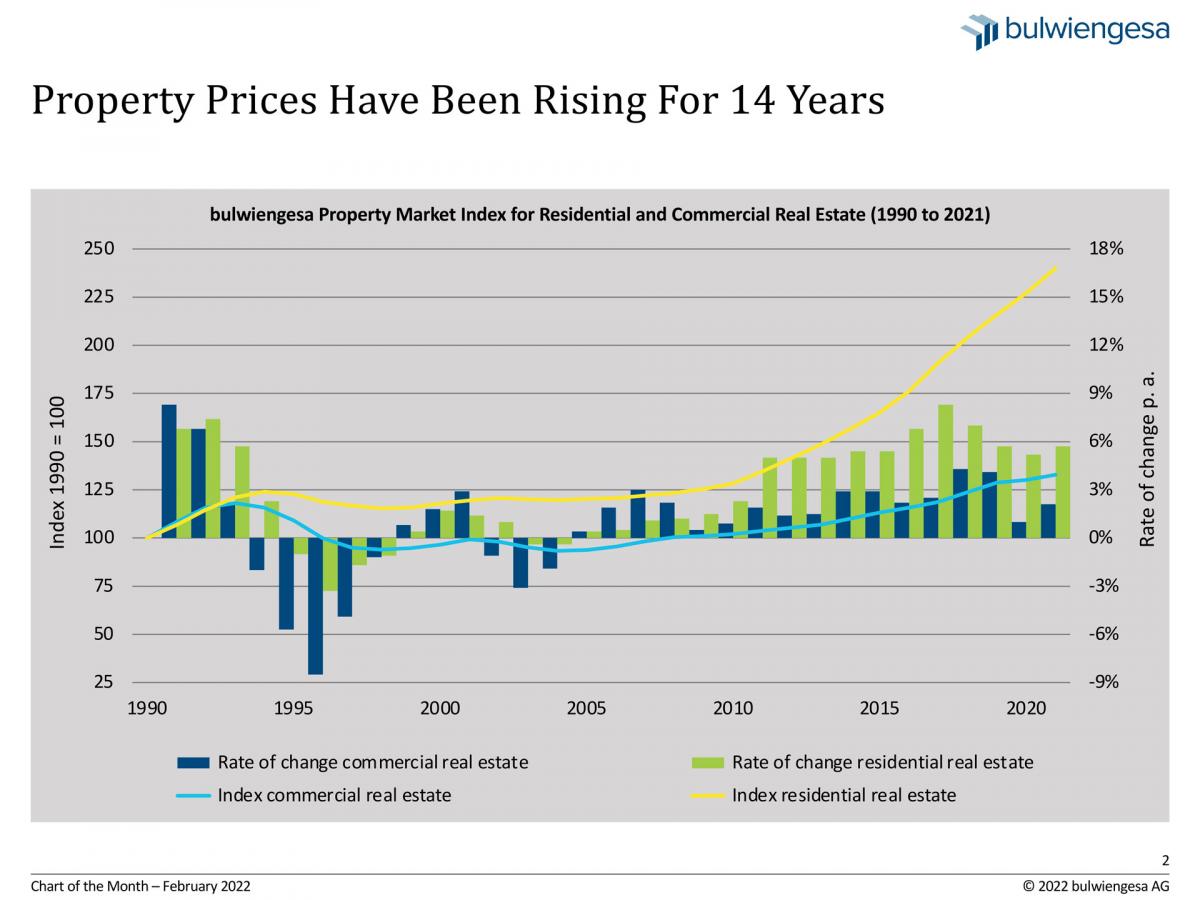

Property prices have been rising in Germany for 17 years - without interruption. Compared to the previous year, growth has even increased again in 2021, to 4.6 percent. However, the differences between the segments are large.

The bulwiengesa Property Market Index 2022 presented today describes the development of real estate prices in Germany for the 46th time in a row. The methodology and the long series in which the bulwiengesa Real Estate Index is collected make it an important indicator for sustainable decisions in the real estate market, urban development and monetary policy. Among other things, the data flow into the price indices of the Deutsche Bundesbank.

The chart of the month shows impressively: even the corona-induced ups and downs of the economy for the past two years have only led to partially falling prices. In 2021, the plus in the residential segment in particular has increased once again.

In the commercial sector we see two divergent developments: On the one hand, retail rents are coming under pressure, on the other hand, rents and land prices are rising for office and logistics uses. Overall, the rates of change in the property index are comparable to those from 2014 and 2015, but do not reach the top years of 2016 to 2019. Among all the commercial variables analysed, it is the prices for commercial land that are rising the most: by 7.4 per cent. Already since 2009, land prices have become continuously more expensive and are in principle a reflection of the current economic model and the framing urban and regional development. Consumption requires space (production facilities, distribution centres, storage facilities), and this space is becoming increasingly scarce. It is becoming increasingly difficult to designate new land, taking into account the need to reduce new sealing of land.

And where do we go from here? The goal of climate neutrality will require cost-intensive new buildings and transformations in the existing stock. Together with a high demand for real estate, we expect prices to continue to rise in the coming years.

Note: Further information can be found here.

Contact: Jan Finke, Project Manager Property Market Index and Branch Manager Essen, finke@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.