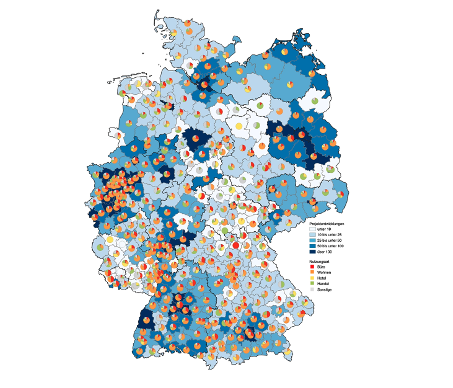

Development Monitor: Wo wird was von wem gebaut?

Auf Basis der Daten aus unserem Development Monitor werden die aktuellen Trends auf dem Projektentwicklermarkt beleuchtet und analysiert. Die Assetklasse Büro stand beim aktuellen Webinar im Fokus. Fast 600 Interessierte hatten sich angemeldet. Hier geht es zur Aufzeichnung und Zusammenfassung.

Die Fakten unserer Auswertung auf einen Blick

Gesamtprojektvolumen: 23.387 Projekte, 186 Mio. qm Fläche.

Nutzungsarten (Flächenwachstum):

- Wohnflächen: +0,9 %

- Büroflächen: -7,0 %

- Logistikflächen: +1,4 %

- Handelsflächen: +1,6 %

Wohnsegment: Hohe Nachfrage in A- und B-Städten, aber schrumpfendes Volumen. Ländliche Regionen zeigen Wachstum, könnten aber zu optimistisch erscheinen.

Logistiksegment: Stabil mit +1,4 %

Bürosegment: Rückgang von 13,5 % seit 2022, - 7 % gegenüber 2023, Baustarts - 68 %. A-Städte bleiben gefragt, B-Städte stark betroffen.

Seniorenwohnen: Wachsende Bedeutung durch demografischen Wandel.

Bestandsmaßnahmen: 26 % des Bürovolumens in Sanierungen, Nachhaltigkeits-Anforderungen treiben die Entwicklung.

Regionale Unterschiede: A-Städte mit moderaten Rückgängen, B-Städte stark betroffen, Wachstum in ländlichen Regionen (Wohn- und Handelsflächen).

Zukunftsperspektiven: Logistik und Top-Lagen stabil, Büroflächen müssen aufgewertet werden, Bestandsmaßnahmen spielen eine Schlüsselrolle.

Die Aufzeichnung des Webinars können Sie hier anschauen.

Ansprechpartnerin: Birgit Haase, Managerin Unternehmenskommunikation und Marketing bei bulwiengesa, haase@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

Little movement on the German real estate market

For the eleventh time, bulwiengesa presents its comprehensive analysis of the German real estate markets. The results of this year's 5% study, conducted in collaboration with ADVANT Beiten, show that the German real estate market is characterized by widespread stagnation. At the same time, niche segments are becoming increasingly attractive. The market is increasingly rewarding professional asset management and specialist knowledge—a trend that separates the wheat from the chaffFive per cent returns no longer illusory even for core properties

The ‘5% study - where investing is still worthwhile’ celebrates its tenth anniversary. Since the first edition was published, the German property market has tarnished its reputation as a safe investment haven. Higher yields are now within sight, even for prime properties, and even residential property is increasingly becoming a profitable asset class again. The market is more exciting than it has been for a long timeRefurbishment of offices - what is the status?

Around a third of office space in the seven A cities is in need of refurbishment. But things are happening - especially where rents are high. This is shown by the first apoprojekt stock compassInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.