Project developments: Few in planning, many postponed

The crisis is now clearly visible among project developers. The market in the seven class A cities is declining, and the traditional project developers in particular are withdrawing from the market. Residential projects, of all things, are significantly affected. And: Many projects are being completed later than planned.

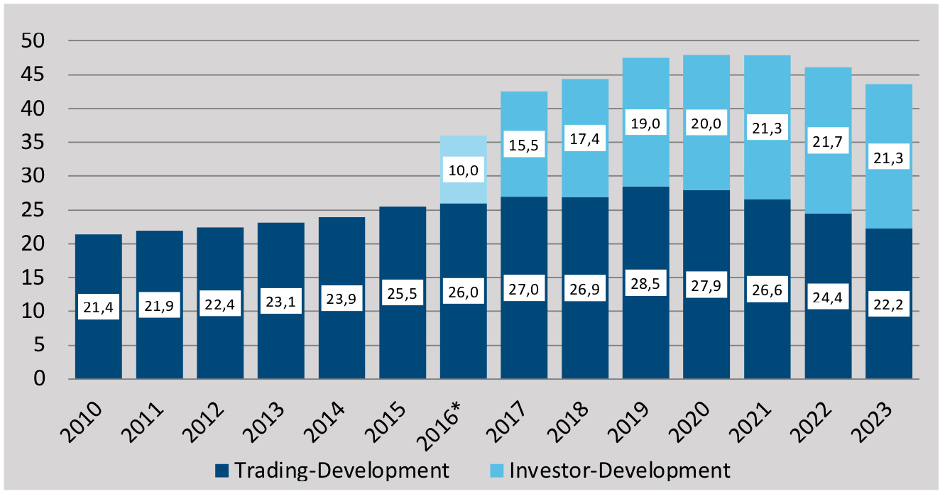

The total project development volume of the seven German class A cities will decline by 5.7% compared to 2022. Residential project developments are significantly affected by the decline with a minus of 7.4% or 1.6 million square metres. The office segment, on the other hand, is "only" shrinking by 5.3% compared to the previous year's evaluation. The decline is mainly in so-called trading development, i.e. the classic project developments for sale. With an overall minus of 8.8%, this is the strongest decline ever measured. Project developments for owner-occupation or portfolio maintenance - investor developments - are currently having a rather stabilising effect on the market. The decline there is 2.0%.

These are the results of a current evaluation of project development activities in the A-cities in our analysis tool Development Monitor, presented at a press conference on 16.5.23. This evaluation continues the time series that has already spanned 17 years, which bulwiengesa began with the Project Development Study and has now been further developed into the Development Monitor. For the current analysis, completed projects as well as projects under construction and in planning between 2020 and 2027 were evaluated.

The market is groaning and all players have been feeling the decline for some time. Now we can clearly see it in the figures. The sceptical earnings expectations of project developers are particularly evident in the slump in planning: These are down 7.8 percent overall compared to 2022. This has at a minimum dampened the danger that too much will be built as demand wanes. It also frees up urgently needed resources for the inevitable refurbishment of existing buildings.

Postponements

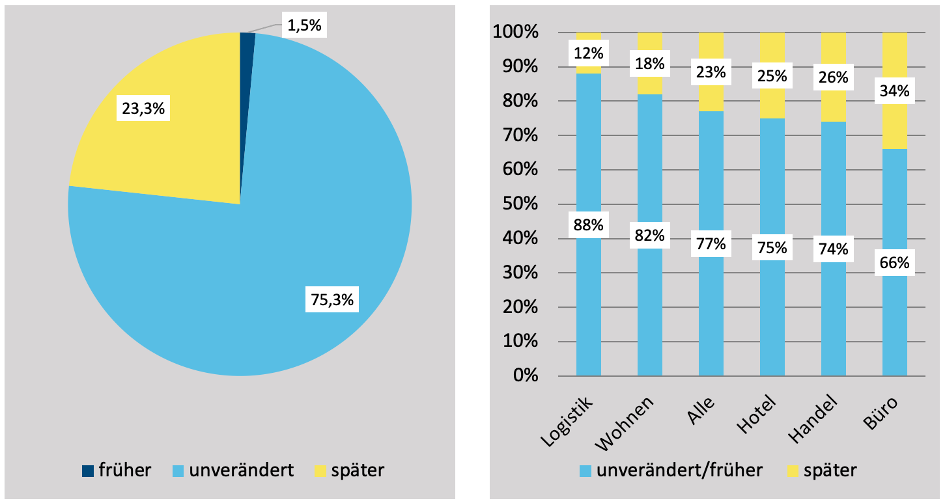

The currently much-discussed topic of "project postponements" now also has a confirmation in figures: the evaluation of projects in the Development Monitor shows that a good 23% area-wise will be completed later than planned at the end of 2022.

We see the most delays in office projects, the fewest in logistics projects. Developers expect high demand for logistics properties in the future, but this does not seem to be the case for offices. It is interesting to look at the business model: in Berlin, for example, only 16% of investor development projects are delayed, but 28% of trading developments. The classic project developers are more dependent on market developments and bear a higher risk.

Office market

Are trading developers running out of steam? Their office project volume in the class A cities has fallen by 560,000 square metres or 7.1 percent and now stands at 7.3 million square metres. This is a smaller decline than in the residential segment. But the enormously high decline in planning of 22.3 percent is particularly significant.

Many are not in the mood for large-scale new office planning at the moment: home offices and now the weakening economy are causing great scepticism about bringing properties to the market in an economically viable way.

The largest absolute (-488,000 square metres) and relative decline of 20 per cent was recorded in Munich, partly because some of the larger areas such as the Werksviertel have now been built on and are no longer included in the analysis.

Residential

20.4 million square metres of residential project space in the class A cities correspond to a decline of 1.6 million square metres compared to the previous year's evaluation (-7.4 percent). However, the decline is not a new phenomenon, but has been observed for several years. Even before Corona and the current crisis, high land prices and building costs, political restrictions and a shift to smaller towns or the outskirts of the A-cities led to a continuous decline. Residential project developments were last on the plus side in 2019.

In Berlin alone, project areas are declining by 790,000 square metres. In Düsseldorf and Hamburg, too, the decline compared to the last year's analysis is huge (both around 15%). With the exception of Cologne (+1%), residential project area is falling in all A-cities. Public housing associations are currently still keeping residential construction going, while trader developers are withdrawing much more strongly from the metropolises.

Of all places, it is in the metropolises, where the housing shortage is greatest, that construction activity is now heading towards hibernation. Without a speeding up of procedures and at least temporary financial support for housing construction, we will not solve the problem.

Trade and Hotel

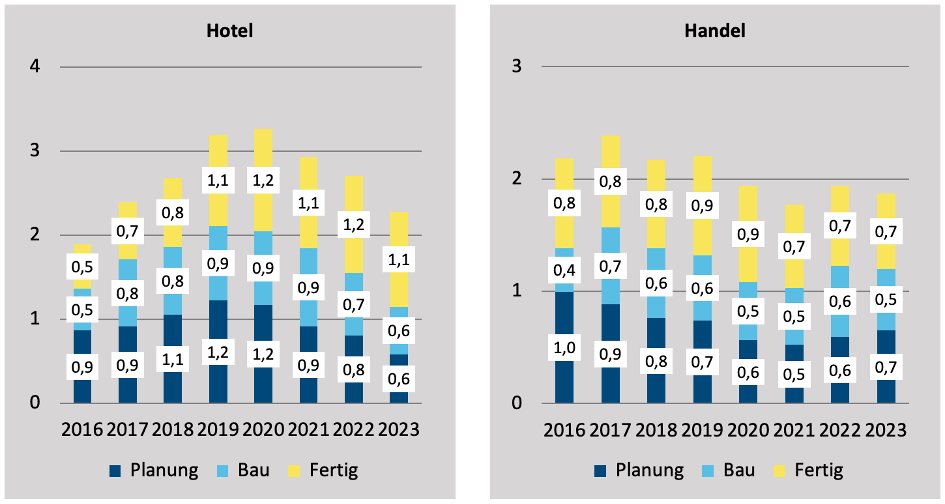

Despite a recovery in the number of overnight stays in the cities, the hotel industry has not yet found its way out of the crisis triggered by the corona-related lockdowns. Significantly declining planning volumes dominate the development in the hotel segment. Since 2020, the curve for completions, planning and projects under construction has been continuously declining.

It is all the more surprising that the volume of retail project developments is stable. However, it should be noted that the refurbishments and conversions of retail space are also included here. This development is not to be equated with a net increase in retail space. If one takes the slightly increasing planning volume as a yardstick for future business expectations, one can assume that the players are cautiously optimistic. However, both segments are also affected by delays: Around every fourth hotel and retail project will be completed later than its originally planned date at the end of 2022.

Note: Who is building what, where and how much, yesterday, today and in the future, who is ahead in the rankings - we can get a good picture from over 20,000 project developments across Germany that are currently listed in our Development Monitor. The Development Monitor and the Developer Profiles (free of charge) can be used via RIWIS access. RIWIS is also available in English.

If you are interested or have any questions, please contact us.

Contact person: Felix Embacher, Head of Research & Data Science, embacher@bulwiengesa.de, and Max Witte, Consultant, witte@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

Little movement on the German real estate market

For the eleventh time, bulwiengesa presents its comprehensive analysis of the German real estate markets. The results of this year's 5% study, conducted in collaboration with ADVANT Beiten, show that the German real estate market is characterized by widespread stagnation. At the same time, niche segments are becoming increasingly attractive. The market is increasingly rewarding professional asset management and specialist knowledge—a trend that separates the wheat from the chaffFive per cent returns no longer illusory even for core properties

The ‘5% study - where investing is still worthwhile’ celebrates its tenth anniversary. Since the first edition was published, the German property market has tarnished its reputation as a safe investment haven. Higher yields are now within sight, even for prime properties, and even residential property is increasingly becoming a profitable asset class again. The market is more exciting than it has been for a long timeValuation for corporate insolvencies

In turbulent times, more companies than ever are facing insolvency. According to our data alone, this affects around 400 project developments and countless existing properties. Ideally, valuations for insolvency administrations show more than the actual valueInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.