Chart of the Month December: Office market better than expected

In the coming years, high volumes of newly completed offices will again come onto the market. Vacancy rates are rising, but not to a critical extent. Landlords and tenants can once again negotiate at eye level.

Despite several crises, the office market has proven to be surprisingly robust. Only the investment market has become quieter - the price expectations of sellers and buyers often do not come together, the finding phase continues.

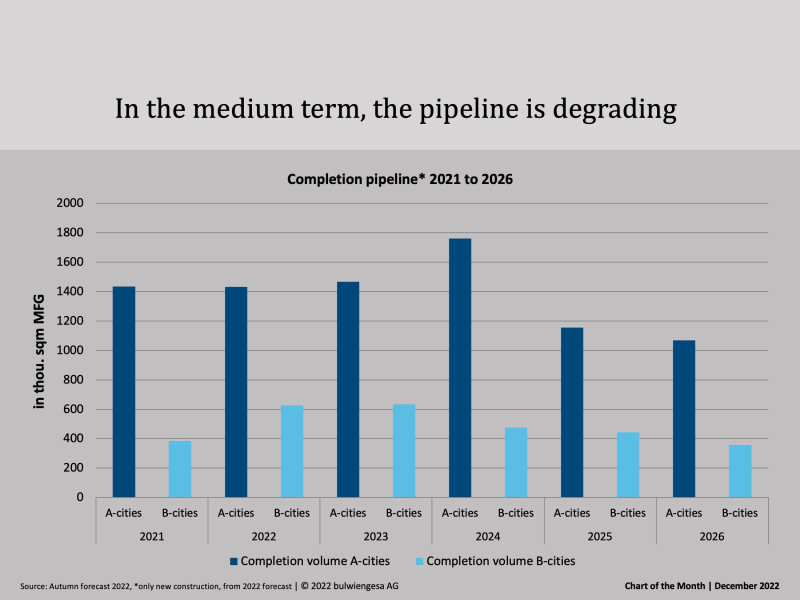

A look at the demand side shows that the number of office employees in the A and B cities has not declined, on the contrary. In the A-cities it will continue to rise over the next four years, only in the B-cities will growth flatten out. However, in the still smaller cities, demographic change will partly cause a decline in the medium term. On the supply side, completions will continue to rise until 2024, but new construction will decline in the medium term. Vacancy rates will continue to rise in the coming years, albeit from a very low level in the A and B cities. We are thus returning to an area of a fluctuation reserve - tenants and landlords can once again negotiate at eye level.

Offices will continue to be needed, albeit with slightly different concepts. It is no longer possible to imagine life without the topic of ESG, which is already determining the investment market (and successively also the rental market) and thus also has a considerable impact on new construction.

Contact: Alexander Fieback, Team Leader Office and Logistics Real Estate at bulwiengesa and Branch Manager Berlin, fieback@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

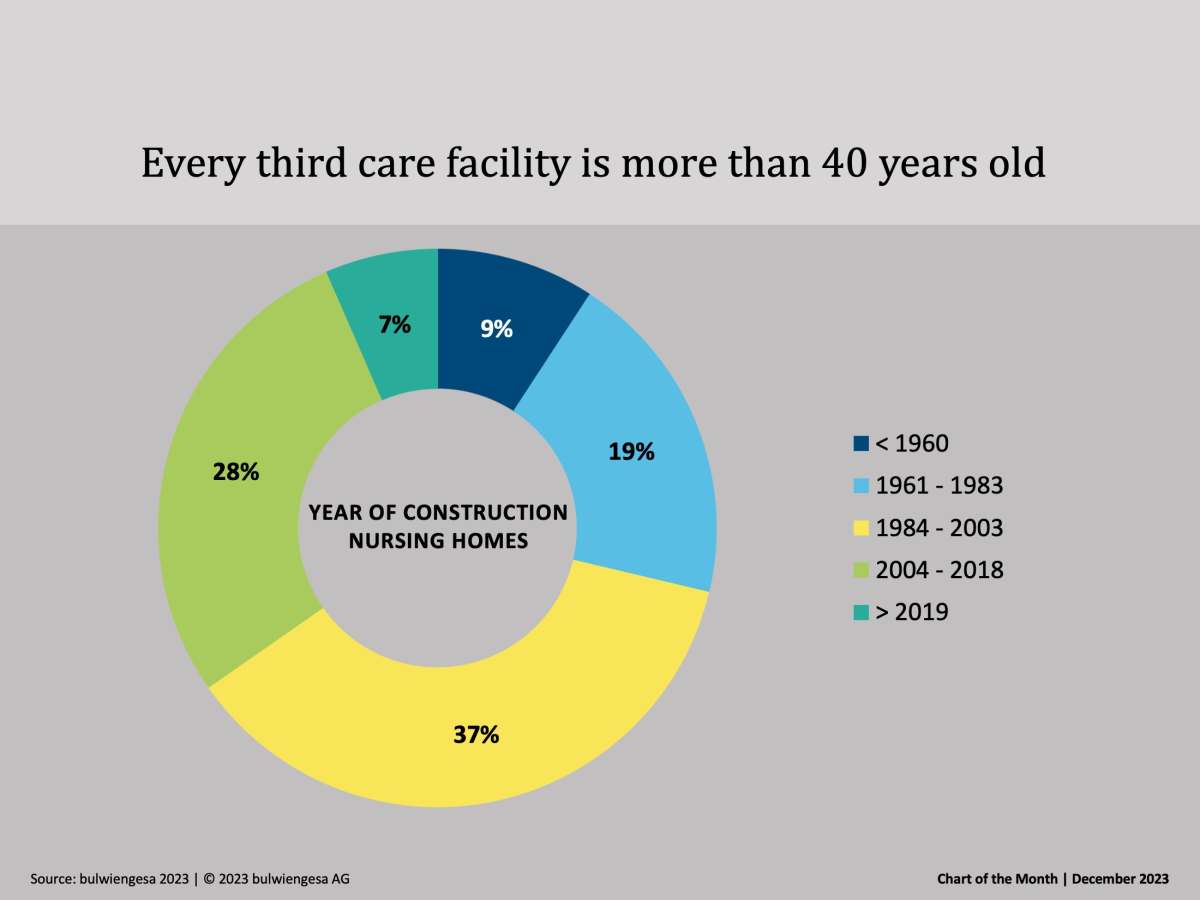

Chart of the month December: The country needs new care properties

Many care homes are no longer up to date - no one wants "care centres" any more, and building standards have changed fundamentally. Therefore, when planning the care infrastructure, not only the additional need for care places, but also the need for substitution must be taken into account.Chart of the month November: Top offices are still in demand

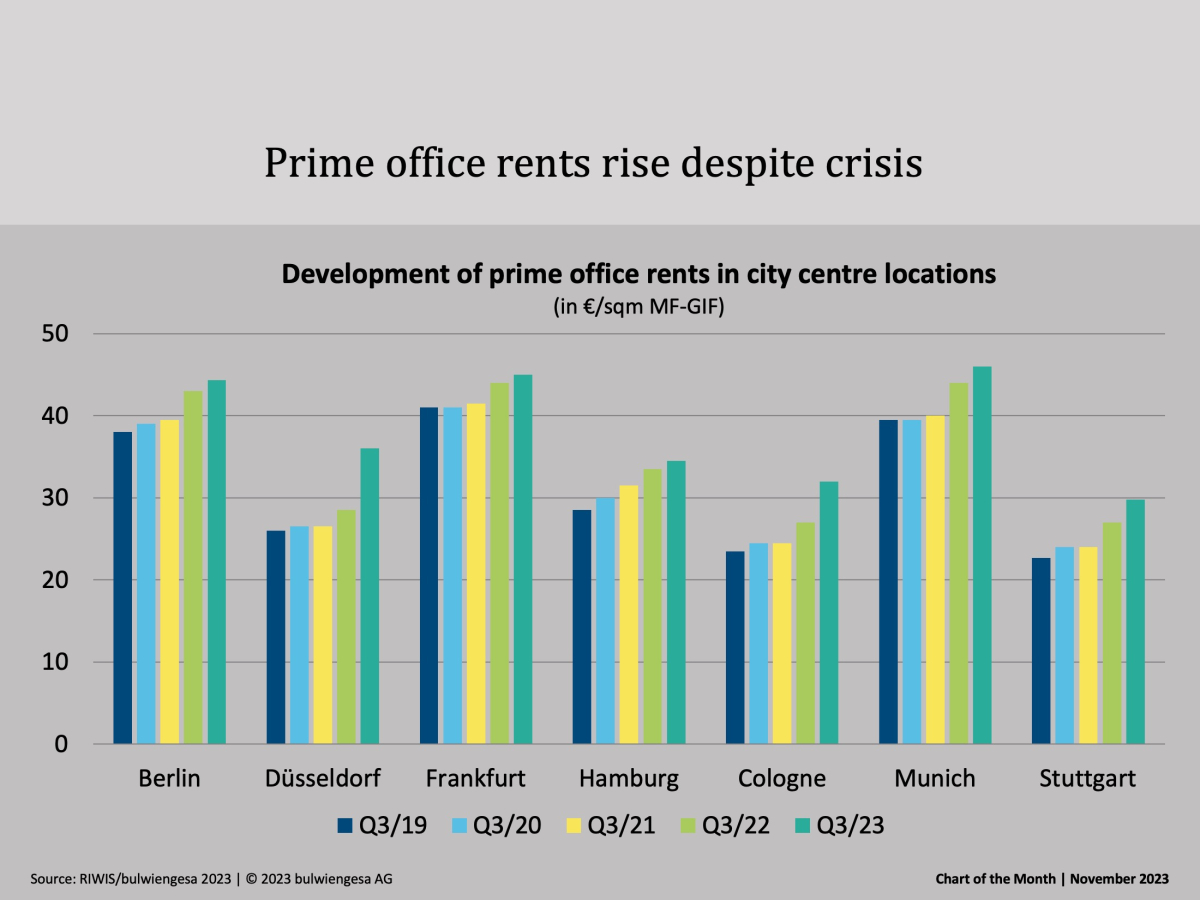

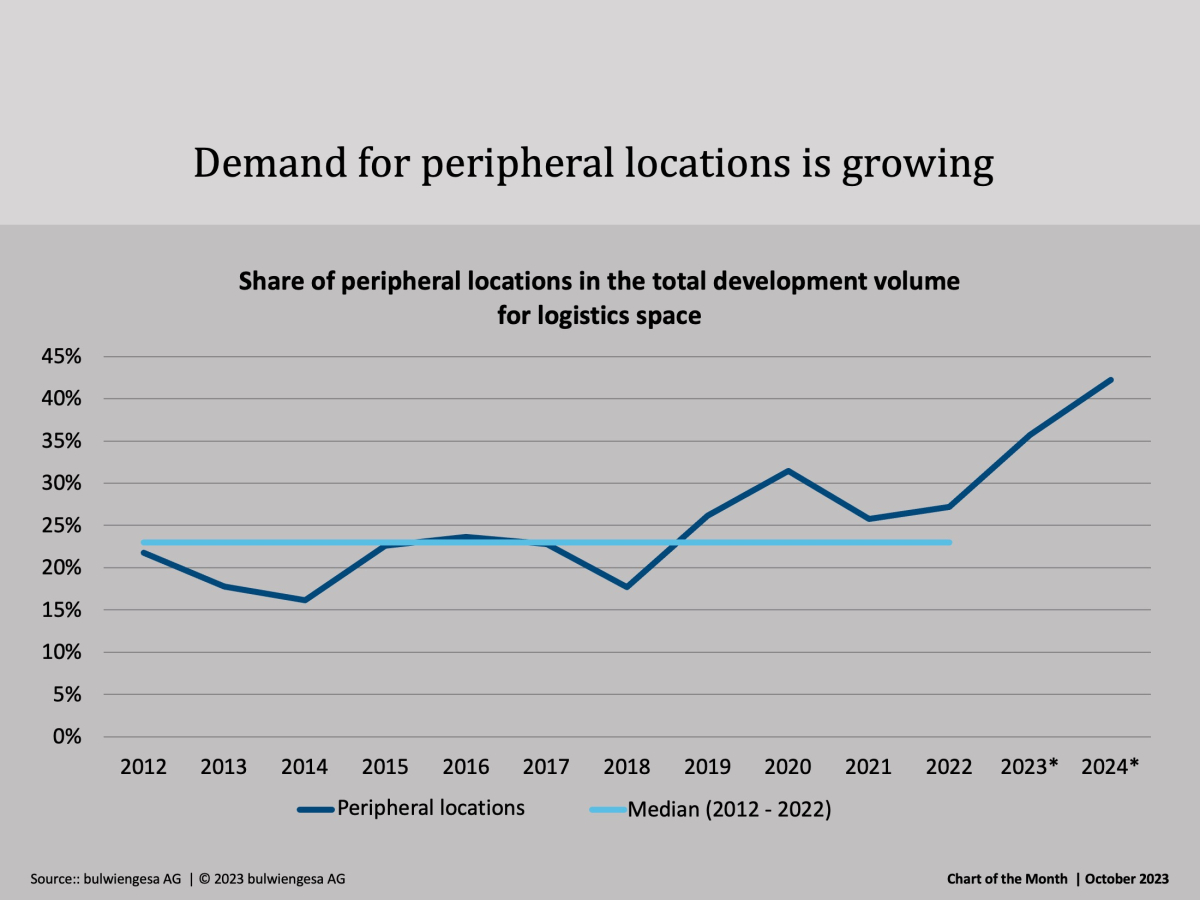

Office vacancies are increasing in the seven class A cities. According to classic economic theory, rents should therefore be falling. But our quarterly figures show: Prime rents are still risingChart of the Month October: Boom in the peripheral locations

The recently published study "Logistics and Real Estate 2023" shows: former "second-tier" regions are increasingly in demand - even those outside the classic logistics regions. And the trend is continuingInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.