The 5 % Study 2020 – Where It Still Pays Off to Invest

Yields for experts at most

Risks are increasing in some real estate markets - but this is not reflected in returns everywhere. For the 5% Study 2020 published today, bulwiengesa has once again examined the potential returns (IRR) on the German real estate markets.

The 5% Study has already been offering a compact market overview since 2015 and provides a new approach to describing real estate markets. It examines the performance expectations of the most important asset classes that currently dominate the German investment market:

- Residential

- Office

- Shopping centers and retail parks

- Hotel

- Logistics real estate

- Micro apartments

- Corporate real estate

Contact:

Sven Carstensen, carstensen@bulwiengesa.de, Phone: +49 30 27 87 68 31

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

Senior Living – the ideal location

The location is particularly important for properties for seniors. Acceptance by the residents stands and falls with the location of a new building. What should be considered when choosing a location?Chart of the Month September: Residential Project Area Continues to Decline

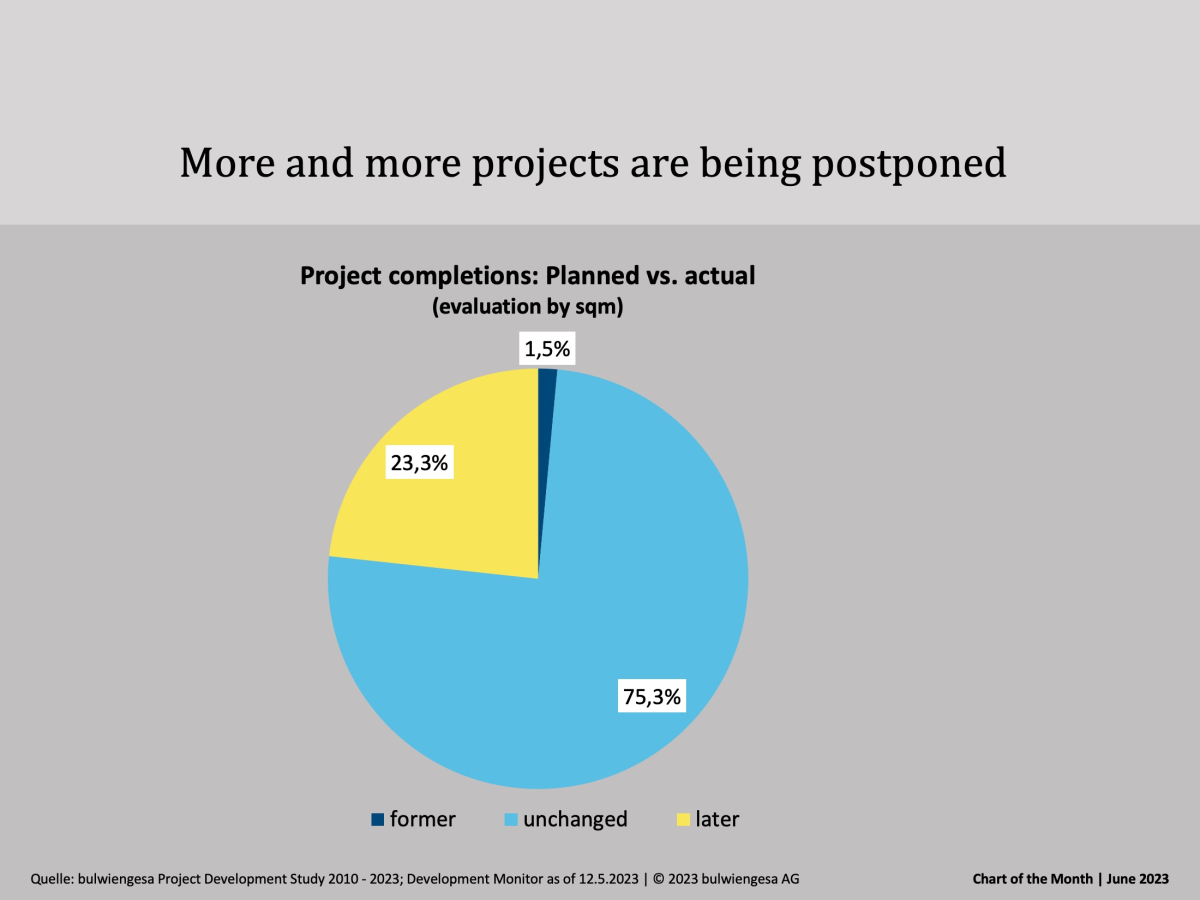

The insolvencies of large and small project developers illustrate the extremely tense market situation. And the number of residential projects planned and under construction is falling - most sharply in the metropolises, of all places, where the housing shortage is greatestChart of the Month June: Every Fourth Project Development Postponed

Project developments in the A-cities have not only declined rapidly. Many projects are also postponedInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.