Project developer market 2022: Turnaround and change at the same time

Project developers find themselves in the grip of rising interest rates, inflation and the explosion of construction costs. After years of growth, the German project development market is faltering. Our current analyses show: The overall market in A-cities is declining significantly, especially in residential. This reinforces the suburban trend.

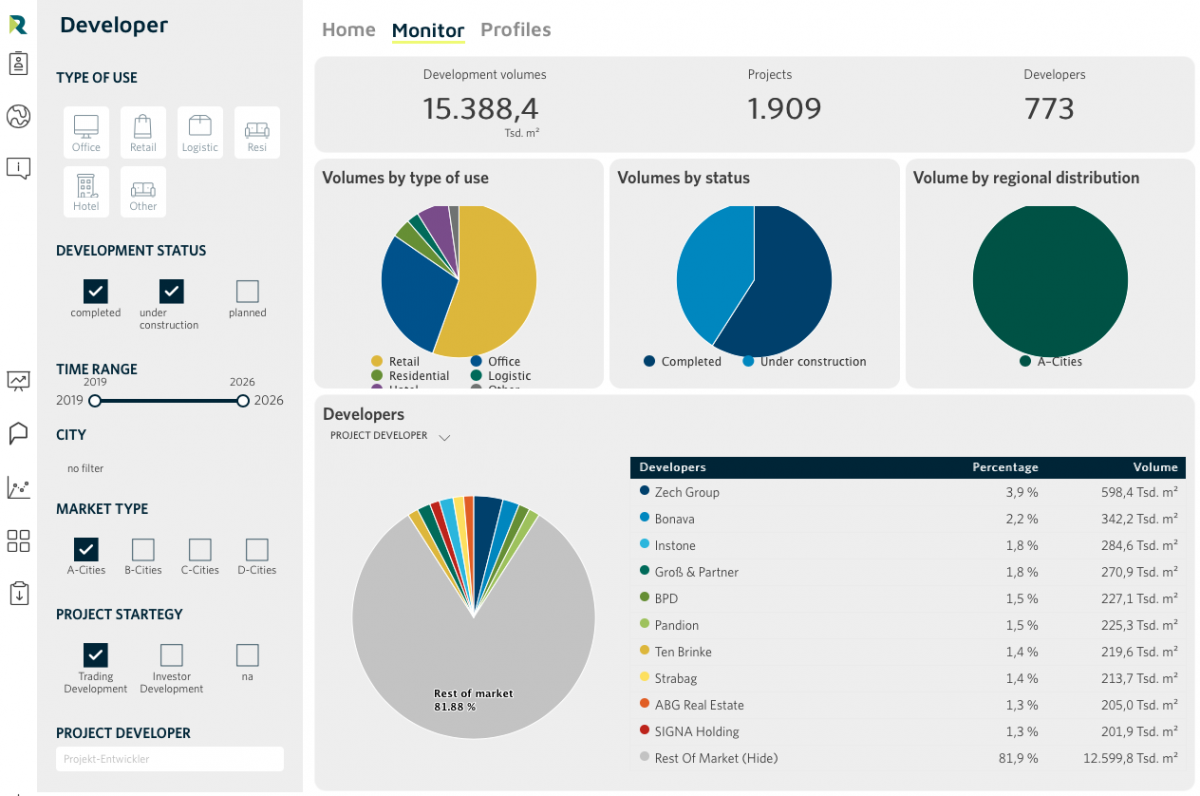

Rising interest rates and sharply rising construction costs are making business much more difficult for project developers. In the seven German A-cities, the project development volume fell by 3.6% between the analysis years 2021 and 2022, especially in residential construction - where it was 7.6%. Virtually all types of use (office, retail, residential, other) are suffering from uneconomic market conditions such as limited returns on rents and prices and still very strongly rising costs for construction services.

On the financing side, it is evident that banks have become more cautious in project developments and are demanding more equity. In general, the increased risks, for example due to the enormous rates of increase in construction costs, and the significantly higher interest rates are leading to significantly higher financing costs - and this in a market environment that is characterised by uncertainty.

Despite the slump in the seven A-cities Berlin, Hamburg, Cologne, Düsseldorf, Stuttgart, Frankfurt and Munich, almost one third of the project space (22.1 million sqm) is being built in the residential segment, which continues to dominate. 15.0 million sqm are calculated as office space, with a further 1.9 million sqm in the retail segment and 2.7 million sqm of project space for hotels.

The individual cities continue to be led by Berlin with 16.6 million sqm, ahead of Munich (7.8 million sqm), Hamburg (7.2 million sqm), Frankfurt/Main (5.1 million sqm), Düsseldorf (3.6 million sqm), Cologne (3.8 million sqm) and Stuttgart (2.2 million sqm).

Metropolitan areas are popular residential locations

In the nationwide bulwiengesa monitoring of over 150 project developers, the "Developer Profiles", it can be seen that building in the surrounding areas of metropolises plays an important role for these companies. Around 80% of logistics properties are built there and up to 27% of new flats.

High land prices coupled with municipal restrictions are causing many project developers to move to the suburbs. In addition, there are developments such as increasing home working, which also makes these locations much more attractive for users. This is the case for Berlin, for example: there, too, the importance of the Speckgürtel continues to grow. For many, Berlin has become too expensive to live in. In addition, longer commutes are being accepted as more people work from home. The share of completed square metres in the surrounding area of the capital region will rise from 17 % in the current year to 36 % in 2026. This is the result of the projection of residential project developments. There are considerable differences between the city and the surrounding area, for example in the investor structure. Private investors dominate in both submarkets, 67 % in Berlin, but as much as 92 % in the surrounding area. However, while municipal housing companies cover 30 % of the market in the capital, they account for only 5 % in the Speckgürtel. The housing structure also differs: owner-occupied flats account for 27 % within Berlin, but only 14 % outside. Rental housing accounts for 32 % of the project development market in the surrounding area, compared to 60 % in Berlin. The share of rental housing construction in the capital has risen significantly again in recent years. This is mainly due to the activities of the municipal housing companies.

The trend towards city quarters has also been clearly visible in recent years. According to a comprehensive analysis of this market, well over 600 projects with corresponding approaches are under development. According to this, neighbourhoods are strongly concentrated in the A-cities, but also in the B-cities. Due to their absolute size as a project development market, the A-cities, above all Berlin, are also centres for conversions of neighbourhoods and buildings. Almost 8 % of all project developments in the A-cities are conversions.

Extended analyses for project developer market beyond the A-cities

The results on the project development market come from an evaluation of the German project development market by bulwiengesa with the support of BF.direkt AG.

After 15 years of project development study with an annual results report, the analysis of project developments will go online from 2022 as an interactive "Development Monitor". Rankings and market structures are available throughout the year and can be analysed individually. bulwiengesa itself researches the relevant information for the A-cities and - new - also nationwide. Companies have the opportunity to check the research as part of a data exchange and to name projects.

The "Developer Profiles" are an online catalogue with information on selected project developers. The portfolio information is based on the data from the "Development Monitor". This is supplemented by qualitative information from the companies themselves on acquisition profile, strategic partners, USP, ESG characteristics, exit strategy and track records.

Note: If you have any questions about the Development Monitor or the Developer Profiles or are interested in participating, please contact Björn Bordscheck, bordscheck@bulwiengesa.de.

Contact: Andreas Schulten, Chief Representative at bulwiengesa, schulten@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

Little movement on the German real estate market

For the eleventh time, bulwiengesa presents its comprehensive analysis of the German real estate markets. The results of this year's 5% study, conducted in collaboration with ADVANT Beiten, show that the German real estate market is characterized by widespread stagnation. At the same time, niche segments are becoming increasingly attractive. The market is increasingly rewarding professional asset management and specialist knowledge—a trend that separates the wheat from the chaffFive per cent returns no longer illusory even for core properties

The ‘5% study - where investing is still worthwhile’ celebrates its tenth anniversary. Since the first edition was published, the German property market has tarnished its reputation as a safe investment haven. Higher yields are now within sight, even for prime properties, and even residential property is increasingly becoming a profitable asset class again. The market is more exciting than it has been for a long timeValuation for corporate insolvencies

In turbulent times, more companies than ever are facing insolvency. According to our data alone, this affects around 400 project developments and countless existing properties. Ideally, valuations for insolvency administrations show more than the actual valueInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.