bulwiengesa Property Market Index 2022

The bulwiengesa Property Market Index 2022 describes the development of real estate prices in Germany for the 46th time in a row: real estate prices have been rising for 17 years now. Even the corona-related ups and downs in the economy over the past two years have only led to a partial decline in prices. Compared to 2020, growth has even increased again.

The most important results:

- Property prices rise by 4.6 per cent in 2021 - with large differences

- Residential markets continue to pick up, especially for properties for sale

- Office rents rise, vacancies too

- Fall in retail rents continues

- Highest price increases in 46 years: Bavarian cities

More detailed information is available in the brochure and in the press release. For the acquisition of individual evaluations and time series, e.g. of individual locations and asset classes, please contact us.

Contact: Jan Finke, finke@bulwiengesa.de, Phone +49 201 - 8746 96-63

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

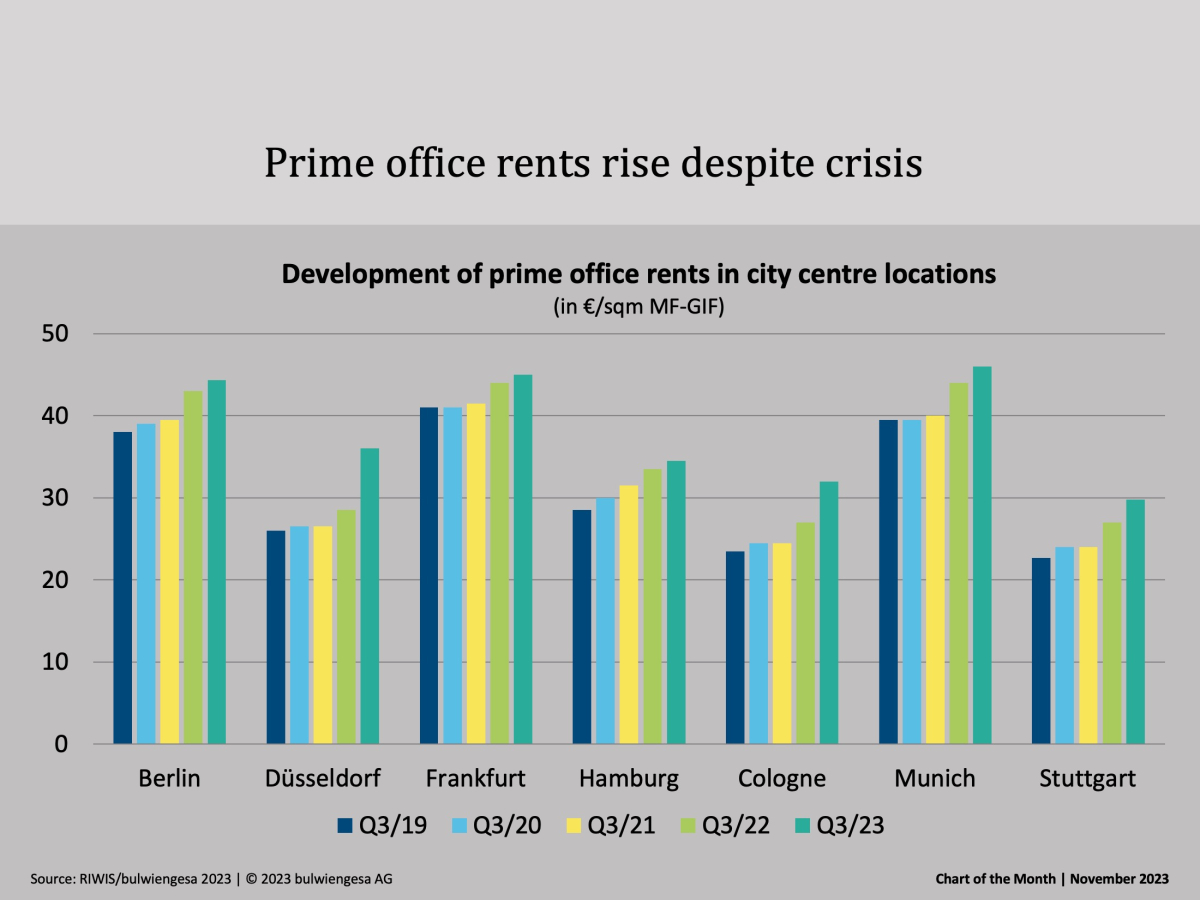

Chart of the month November: Top offices are still in demand

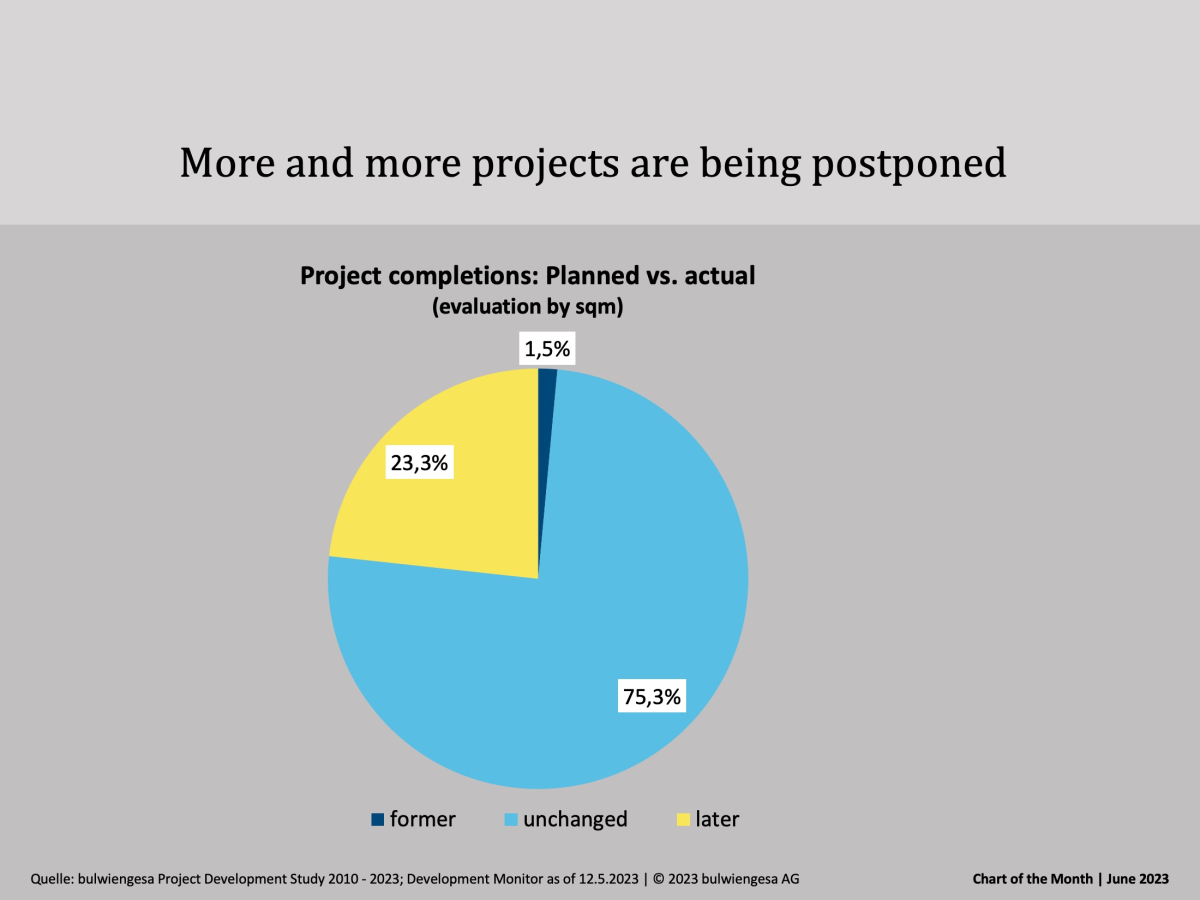

Office vacancies are increasing in the seven class A cities. According to classic economic theory, rents should therefore be falling. But our quarterly figures show: Prime rents are still risingChart of the Month June: Every Fourth Project Development Postponed

Project developments in the A-cities have not only declined rapidly. Many projects are also postponedProject developments: Few in planning, many postponed

The crisis is now clearly visible among project developers. The market in the seven class A cities is declining, and the traditional project developers in particular are withdrawing from the market. Residential projects, of all things, are significantly affected. And: Many projects are being completed later than plannedInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.