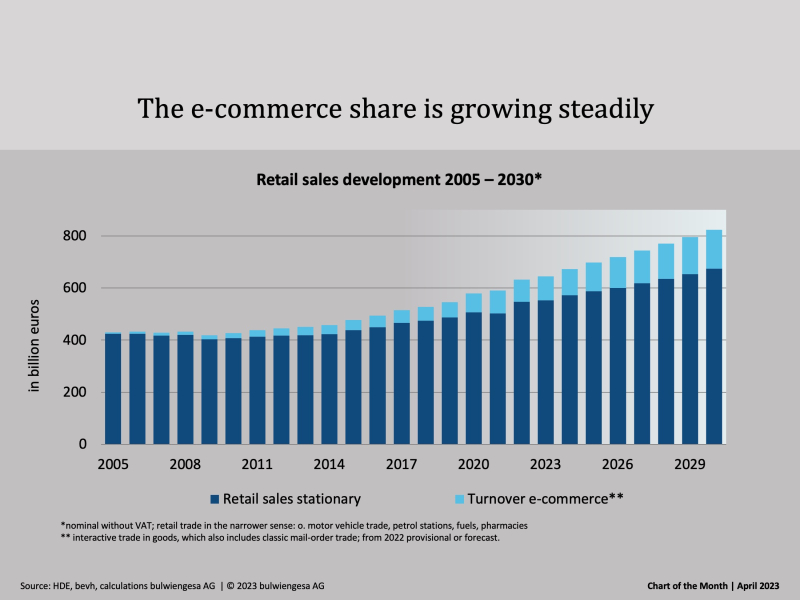

Chart of the Month April: Stationary Retail Sales versus E-Commerce

From eyecare to houseplants: We collect consumption data for numerous product groups, e.g. for impact and risk analyses as well as location searches. The share of e-commerce will continue to grow in the future, although it will vary greatly depending on the product group.

Retail sales in Germany have undergone an unusual development in the years from 2019 to 2022 due to various factors. While average nominal growth of around 3% per year was observed over the last ten years, this jumped with the onset of the pandemic in 2020 due to, among other things, the shift in sales from gastronomy to food retail.

From 2021 at the latest, stationary retail suffered a significant drop in sales due to the shop closures imposed during the lockdown phases, which was, however, compensated for by considerable growth in e-commerce sales, so that retail sales also grew in that year.

For 2022, the nominal growth path continued. Nevertheless, this is essentially supported by the increased inflation in the wake of the war in Ukraine and the energy crisis and even declined slightly in real terms. There was a slight recovery in stationary trade, while interactive trade experienced a significant decline in turnover compared to the previous year. Overall, however, e-commerce retains a level of turnover that was boosted by the pandemic.

For the coming years, a gradual normalisation of inflation and a convergence towards the 2% target of the European Central Bank and moderate growth in private consumption are expected. As a result, retail sales are also expected to grow steadily. The sales share of e-commerce will steadily increase. However, there are significant differences depending on the product group, as the detailed report (to be published shortly) shows.

Note: Consumption expenditure for selected commodity groups is published annually and will soon be available as a download. More info coming soon here: https://bulwiengesa.de/de/publikationen

Contact: Dr. Joseph Frechen, Retail Division Manager and Hamburg Branch Manager, frechen@bulwiengesa.de, and Felix Schrader, Senior Consultant in the Retail Division, schrader@bulwiengesa.de.

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

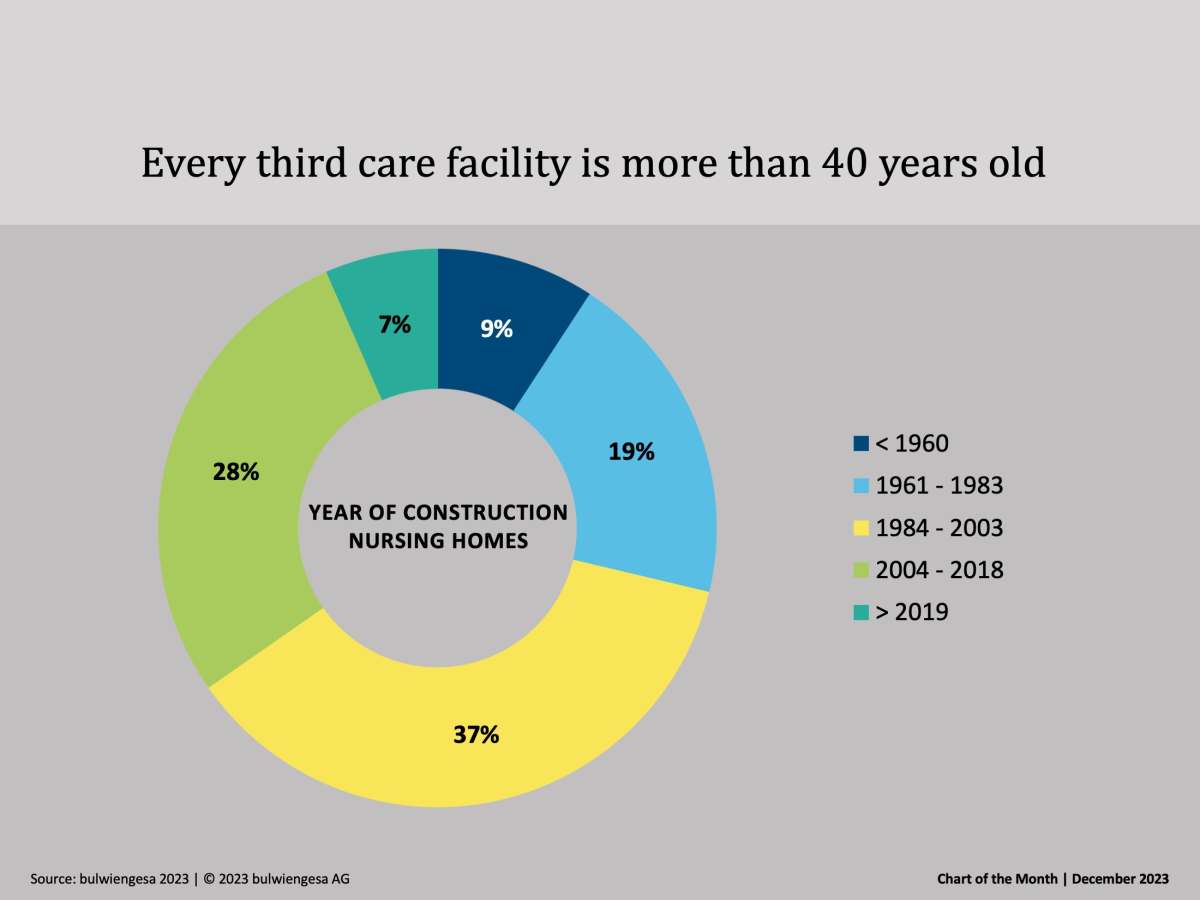

Chart of the month December: The country needs new care properties

Many care homes are no longer up to date - no one wants "care centres" any more, and building standards have changed fundamentally. Therefore, when planning the care infrastructure, not only the additional need for care places, but also the need for substitution must be taken into account.Chart of the month November: Top offices are still in demand

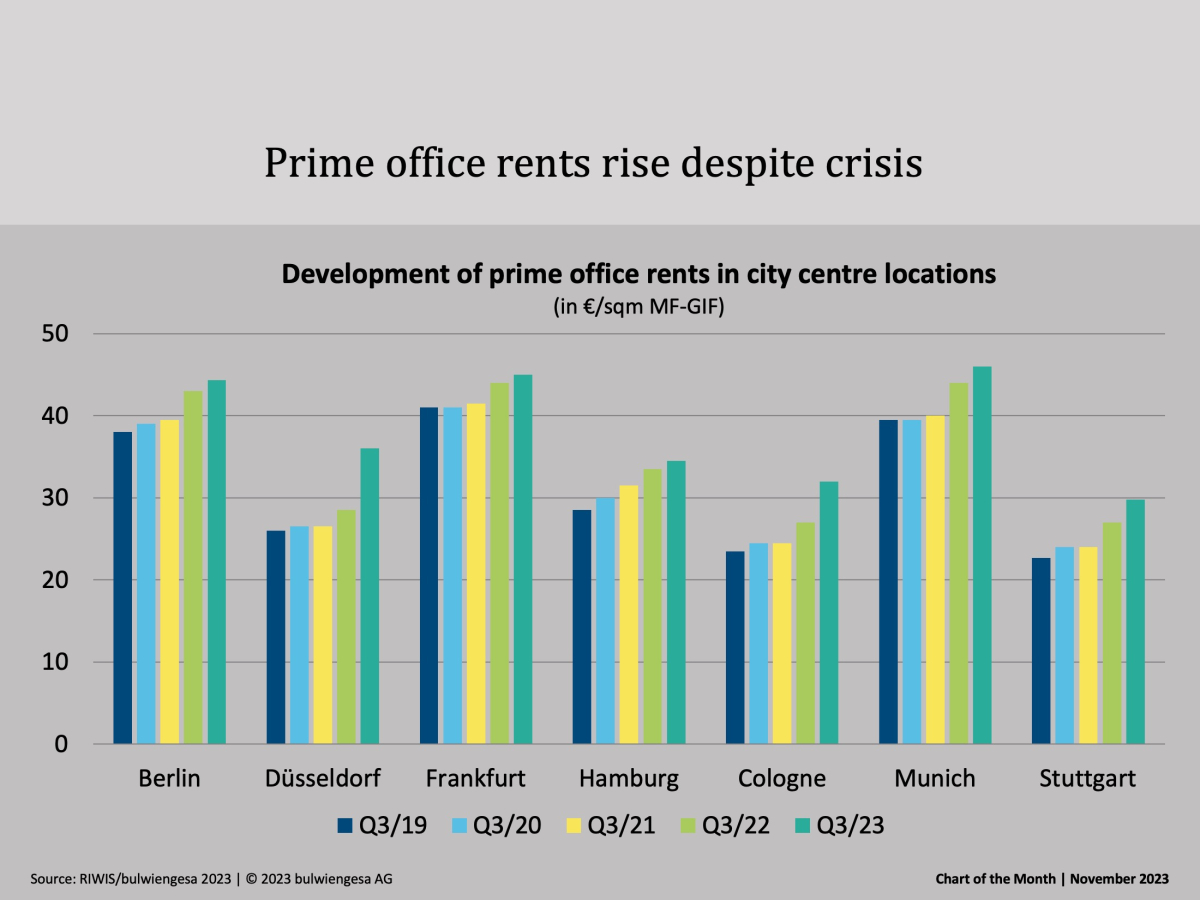

Office vacancies are increasing in the seven class A cities. According to classic economic theory, rents should therefore be falling. But our quarterly figures show: Prime rents are still risingChart of the Month October: Boom in the peripheral locations

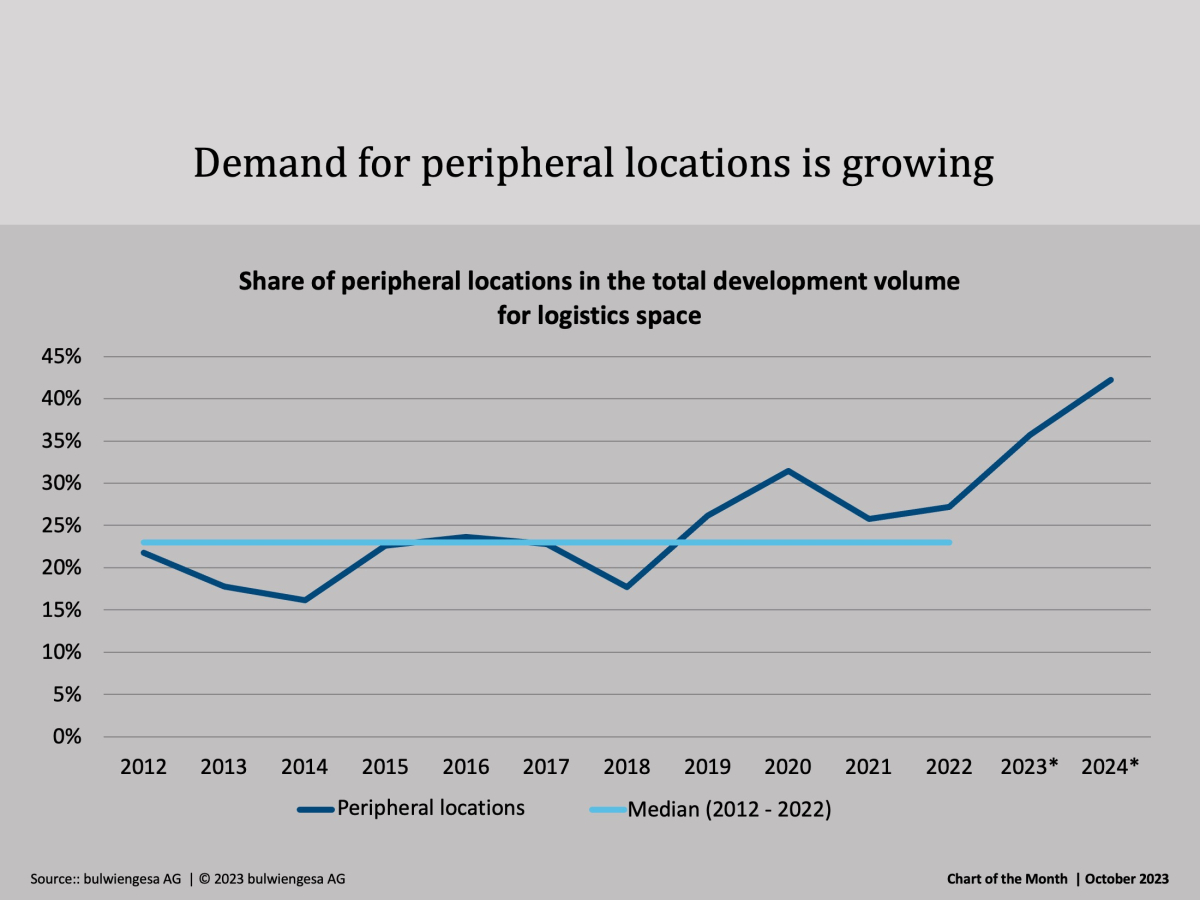

The recently published study "Logistics and Real Estate 2023" shows: former "second-tier" regions are increasingly in demand - even those outside the classic logistics regions. And the trend is continuingInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.