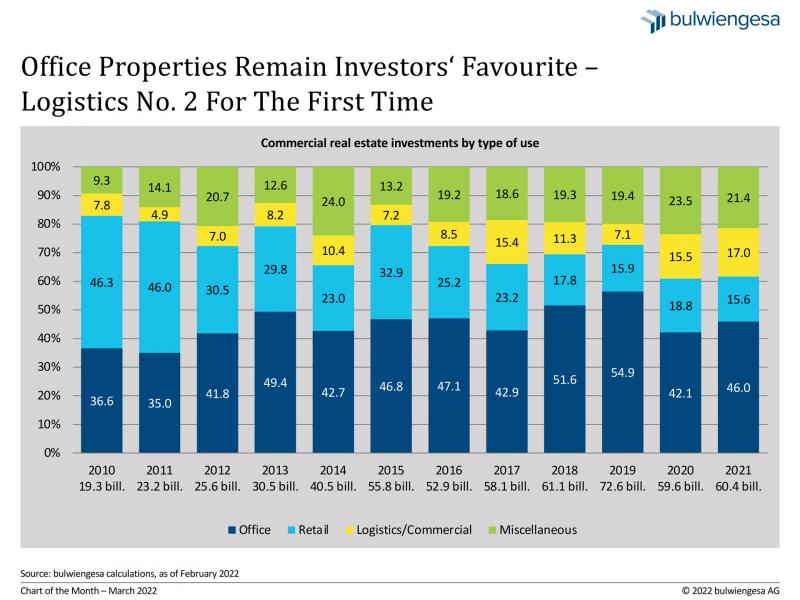

March: The Office Love

The general conditions on the capital market have not changed significantly in 2021. Private and institutional capital is still looking for risk-adequate investment opportunities. German commercial real estate thus remained in high demand in 2021. A total of around 60.4 billion euros was turned over. In addition to office properties, especially with long-term secured cash flow and tenants with a low probability of default (ideally the public sector), investors' favourites were logistics properties and retail properties with a focus on periodic demand (supermarkets, discounters, drugstores and local supply centres).

The swansong to the office as a place of work has not come true from the investors' and users' point of view. Office properties remained the most traded asset class among commercial properties despite the ongoing discussion about home offices and changing space requirements. The capital invested in office properties in 2021 was around 27.8 billion euros (2020: 25.1 billion) or 46% of the total volume. In contrast, the good overall result was supported by numerous individual transactions with a volume of more than 500 million euros. Decisive for the high proportion of individual deals in this order of magnitude were further price increases in the core segment as well as numerous large-volume new construction projects. At least eight individual transactions in Berlin, Frankfurt am Main and Munich broke the €500 million mark in 2021. The largest single deal of the year was the purchase of the Four-T1 high-rise project in Frankfurt city centre by a joint venture between the Allianz Group and the Bayerische Versorgungskammer from project developer Groß & Partner for around €1.4 billion. Demand for core office properties on the investment market will remain at a high level. After the discussion about space savings, it has now become clear that the office will remain the centre of work organisation for most companies.

Logistics properties were in high demand among investors. At around 10.3 billion euros, the transaction volume in 2021 was even above the level of the previous year (9.3 billion euros). For the first time, the logistics segment displaced retail properties from second place. The share of total turnover was around 17 % (retail approx. 16 %). The high investor demand is also due to the very dynamic user market. The continuing growth in e-commerce is driving demand from retailers for new distribution properties and fulfilment centres. At the same time, delivery services and freight forwarders need modern space and larger capacities. In addition, a reorientation in terms of warehousing with additional demand is also discernible from the industrial sector due to the ongoing difficulties with global supply chains. This mixed situation is ultimately also leading to increasing demand from end investors for this asset class.

At around €9.5 billion, the investment volume in retail real estate fell short of the €10 billion turnover mark for the first time since 2014 and thus remained below the previous year's result of around €11.2 billion. As in the previous year, the investor focus was on supermarkets, discounters and food-anchored retail parks and local shopping centres. The reluctance of investors to invest in shopping centres and department stores, on the other hand, has become more pronounced. The growing importance of online retailing had already made shopping centres and department stores more interesting as conversion properties before the crisis. Due to the decline in rents in some prime city centre locations, commercial buildings were also traded somewhat more cautiously in 2021.

Other assets, which include hotels, social and healthcare properties as well as development sites, contributed around €10.7 billion to the transaction volume, which represented a slight decline of around 10% or €1.0 billion compared to 2020. As expected, the hotel investment market has not recovered in 2021. The focus of investment activity here will continue to be on possible conversions of projects or older existing properties. The transaction volume with care properties and senior residences totalled approx. 3.7 billion euros in the past year, which represents a further increase compared to the already high transaction volume of the previous year (approx. +10 %). The healthcare segment has undergone a change in risk perception on the part of end investors. The advancing demographic change is leading to a long-term increase in demand.

The defining issues of the past year will continue to influence the investment market in 2022, especially developments on the capital market and ESG (EU taxonomy). A decline in demand for commercial real estate, especially from institutional capital, is not expected for the time being due to the capital market parameters. The evaluation of sustainability aspects of a real estate investment will continue to gain in importance. ESG will change the pricing and strategies of end investors and project developers in the short to medium term.

Contact: Andreas Wiegner, project manager investment, wiegner@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

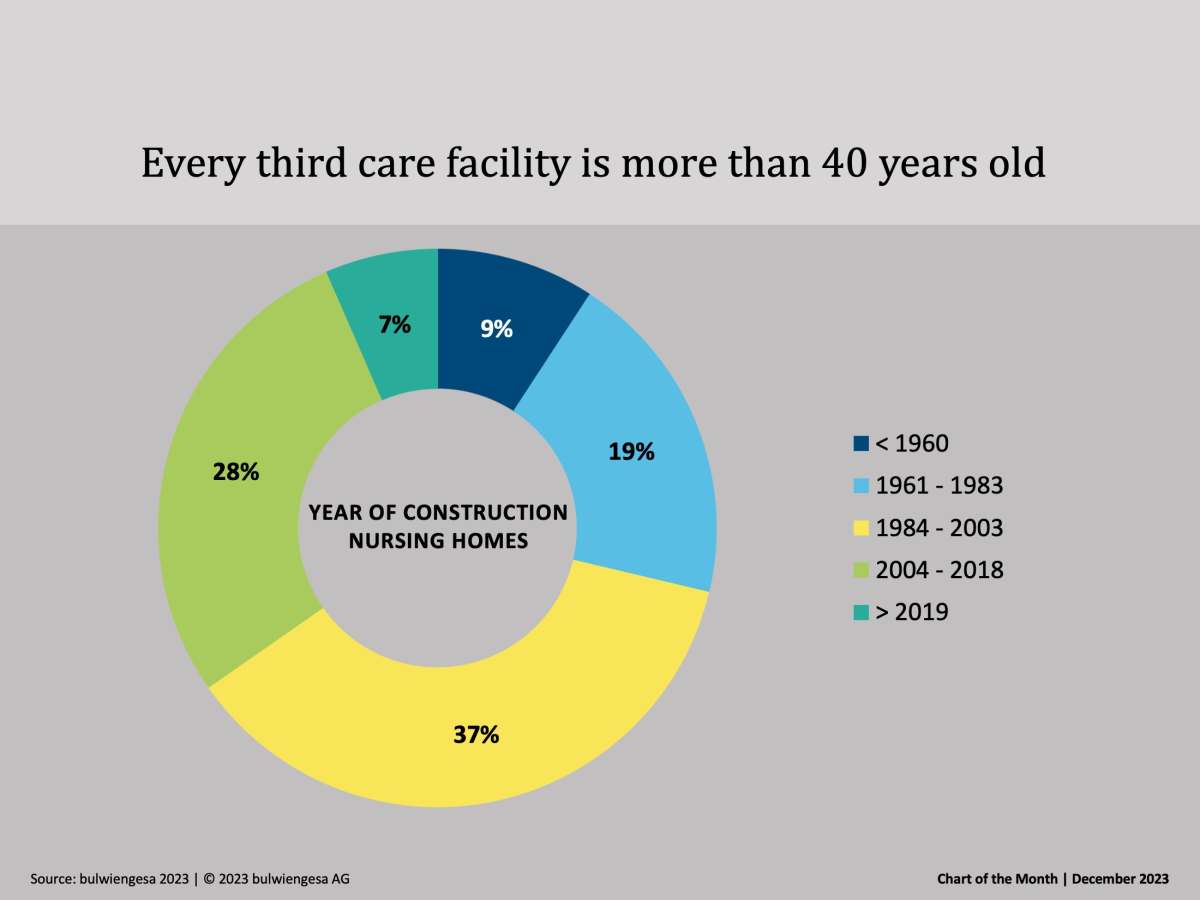

Chart of the month December: The country needs new care properties

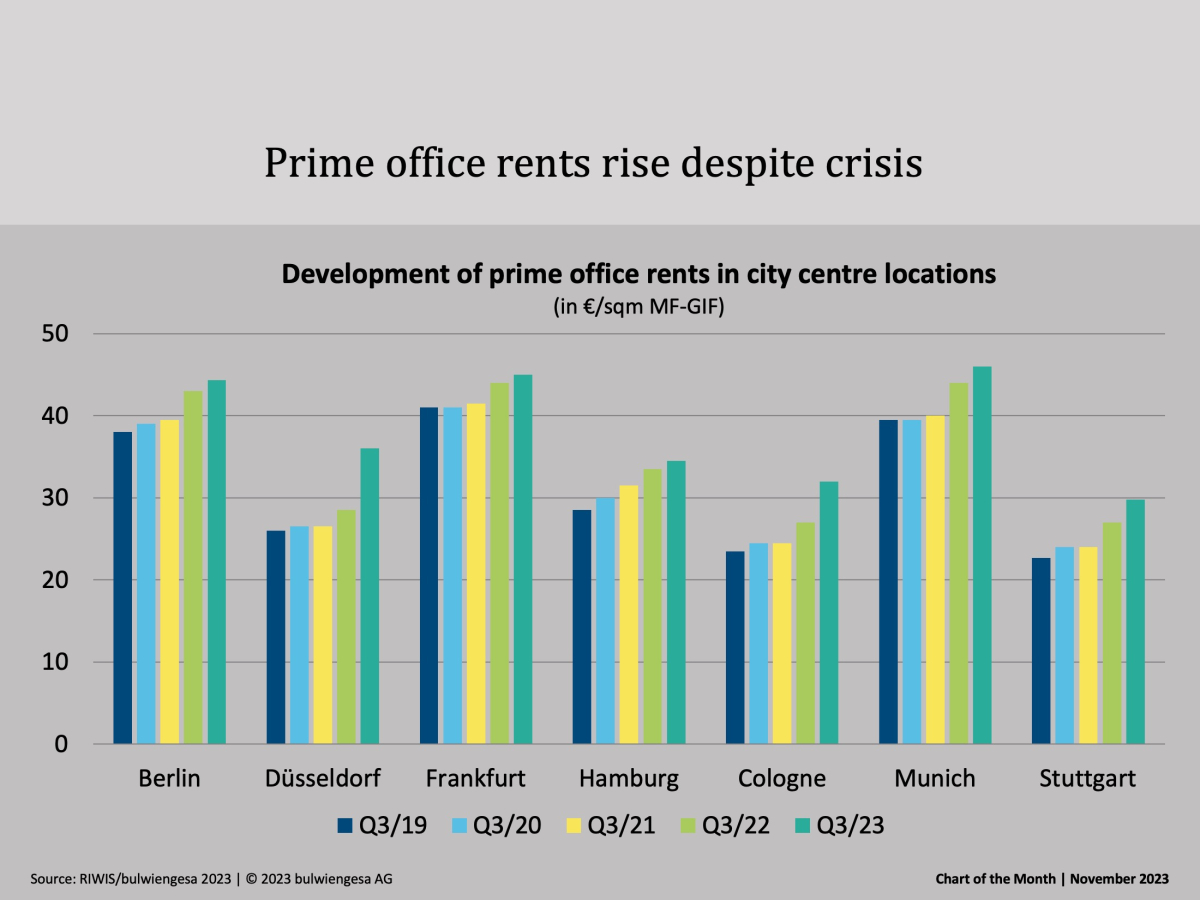

Many care homes are no longer up to date - no one wants "care centres" any more, and building standards have changed fundamentally. Therefore, when planning the care infrastructure, not only the additional need for care places, but also the need for substitution must be taken into account.Chart of the month November: Top offices are still in demand

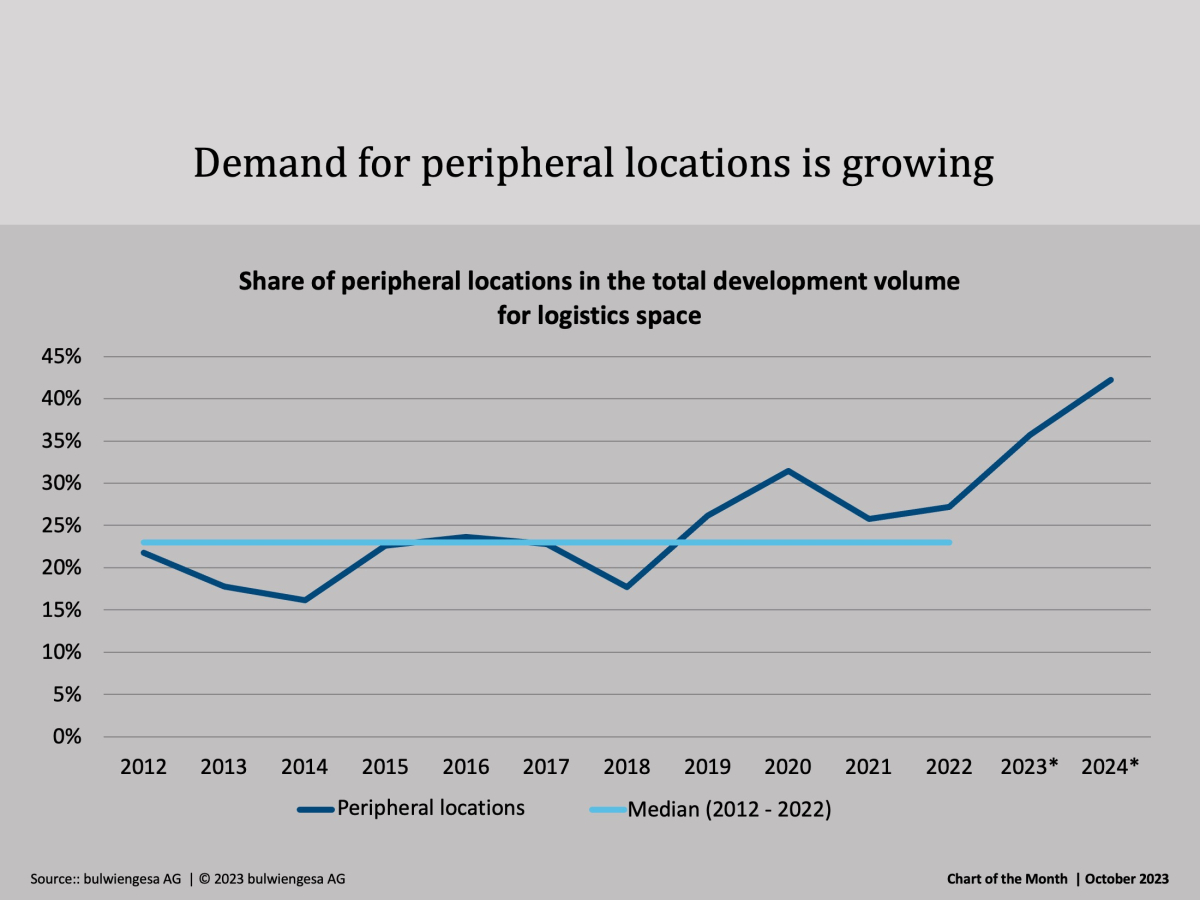

Office vacancies are increasing in the seven class A cities. According to classic economic theory, rents should therefore be falling. But our quarterly figures show: Prime rents are still risingChart of the Month October: Boom in the peripheral locations

The recently published study "Logistics and Real Estate 2023" shows: former "second-tier" regions are increasingly in demand - even those outside the classic logistics regions. And the trend is continuingInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.