Senior Living – the ideal location

The location is particularly important for properties for seniors. Acceptance by the residents stands and falls with the location of a new building. What should be considered when choosing a location?

In an interview for Care Invest magazine (issue no. 19/2023), Dr Heike Piasecki, Head of Residential Real Estate and Munich Branch Manager at bulwiengesa, provided information on location criteria for project developments of senior citizen properties. Here is an excerpt from the interview conducted by Darren Klingbeil together with us and HBB.

What does the ideal location for a nursing home have to offer?

We always assess a micro-location from three perspectives: Residents, relatives and visitors, and staff. For the residents and their relatives, it is important that the environment is suitable for senior citizens. This means: embedding in a structure that is as urban as possible with green spaces, infrastructure and public transport connections within walking distance. Attention is also paid to which crossing aids are available on roads, key words being lowered kerbs or traffic lights. For relatives, but above all for employees, accessibility by private motorised transport, but also by public transport, is an important location criterion.

Are there any exclusion criteria?

Let me divide the term location into micro-location, the direct surroundings of the project site, and macro-location, the city or district in which the nursing home is to be built. We advise an investor against the micro-location if, for example, the immission load there is classified as very high. This can be the case due to noise, but also due to permanent odours. Insufficient transport connections are also a negative criterion. A macro-location may not be suitable for the construction of a nursing home if the demand potential is classified as unsustainable due to the demand side, but also due to a very high competitive supply.

At what point in the selection of a location does bulwiengesa contribute data?

In most cases, we contribute our advisory services as part of the acquisition appraisals. The appraisals cover several areas: In the macro-location analysis, characteristic indicators of the city are assessed. These include the assessment of the traffic situation, the infrastructure, the labour market and the image.

In the treatment of the demand level, socio-demographic data such as the development of the population, the age structure of persons over 65, the nursing care statistics or the development of income in the defined study area are worked out. It is important here that the perspective is always also directed towards the forecast of values, since we are dealing with long-term real estate investments.

In the supply analysis, we assess the competition: How is it structured? What are the location criteria? What are the cost and occupancy structures and who are the operators?

Finally, in the demand calculation, the findings from the demand and supply analysis are combined and the future demand potential for the planned facility is derived.

In a recent analysis, bulwiengesa forecasts a need for 372,000 places in full inpatient care by 2040. How do you arrive at this figure?

The considerable demographically induced demand results from the comparison of the forecast of inpatients in need of care, which is supported by the strong increase in future senior citizens of the baby boomer generation, and the supply, which is assumed to be based on a continuation of the current construction activity in inpatient care. It should be noted here that these projections suffer from limitations, as the central determinants were largely kept constant by way of simplification. The number of people in need of long-term care can change solely as a result of definitional changes by the legislator. The problem of the necessary nursing staff to operate these facilities remains unconsidered in all the calculations.

In view of exploding costs, supply bottlenecks and global crises, how do you assess the chances that this demand gap can be closed?

Negative. Even without the current crisis elements mentioned, the evaluation of the planning and construction activity of the past two to three years shows that the demand gap cannot be closed at the existing pace. In addition to the issues of land availability and financing, the increasing legal regulations as well as the federal structures and legislations are not conducive to construction.

Contact person: Dr. Heike Piasecki, Head of Residential Real Estate at bulwiengesa, piasecki@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

Little movement on the German real estate market

For the eleventh time, bulwiengesa presents its comprehensive analysis of the German real estate markets. The results of this year's 5% study, conducted in collaboration with ADVANT Beiten, show that the German real estate market is characterized by widespread stagnation. At the same time, niche segments are becoming increasingly attractive. The market is increasingly rewarding professional asset management and specialist knowledge—a trend that separates the wheat from the chaffFive per cent returns no longer illusory even for core properties

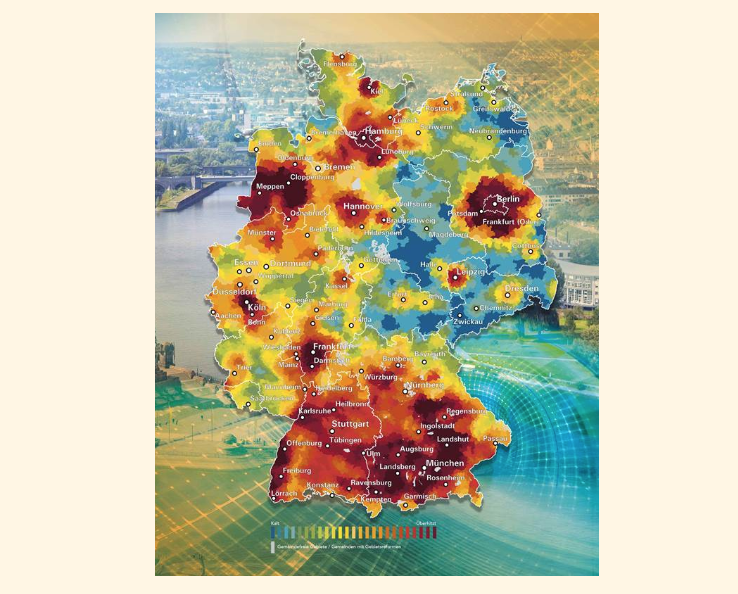

The ‘5% study - where investing is still worthwhile’ celebrates its tenth anniversary. Since the first edition was published, the German property market has tarnished its reputation as a safe investment haven. Higher yields are now within sight, even for prime properties, and even residential property is increasingly becoming a profitable asset class again. The market is more exciting than it has been for a long timeHow hot are the housing markets?

The rise in interest rates is putting a massive damper on residential construction. For the fifth time, we have analysed the relationship between supply and demand for each of the more than 11,000 German municipalities together with BPD for the "Housing Weather Map"Interesting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.