No Turnaround in Prices

Rising rents, unrenovated condominiums, sluggish land prices and an allowance from grandma: Sven Carstensen analysed price developments in the German real estate market for an interview with Handelsblatt. Here is the summary.

Even though purchase prices on the German property market have been falling since last summer - we do not expect a turnaround with prices rising again. At present, we only see a certain stabilisation because buyers assume that most of the interest rate increases are already behind us.

However, the current crises are affecting the individual segments differently. In the commercial property market, for example, prices are falling by 20 to 25 percent in some cases. For condominiums, on the other hand, the scarcity ensures that this effect is largely absent. Prices will not become cheaper in new construction. Only a few ongoing construction projects could run into difficulties. In the housing stock, the price increasingly depends on the energy condition and location of the buildings. Investors deduct from the asking price what it will cost them to renovate the houses - and these sums are increasingly higher.

The basic rule for buyers is: at the moment, their own liquidity is the trump card. And those who have it are in a good negotiating position. If someone is on the move with grandma's money and hardly needs to borrow, one or the other opportunity can be found. Some property developers and project developers will certainly come under pressure and therefore accept prices that they would not otherwise accept. In the existing stock, increasing attention must be paid to the issue of sustainability, but there should be attractive opportunities there as well. Because those who sell now have the pressure of having to sell. In the land market, a downward movement in prices may still be pending, as this market reacts somewhat sluggishly.

When looking at residential rents, a distinction must be made between new construction, which is less regulated, and the existing market, which is subject to high regulations. In the existing stock, rents will not rise as much because of the regulations; however, the levies for energy-efficient modernisation will climb significantly, as a lot still has to happen in terms of climate neutrality by 2045. For new tenants, these charges are not an issue. Nevertheless, we expect rents for new flats to rise very strongly. Nevertheless, the price thresholds have often not yet been reached at which it is worthwhile for most developers to start a new building for the tenant market again.

The bottom line is that it will become much more expensive for tenants in Germany in the next few years, increasing the potential for societal conflict and inequality. For the situation on the housing market will continue to worsen in the next few years. The price spiral for tenants will continue to spiral upwards.

Even the sensible approach of motivating existing tenants in large flats to move into smaller flats and thus ensuring more permeability within the housing market will hardly bring any significant relief. The human component should not be underestimated. Nevertheless, there should be no prohibitions on new ideas when it comes to combating the housing shortage. For example, there is still potential in adding storeys to buildings and densification. We need to review the requirements for new construction, build more serially and speed up and digitise the designation of building land as well as the time frames for granting building permits. But land prices coupled with high financing costs are so high that building affordable housing is hardly attractive for the free market at the moment. Perhaps we should also think - for a limited time - about more state support, because it's a crux: we get a lot of building projects on the table, and they simply don't pay off now. The construction industry is not as thoroughly digitalised as it would like to be. At the same time, the requirements are enormously high and still rising, and Germany needs new housing quickly. So we will have to make compromises somewhere.

Anyone who wants to invest now has to look carefully. It would not be right to generally refrain from buying old existing buildings. Not even in the residential segment. However, new construction or very well renovated existing buildings make sense if you want to have fewer problems. As a rule, the structural quality is good, the buildings are usually more sustainable and the rents are less regulated. In addition, warranties still apply here. Unrenovated condominiums in apartment buildings are not advisable, unless you can be sure that your neighbours can also afford refurbishment.

Note: The text is a slightly modified and abridged version of the interview by Carsten Herz and Julian Trauthig that appeared in Handelsblatt on 14 April 2023.

Contact person: Sven Carstensen, CEO at bulwiengesa, carstensen@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

Little movement on the German real estate market

For the eleventh time, bulwiengesa presents its comprehensive analysis of the German real estate markets. The results of this year's 5% study, conducted in collaboration with ADVANT Beiten, show that the German real estate market is characterized by widespread stagnation. At the same time, niche segments are becoming increasingly attractive. The market is increasingly rewarding professional asset management and specialist knowledge—a trend that separates the wheat from the chaffFive per cent returns no longer illusory even for core properties

The ‘5% study - where investing is still worthwhile’ celebrates its tenth anniversary. Since the first edition was published, the German property market has tarnished its reputation as a safe investment haven. Higher yields are now within sight, even for prime properties, and even residential property is increasingly becoming a profitable asset class again. The market is more exciting than it has been for a long timeHow hot are the housing markets?

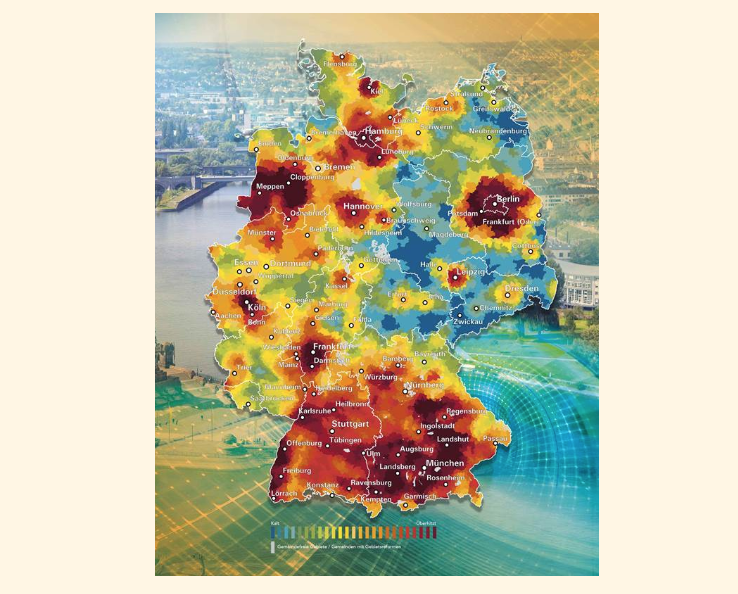

The rise in interest rates is putting a massive damper on residential construction. For the fifth time, we have analysed the relationship between supply and demand for each of the more than 11,000 German municipalities together with BPD for the "Housing Weather Map"Interesting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.