Chart of the Month February: Mixed Mood in the Hotel Market

Overnight stays recovered in 2022, with demand in German resorts again high. Nevertheless, the mood in the German hotel real estate market is mixed. Many households are saving, possibly also on holidays. At least tourism is finally returning to the cities.

As in 2020 and 2021, tourism demand in Germany in 2022 was concentrated in rural holiday regions. In many cases, these were more heavily booked in the summer months than before the crisis, although in some areas of Germany the return of Germans' desire to travel abroad was already noticeable. In the region of "Mecklenburg Switzerland and Lake District", overnight stays were still above pre-Corona levels, but almost 12 % below the boom year of 2021. And in view of declining purchasing power and some concerns about the future, it is to be expected that especially lower-income households will have to save on and during their holidays this year.

On the other hand, in contrast to 2021, tourism slowly returned to Germany's cities - especially to cities with high recreational value. Among the major cities, the two cities of Hamburg and Leipzig stood out in particular, coming almost close to the overnight stays of 2019 by the end of October 2022. In contrast, Frankfurt am Main, Stuttgart and Berlin still lacked more than a fifth of the overnight volume of 2019 by the end of October. And since numerous new hotels have opened in the major cities in the last two years in particular and the MICE business and tourist demand from abroad are still weak, the hotel industry will continue to struggle there for the time being. Hotels in medium-sized cities, where the competition is (still) manageable and which have a good leisure infrastructure, have better prospects.

However, it will take some time before normality is achieved, as staff shortages and rising operating costs for the hotel industry cannot be solved so quickly and the prospects for geopolitical stability in Europe are extremely uncertain. Thus, the situation in the German hotel industry - despite rising and smoothing demand effects - will remain tense in 2023.

Contact: Dierk Freitag, Head of Hotel and Leisure Real Estate at bulwiengesa, freitag@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

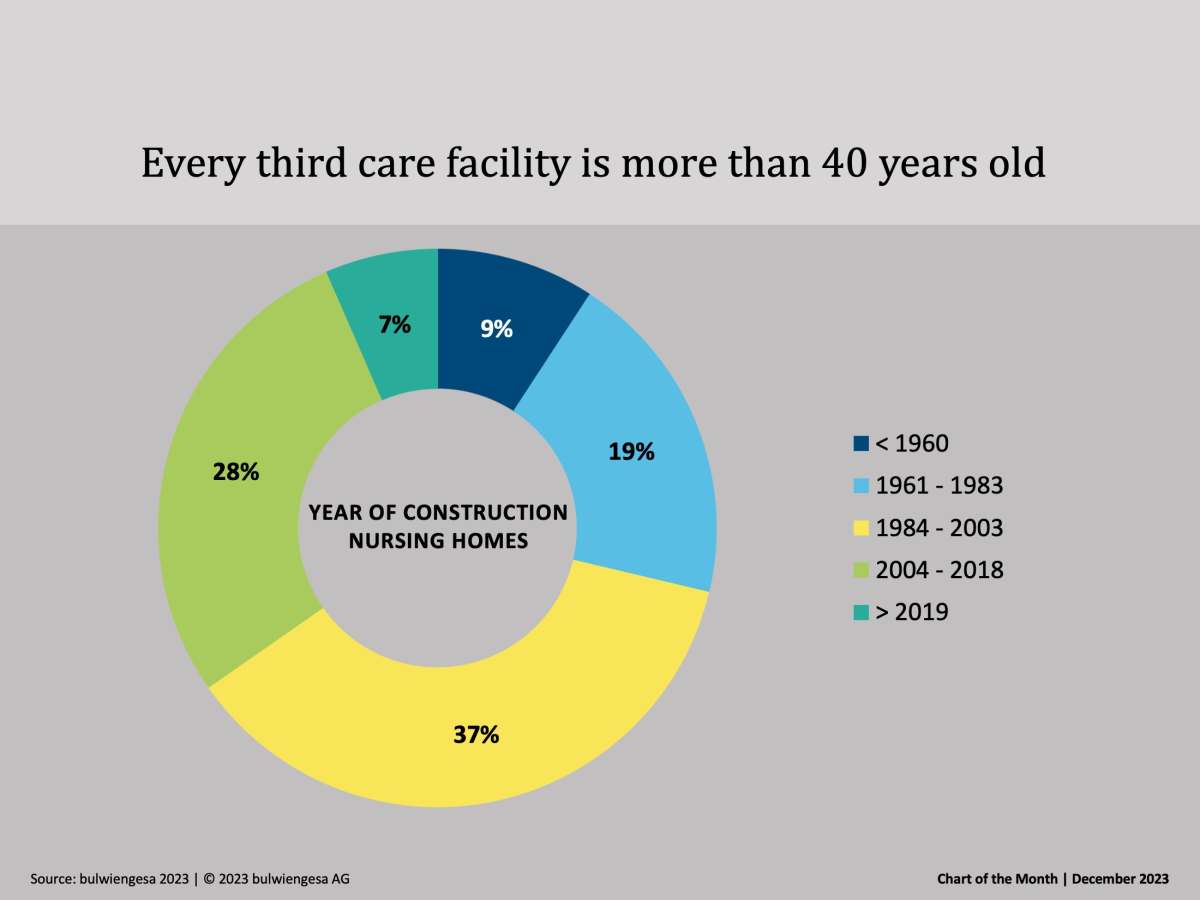

Chart of the month December: The country needs new care properties

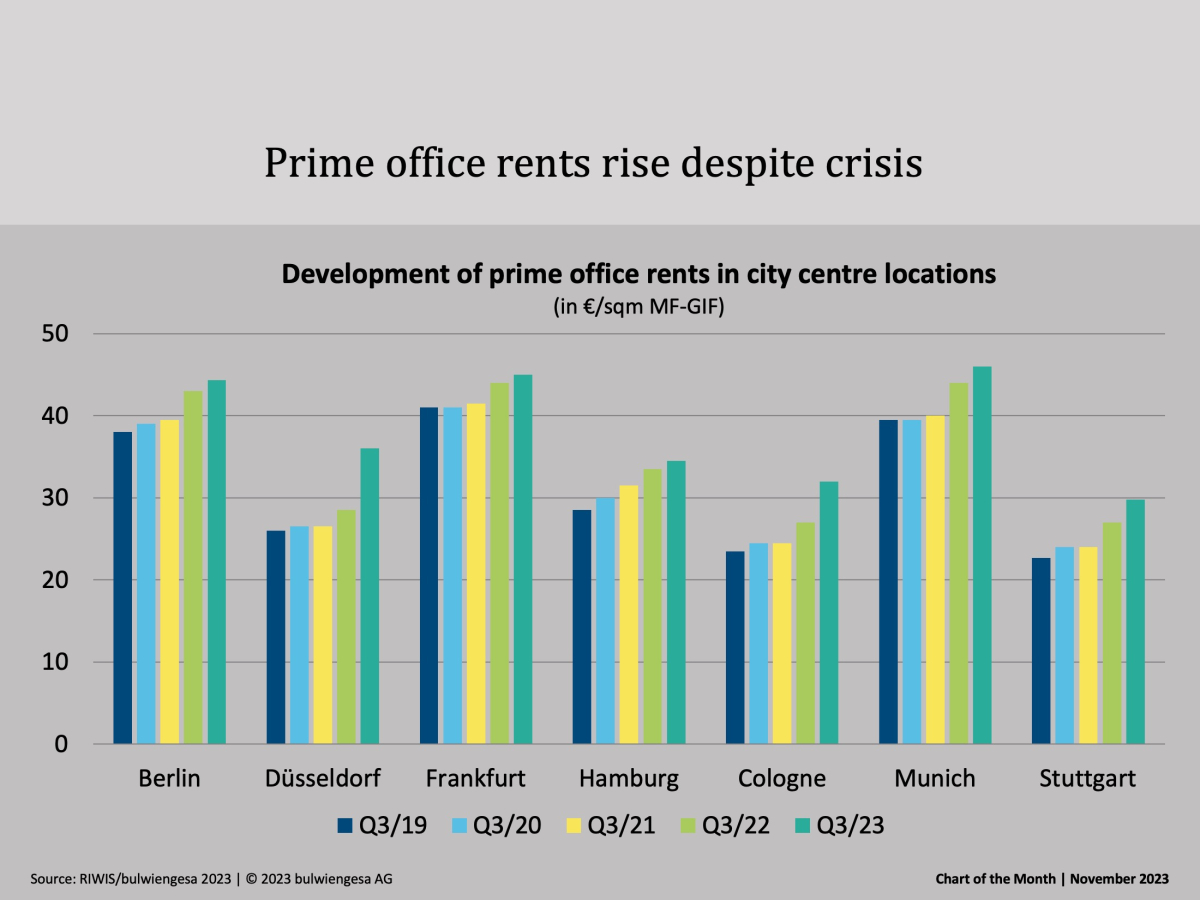

Many care homes are no longer up to date - no one wants "care centres" any more, and building standards have changed fundamentally. Therefore, when planning the care infrastructure, not only the additional need for care places, but also the need for substitution must be taken into account.Chart of the month November: Top offices are still in demand

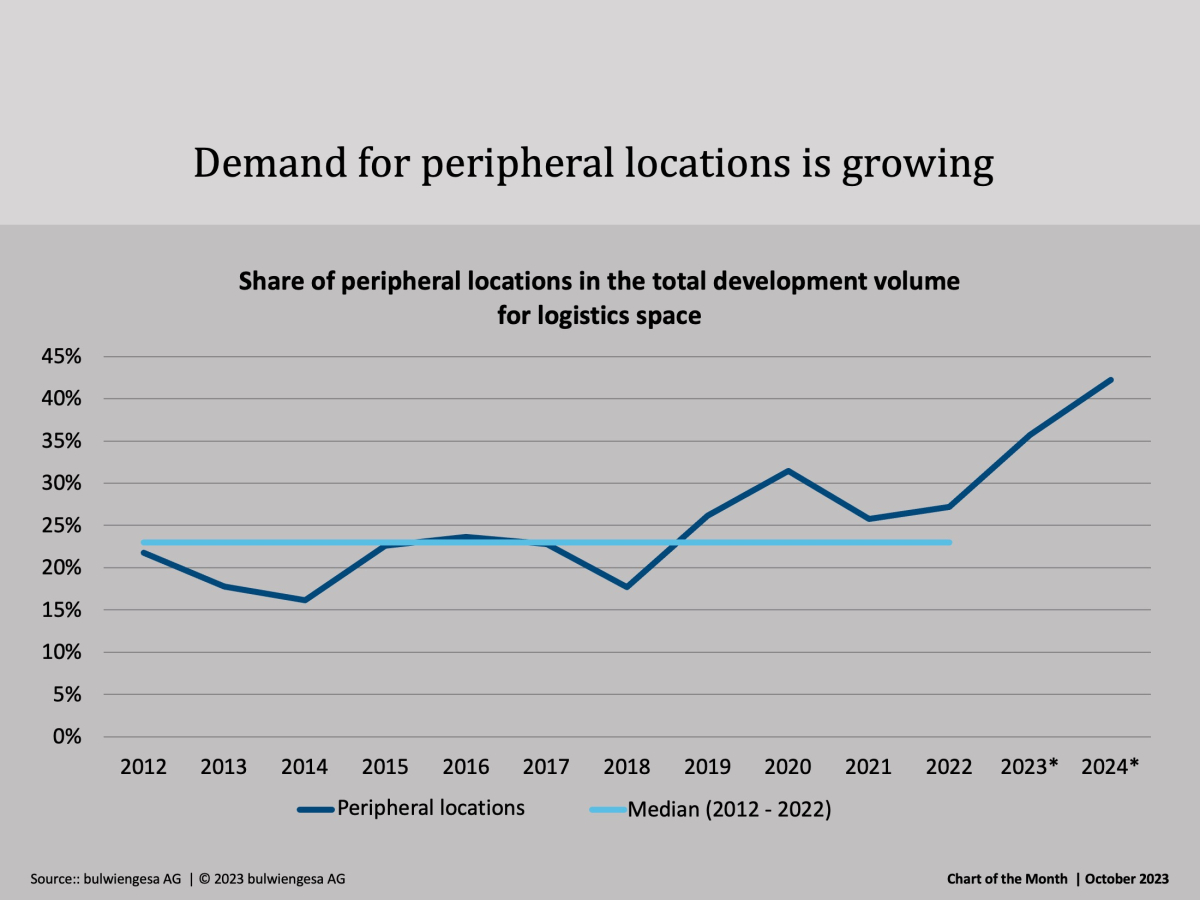

Office vacancies are increasing in the seven class A cities. According to classic economic theory, rents should therefore be falling. But our quarterly figures show: Prime rents are still risingChart of the Month October: Boom in the peripheral locations

The recently published study "Logistics and Real Estate 2023" shows: former "second-tier" regions are increasingly in demand - even those outside the classic logistics regions. And the trend is continuingInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.