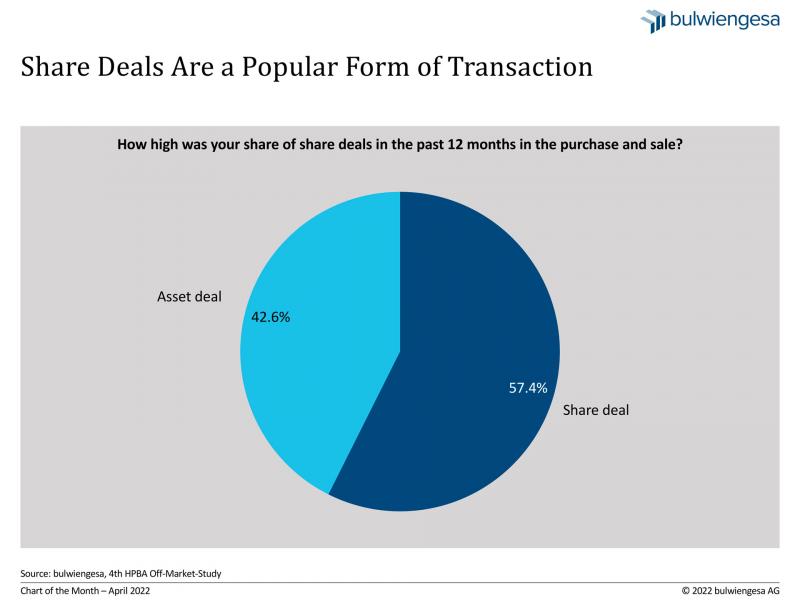

Chart of the month April: Share deals are the reality

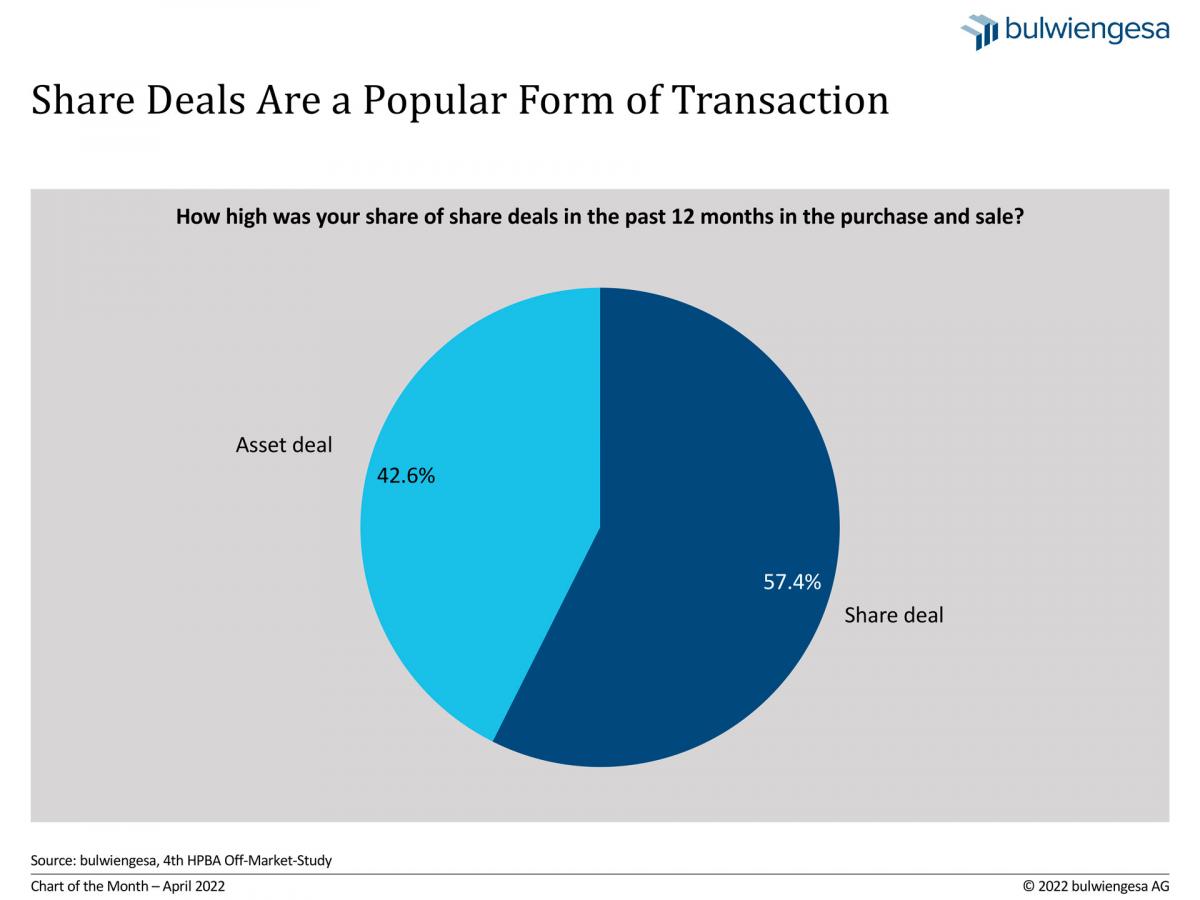

Share deals are politically controversial, as no real estate transfer tax is payable on the purchase of large real estate portfolios. According to our off-market study for HPBA, about six out of ten transactions take the form of a share deal.

In a share deal, it is not the real estate or land that is sold on directly, but shares in a company that owns the land. Often these companies are founded specifically for the purpose of a share deal. The real estate is thus only acquired proportionately, which means that the buyer does not have to pay any real estate transfer tax. The public's criticism that while every purchaser of a home has to put land transfer tax on the table, in the case of deals involving large companies the state misses out on tax revenue through this legal construct is understandable. On the other hand, a new regulation should not make the ever-necessary restructuring of (medium-sized) company and large family assets too difficult. Last year, the legal requirements were tightened. Overall, the share of share deals seems to be declining; according to a response by the Federal Government 2021 (see rbb24), the share was 15 per cent nationwide in 2015 and successively declined to seven per cent in 2020.

For the already fourth off-market study commissioned by HPBA, a specialist for off-market transactions, we again surveyed around 100 investors on their strategies. Off-market transactions take place largely out of the public eye and beyond the usual bidding procedures. Once again, the share deal topic also had a prominent position. Although share deals are not directly related to off-market transactions, the results of the second and third off-market surveys of 2019 and 2021 - namely an average share of first 31 per cent in 2018 and then 35 per cent in 2019 - should be revisited. The development as shown by our (non-representative) survey is in contrast to the above figures.

This survey was particularly relevant because the Act Amending the Real Estate Transfer Tax Act (Gesetz zur Änderung des Grunderwerbsteuergesetzes) was introduced in Germany as of 01.07.2021, which makes it more difficult to avoid paying real estate transfer tax on share deals. Until then, if an investor purchased less than 95 percent of the shares in the real estate-owning company, no real estate transfer tax was due; since 2021, the limit has been 90 percent. At the same time, the holding period for the seller of the remaining shares was extended from five to ten years.

The chart of the month shows: The share of share deals in the past twelve months, according to the respondents, is very high at 57 percent. On the other hand, the share of asset deals, i.e. the direct purchase of another company's real estate, was around 42 percent. Share deals, unlike asset deals, do not have to be reported to the appraisal committees, nor is an entry in the land register necessary. These transactions are only registered by brokers (in part) and tax authorities - so it is generally very difficult to obtain reliable statements.

Despite the change in legislation, the share of share deals in the survey of players has recently increased significantly once again. From market practice it is reported that buyers often acquire one hundred per cent shares in the respective company against a moderate price reduction in order to offer tax advantages to the seller. In these cases, therefore, the land transfer tax is paid, whereby the legislation has achieved its goal and the transactions are merely priced accordingly.

Contact: Andreas Schulten, Plenipotentiary at bulwiengesa, schulten@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

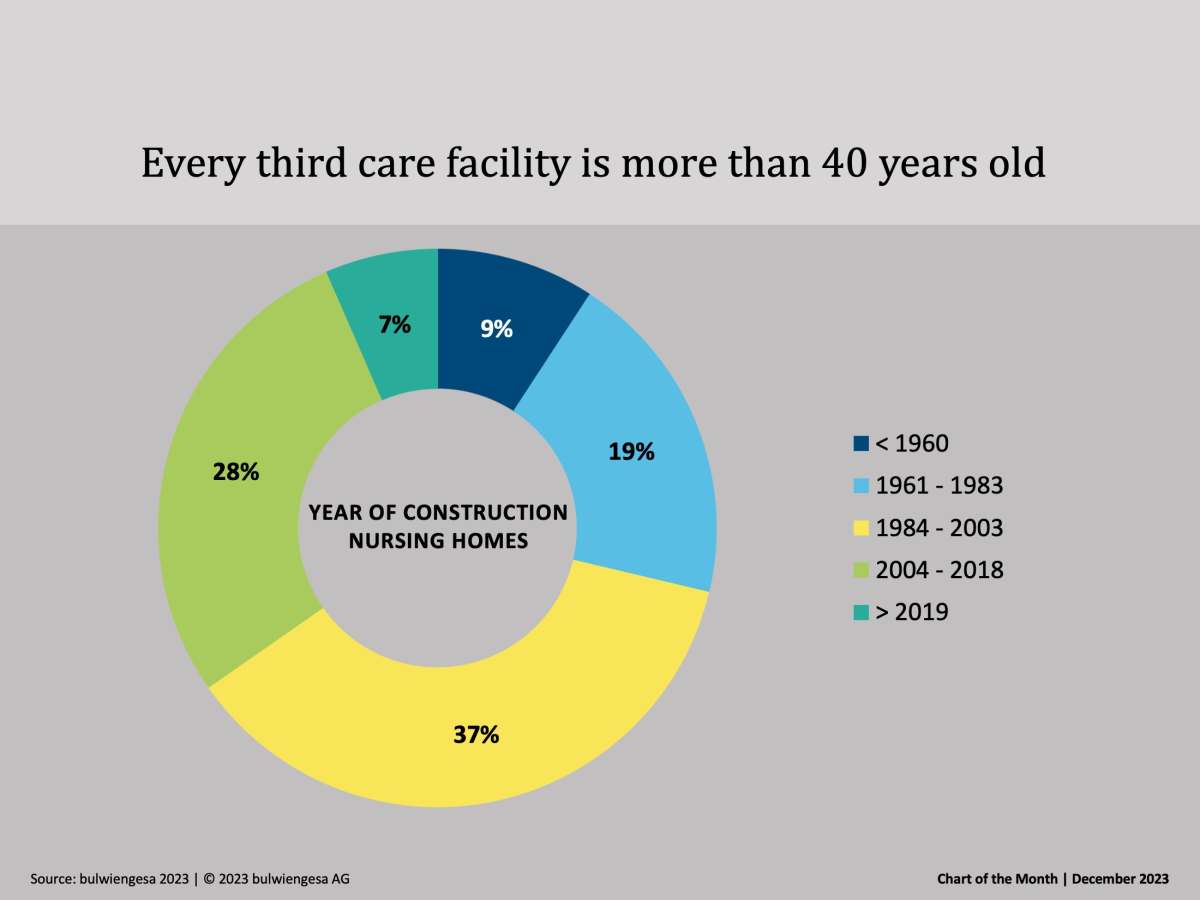

Chart of the month December: The country needs new care properties

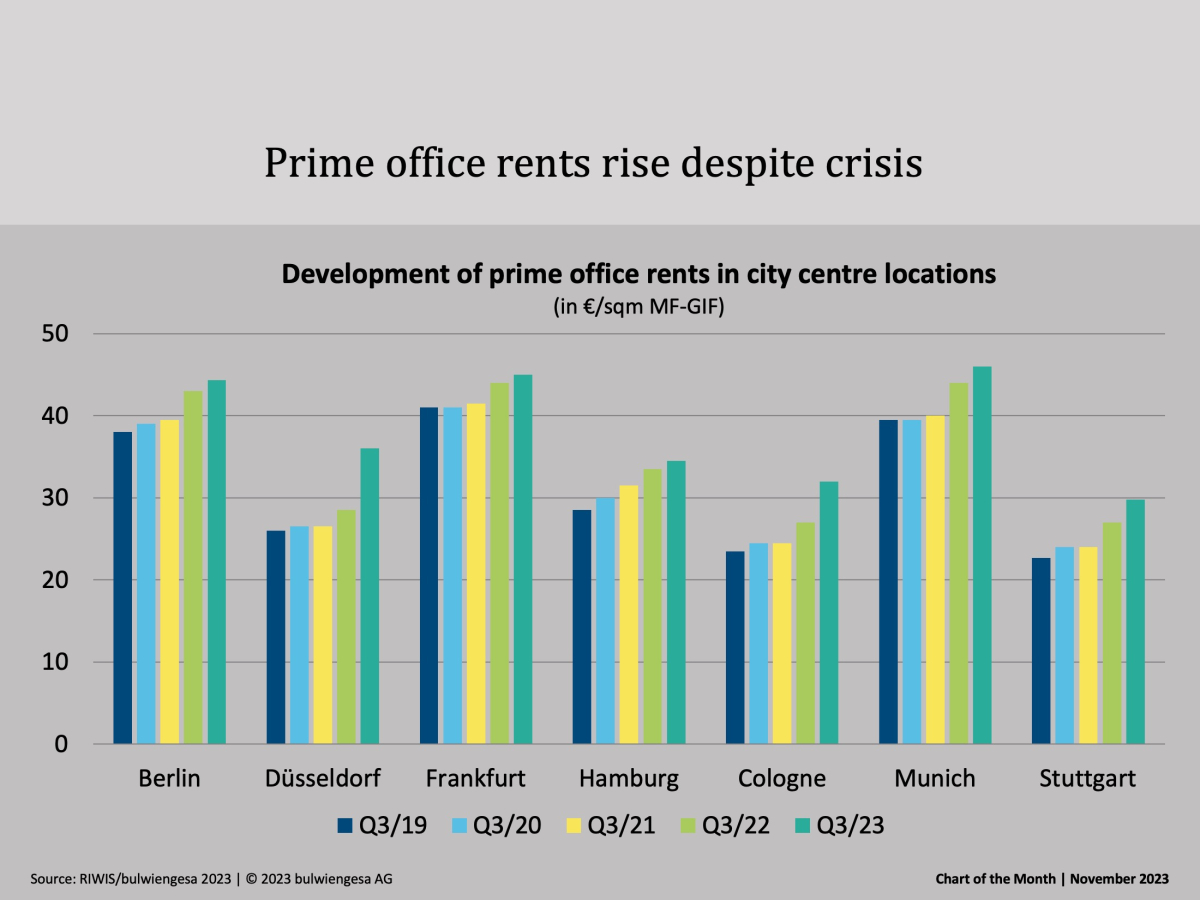

Many care homes are no longer up to date - no one wants "care centres" any more, and building standards have changed fundamentally. Therefore, when planning the care infrastructure, not only the additional need for care places, but also the need for substitution must be taken into account.Chart of the month November: Top offices are still in demand

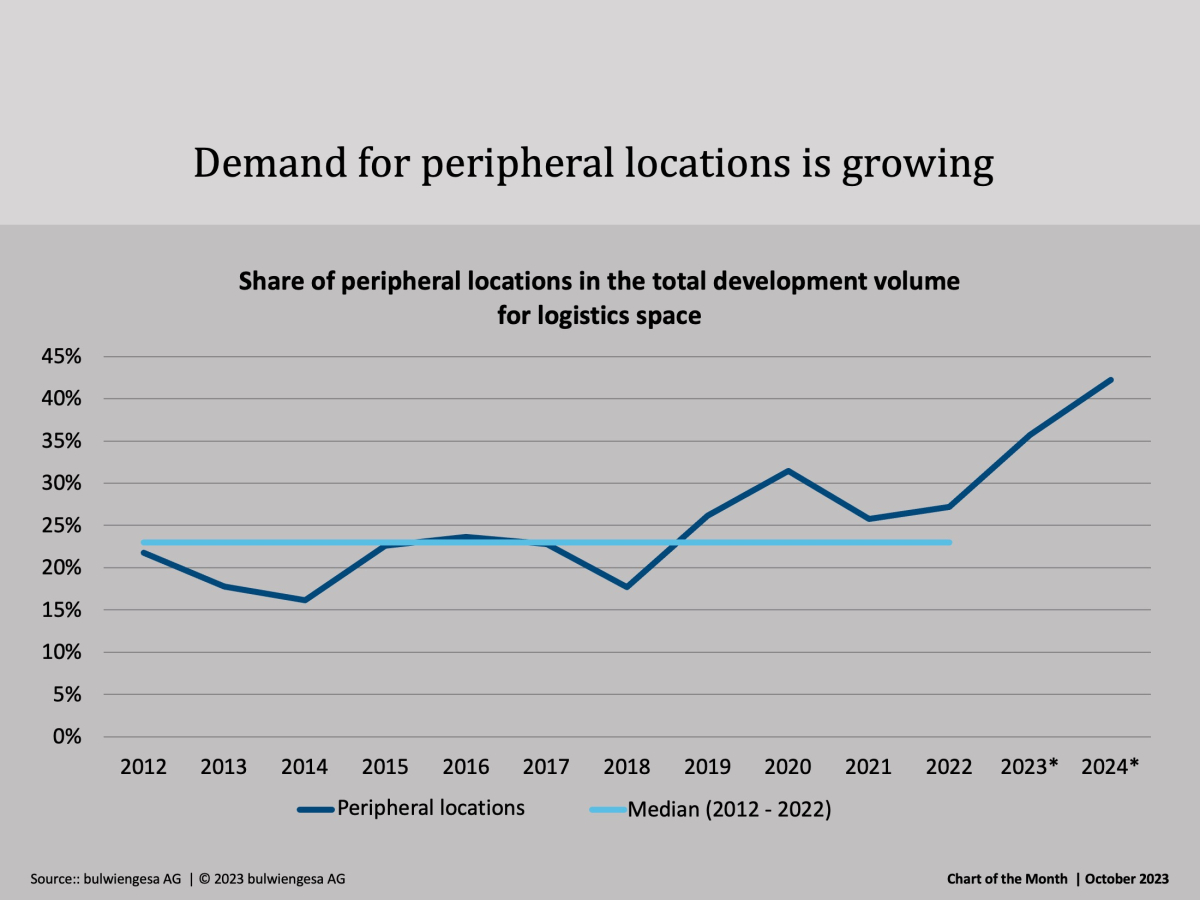

Office vacancies are increasing in the seven class A cities. According to classic economic theory, rents should therefore be falling. But our quarterly figures show: Prime rents are still risingChart of the Month October: Boom in the peripheral locations

The recently published study "Logistics and Real Estate 2023" shows: former "second-tier" regions are increasingly in demand - even those outside the classic logistics regions. And the trend is continuingInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.