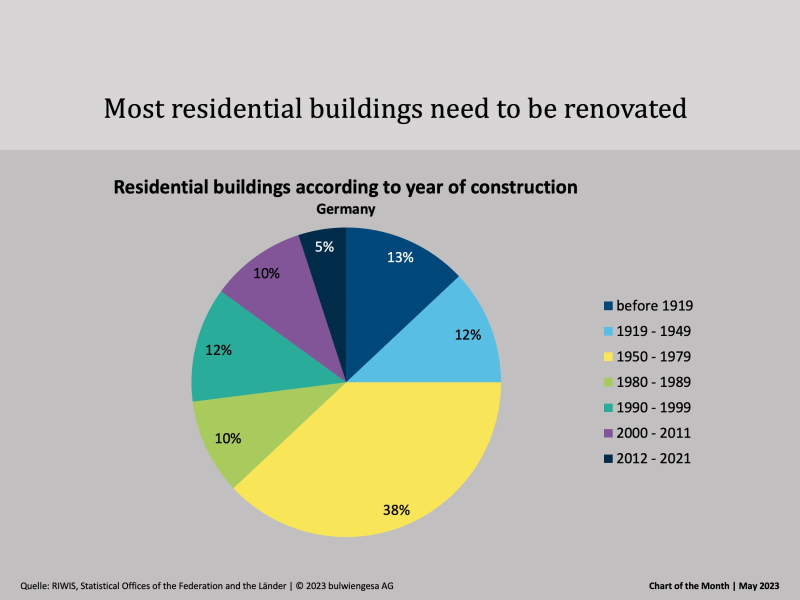

Chart of the Month May: Huge Challenges for Old Buildings

Around 95 % of residential buildings are more than ten years old. Transforming these into zero-emission buildings by 2050 is causing headaches for all involved.

The players in the real estate industry know it: buildings are huge CO2 emitters, both in their construction and in their operation. 40% of final energy consumption and 36% of energy-related greenhouse gas emissions originate in buildings. Around 75% of all existing buildings (i.e. not only flats) are not energy efficient and need large-scale energy renovation. This makes the real estate sector a key sector for achieving the UN climate goals and limiting global warming to 1.5 degrees by 2050. The integration of environmental, social and governance (ESG) criteria will be one of the determining factors in the real estate and investment market in the future, which is also increasingly demanded by regulation.

Existing residential buildings must be transformed into zero-emission buildings by 2050, and non-residential buildings must meet certain energy performance thresholds by 2034. By 2033, energy standard D is to be achieved for all buildings. The chart of the month impressively shows how much work is ahead for the sector: Residential buildings constructed after 2011 are expected to have comparatively positive A+, A and B parameters. However, these only account for 7% of the total residential building stock.

The transformation of existing properties into ESG-compliant assets is the main task for portfolio owners and property managers in the coming years, as they have an enormous need for retrofitting. Portfolio transformation entails a high volume of investment, which, however, has a more future-proof effect in the long term and can lead to an increase in value as well as higher rental income. Political and social risks as well as the danger of sanctions and increased costs in case of non-transformation are thus avoided. The life cycle assessment of a property is essential in this context. However, the measurability and evaluation of existing properties is currently still difficult, as older buildings often do not have the necessary data basis. The objective of sustainable portfolio transformation is also not yet fully defined in the taxonomy and other specifications.

Contact person: Margo Lange, Consultant in Housing and Project Manager Sustainability at bulwiengesa, lange@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

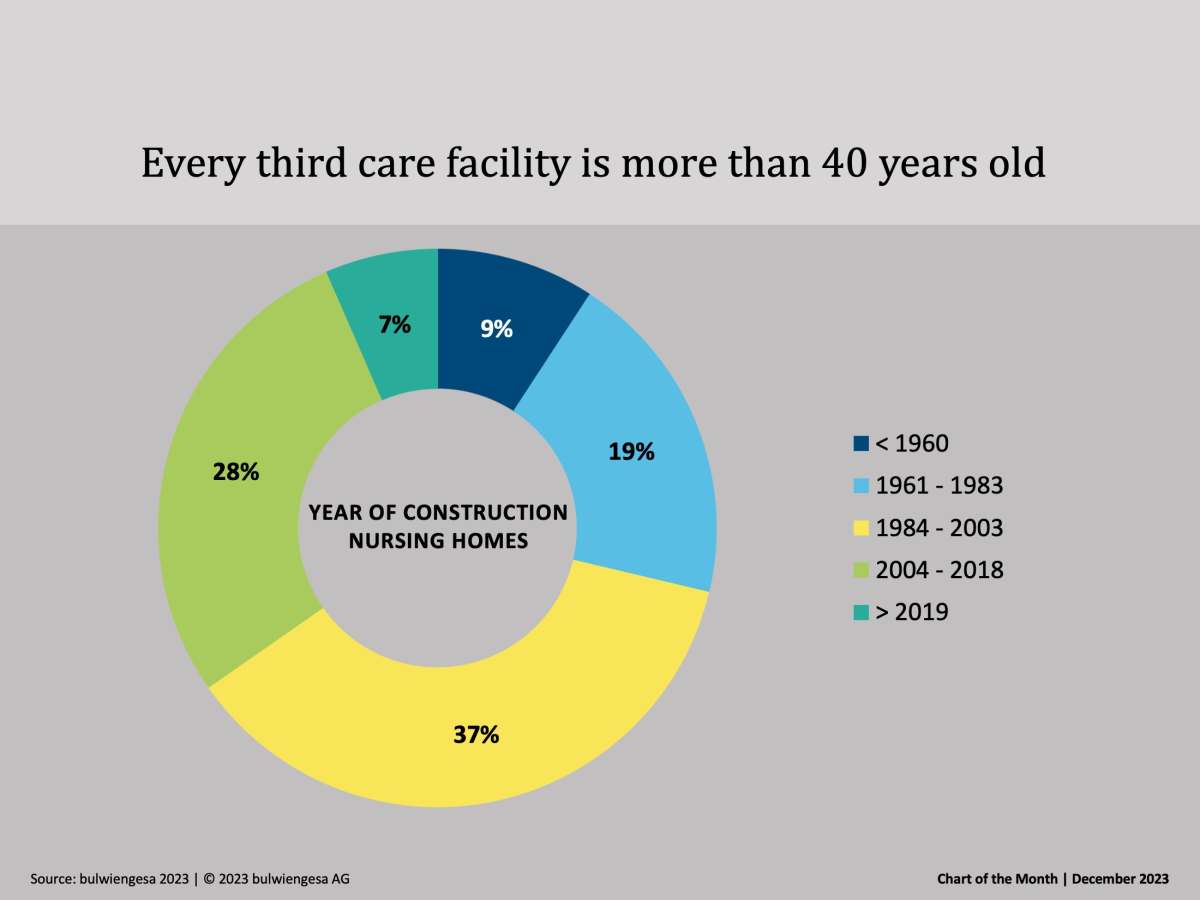

Chart of the month December: The country needs new care properties

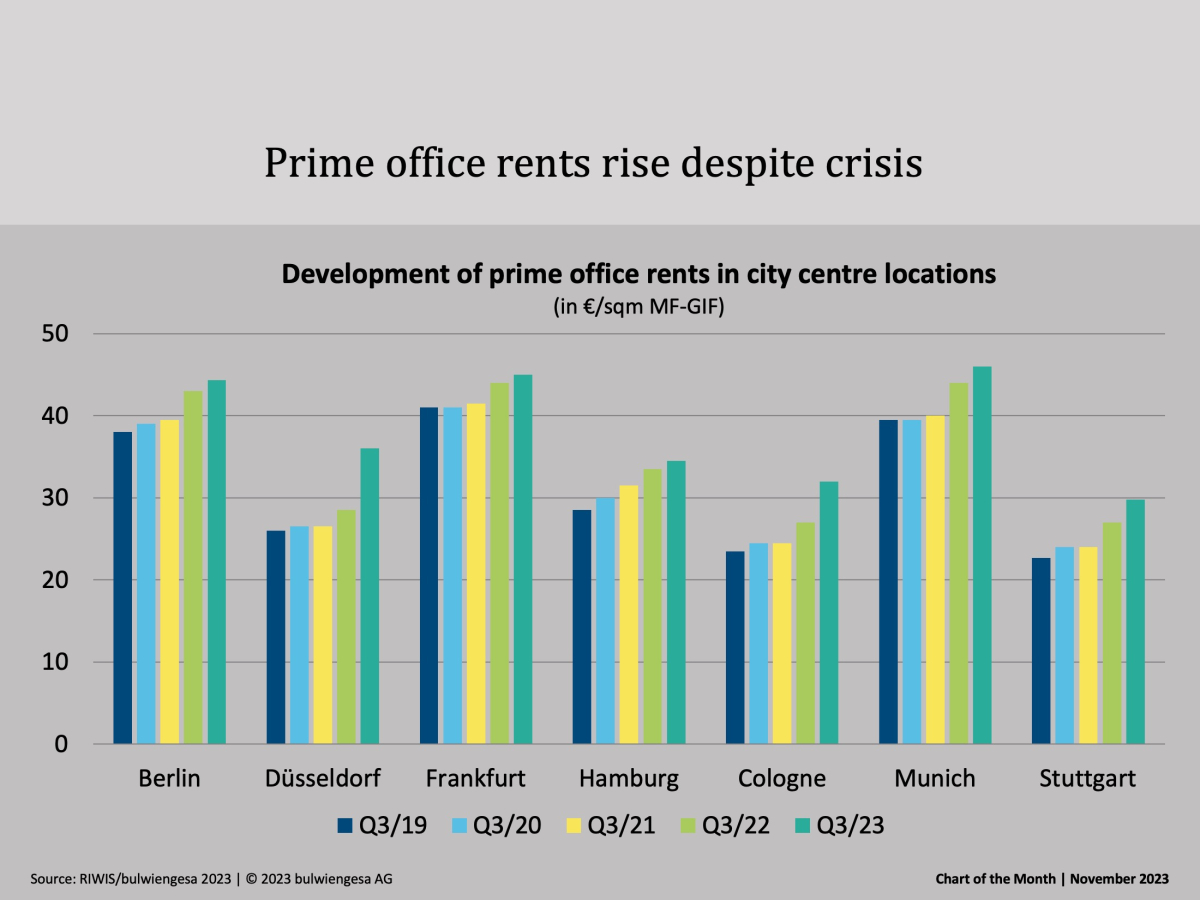

Many care homes are no longer up to date - no one wants "care centres" any more, and building standards have changed fundamentally. Therefore, when planning the care infrastructure, not only the additional need for care places, but also the need for substitution must be taken into account.Chart of the month November: Top offices are still in demand

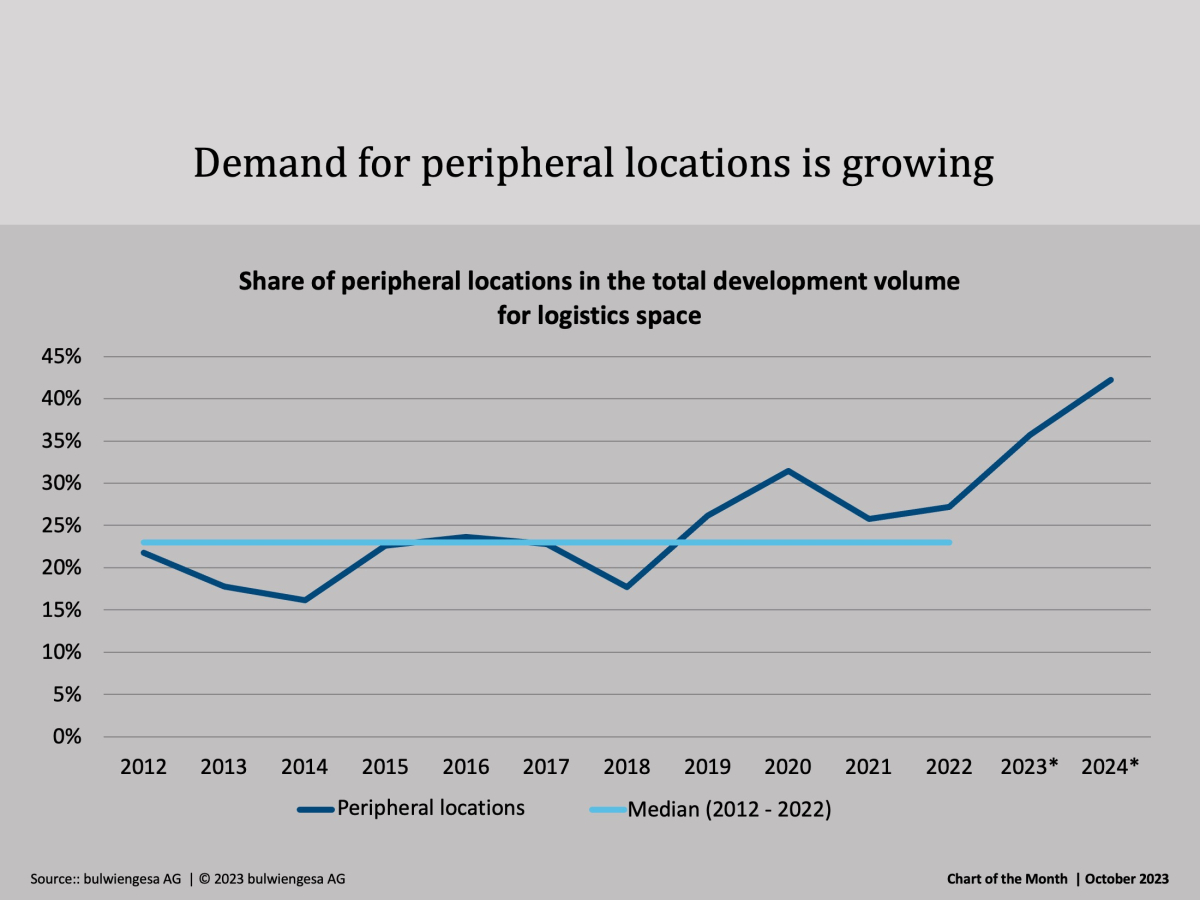

Office vacancies are increasing in the seven class A cities. According to classic economic theory, rents should therefore be falling. But our quarterly figures show: Prime rents are still risingChart of the Month October: Boom in the peripheral locations

The recently published study "Logistics and Real Estate 2023" shows: former "second-tier" regions are increasingly in demand - even those outside the classic logistics regions. And the trend is continuingInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.