Real Estate Developers Study 2021

Superficial stability in new construction in A-cities

- Apartments: Project developments stable thanks to active portfolio holders

- Offices: The segment is growing moderately, but listlessly

- Hotels: Hardly any new ones in planning

- Migration: Many large residential project developers are increasingly building in the metropolitan hinterland

The Project Developer Study 2021 shows: Project developments in the seven A-cities are almost unchanged compared to the previous year. This is also due to the fact that a phase of stagnation at a high level had already occurred before the Corona crisis. Investor-developers are still taking risks on the balance sheet that trader-developers are no longer willing to bear. In 2020, project areas declined only marginally by minus 0.1%.

Once again, investor-development projects, i.e. developments for owner-occupation and portfolio maintenance, stabilised the market development with +1.3 million sqm (+6.3%), even more so than in the last year of analysis. This is particularly true of flats, but also offices. Hotels and retail are again losing project space; hotels, as expected, very significantly.

In contrast, the "classic" trading developments, i.e. developments for the purpose of sale, have again lost project space volume with -1.3 million sqm (-4.7%), and this with a further growing trend. A high decline was already measured in the last study. Now the new value exceeds this by more than double, also because planning was postponed or only very hesitantly newly created. This mainly affects office, retail and hotel.

About the study "Real Estate Developers Study for the German A-Cities 2021"

For the 15th time, the independent analysis and consulting company bulwiengesa has examined the market for project developments in the seven German A-cities Berlin, Munich, Hamburg, Frankfurt/Main, Düsseldorf, Cologne and Stuttgart. Based on more than 5,200 individual projects, the structure and volume of the project development market were analysed and evaluated city by city. The focus was on the types of use office, residential, retail and hotel.

Contact:

Ellen Heinrich, heinrich@bulwiengesa.de, Telefon +49 89 - 2323 7633

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

Senior Living – the ideal location

The location is particularly important for properties for seniors. Acceptance by the residents stands and falls with the location of a new building. What should be considered when choosing a location?Chart of the Month September: Residential Project Area Continues to Decline

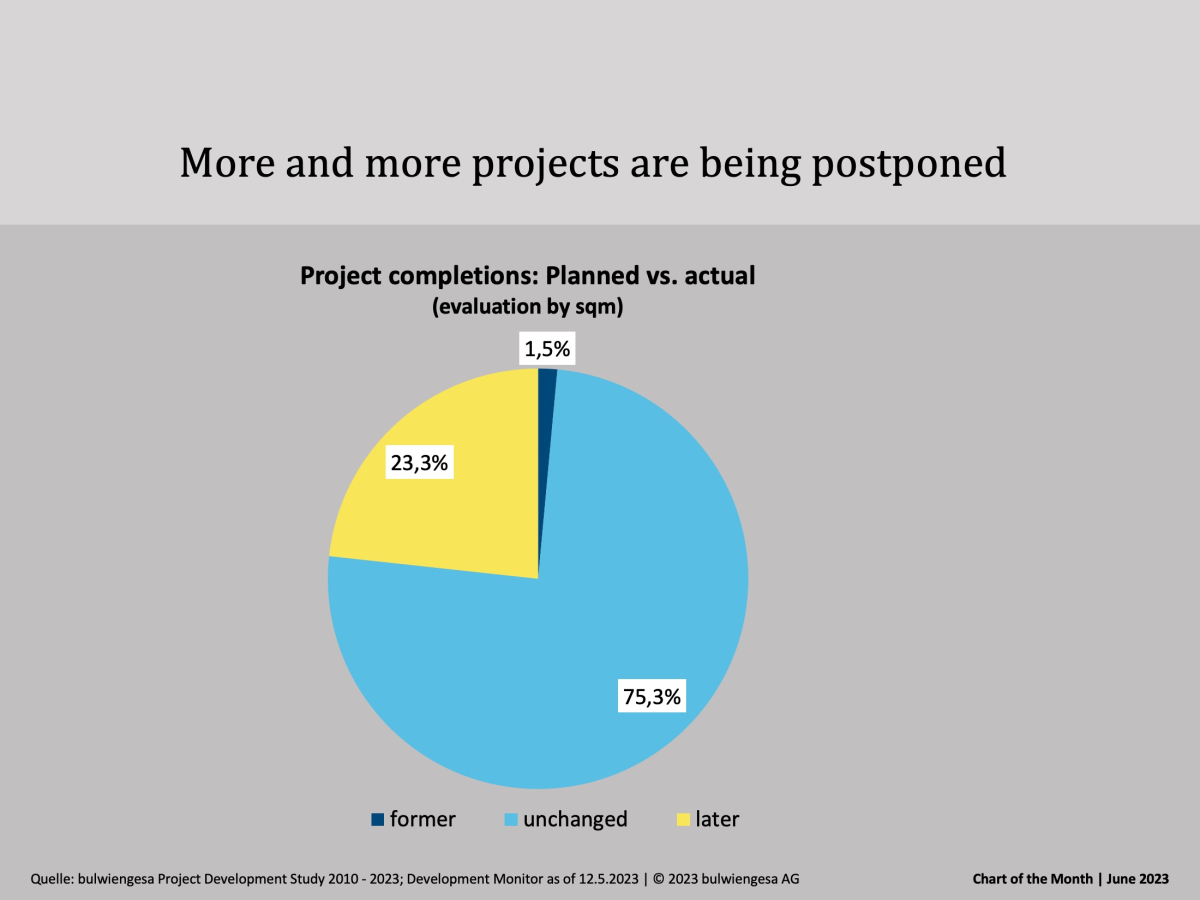

The insolvencies of large and small project developers illustrate the extremely tense market situation. And the number of residential projects planned and under construction is falling - most sharply in the metropolises, of all places, where the housing shortage is greatestChart of the Month June: Every Fourth Project Development Postponed

Project developments in the A-cities have not only declined rapidly. Many projects are also postponedInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.