Chart of the Month July: Ruhr Area bucks the trend

Across Germany, the market for project developments is under scrutiny. Nevertheless, the project development volume in the Ruhr region will increase by around 7 % between 2020 and 2022 - and the pipelines are still full.

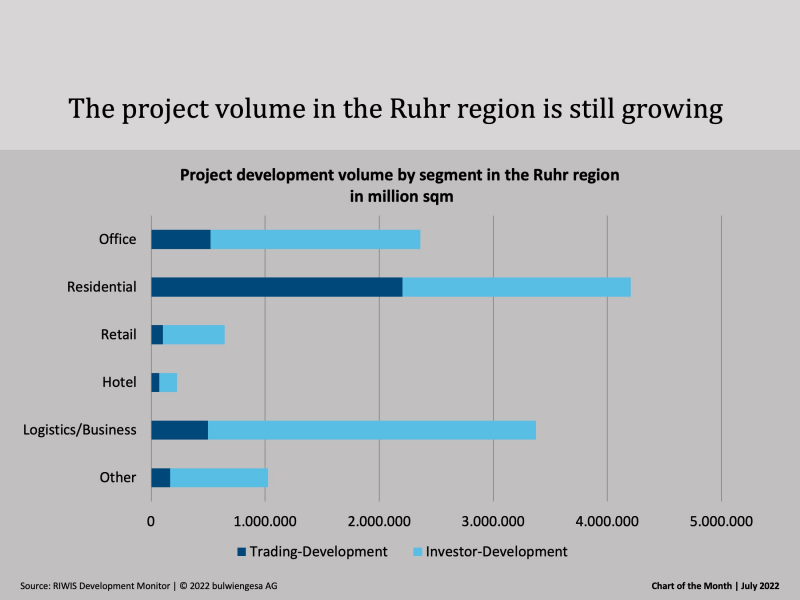

The Ruhr 2022 Project Developer Study analyses the project developer market in all independent cities and districts of the Ruhr region. For this we evaluated around 2,000 individual projects. According to the study, the total project development volume across all real estate segments adds up to 11.8 million sqm. This makes the Ruhr region comparable with the A-cities Munich and Hamburg in terms of construction volume. Around half of the volume is in the four largest cities: Bochum, Duisburg, Dortmund and Essen alone account for 69.6% of all office space and 51.3% of all residential space in the Ruhr region. The positive development is driven by residential and office developments, which have been growing since 2020.

The evaluations include recently completed projects as well as projects under construction or in planning. Due to massively increased construction costs, patchy supply chains and a weakening willingness to invest, momentum and risk are also close together in the Ruhr region in these months. It is unlikely that all plans will soon go into construction. But many projects have their feet firmly on the ground and demonstrate the investment potential of the B-cities, especially in uncertain times. Structural change and real estate market development go hand in hand in the Ruhr region. Residential construction in particular acts as an indicator of purchasing power growth, which ultimately benefits the entire region.

Once again, investor development projects, i.e. developments for owner-occupation and portfolio maintenance, have the strongest market shares in the Ruhr region with around 70 %. These are more pronounced at district level than in the B-cities - the local economy builds for itself, so to speak, especially in the logistics sector. There, just 15 % of the projects are speculative. Trading development projects, i.e. the "classic" project developments for sale, only show a positive development in the residential segment. All other asset classes are losing project space in trading development. In the project development markets in the Ruhr region, which are already dominated by owner-occupiers, current uncertainties and investment obstacles have also led to a decline in the number of new project areas started in trading development, especially in the office and commercial sectors.

Note: Further information and the order form can be found in the publications section.

Contact: Andreas Schulten, Chief Representative at bulwiengesa, schulten@bulwiengesa.de, and Jeremy Feist, Junior Consultant, feist@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

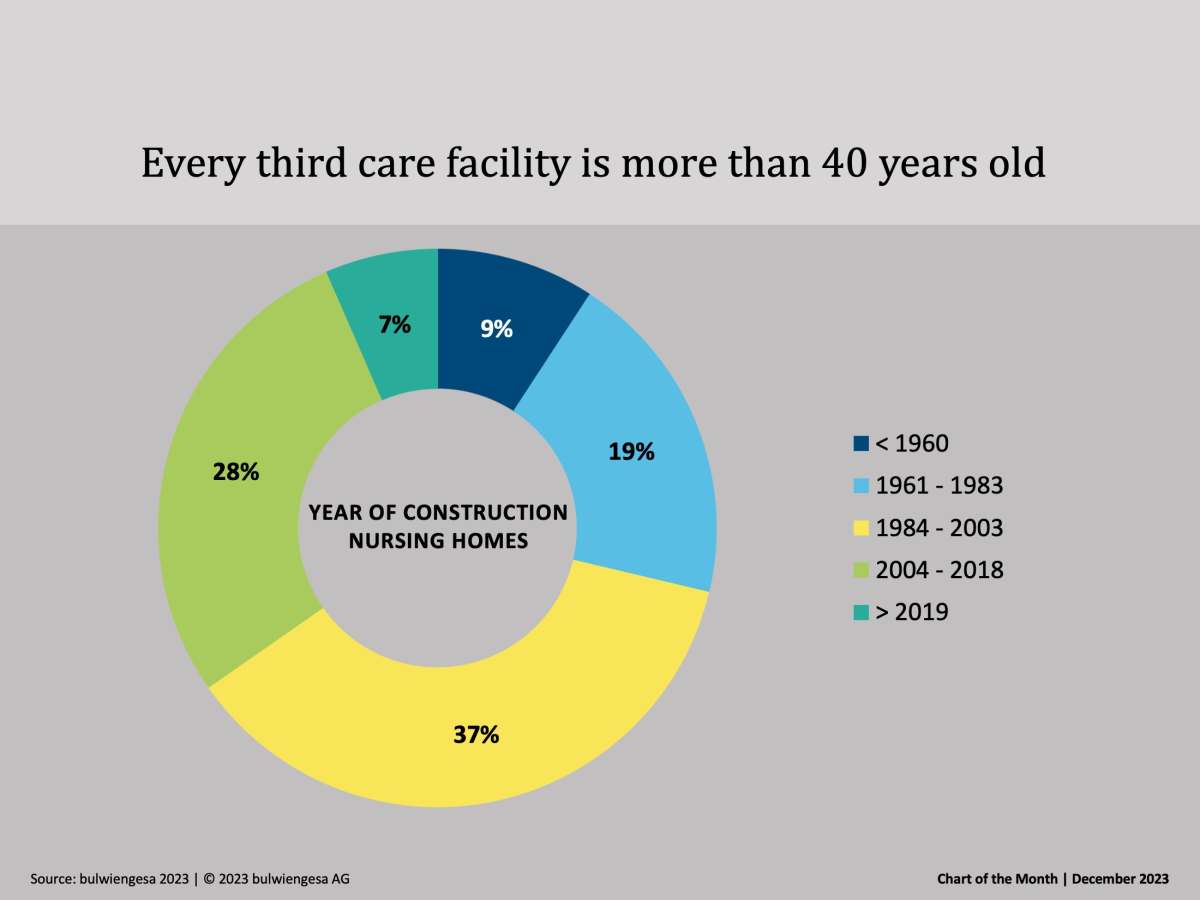

Chart of the month December: The country needs new care properties

Many care homes are no longer up to date - no one wants "care centres" any more, and building standards have changed fundamentally. Therefore, when planning the care infrastructure, not only the additional need for care places, but also the need for substitution must be taken into account.Chart of the month November: Top offices are still in demand

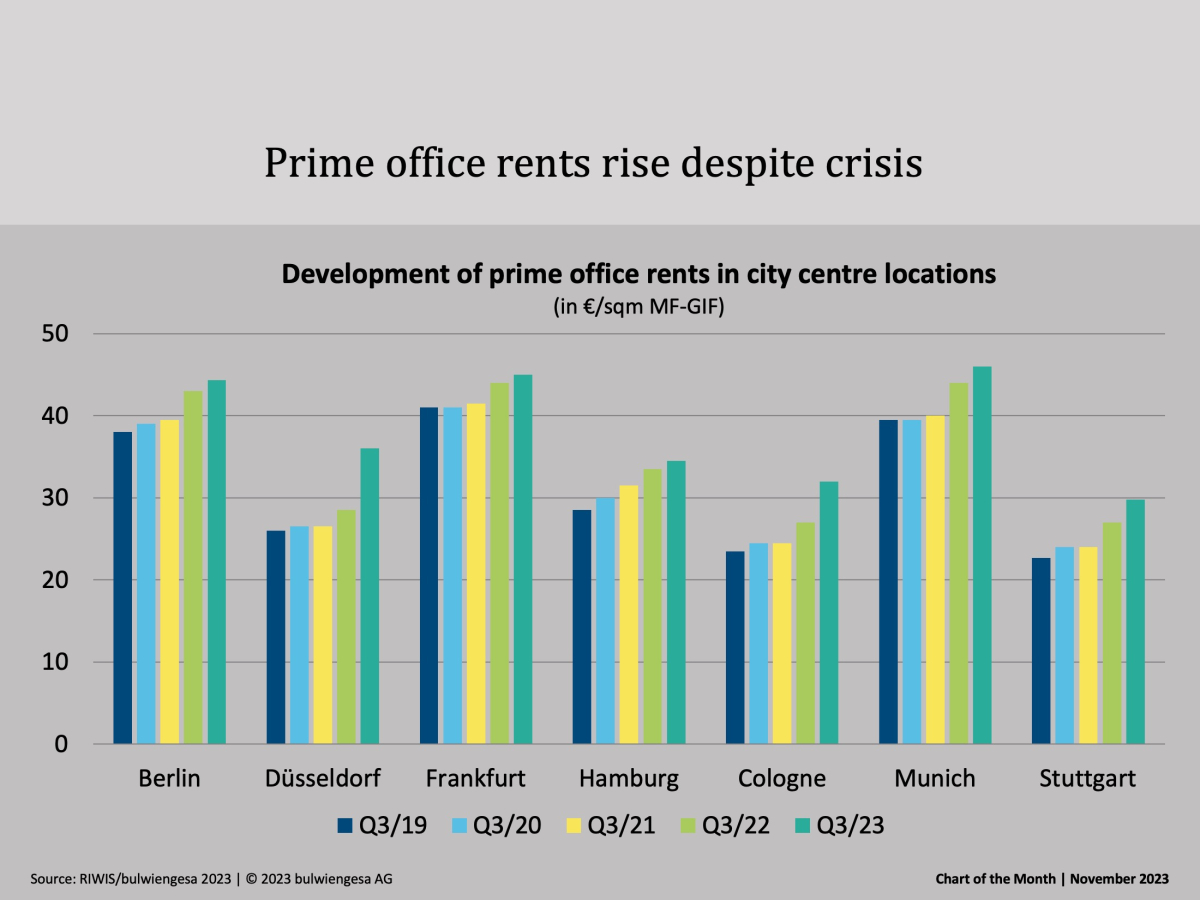

Office vacancies are increasing in the seven class A cities. According to classic economic theory, rents should therefore be falling. But our quarterly figures show: Prime rents are still risingChart of the Month October: Boom in the peripheral locations

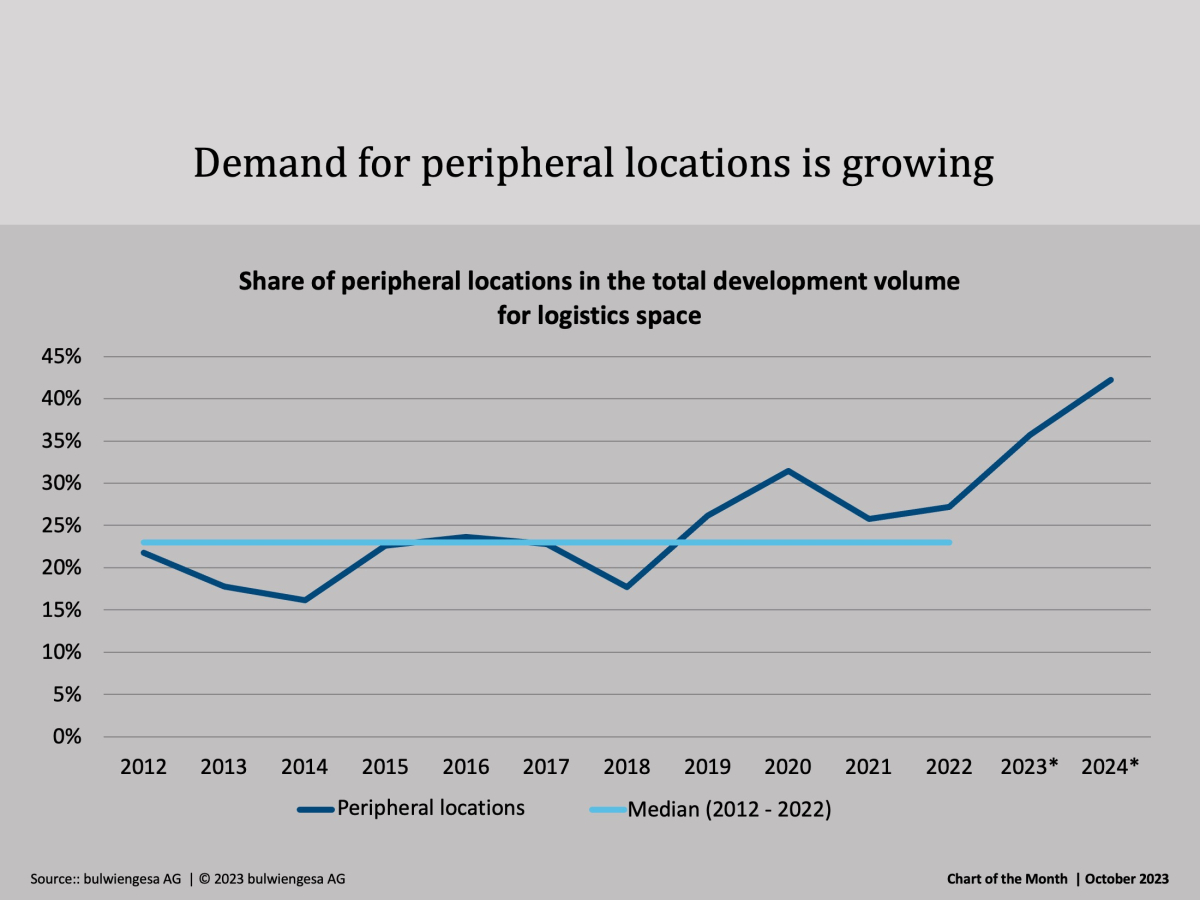

The recently published study "Logistics and Real Estate 2023" shows: former "second-tier" regions are increasingly in demand - even those outside the classic logistics regions. And the trend is continuingInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.