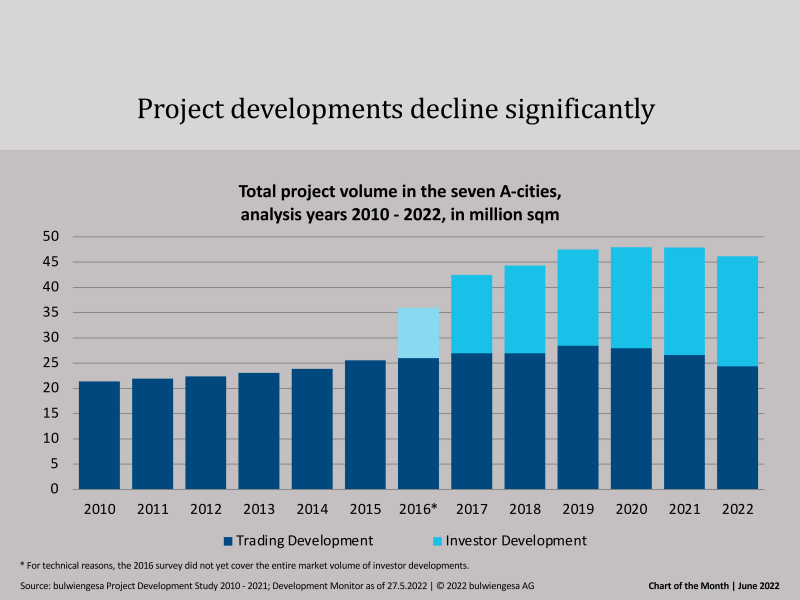

Chart of the Month June: Fewer Project Developments

In the seven class A cities, the project volume now amounts to only 46.2 million sqm. This corresponds to a decline of 3.6 per cent compared to the first Corona year 2020. Trading development in particular is on the decline, while portfolio holders continue to build and plan diligently.

In trading development - i.e. developments with the intention of selling the project - the downward trend continues. At minus 8.3 %, the sharpest decline to date since the financial and debt crisis has been recorded. This is shown by a current evaluation from the Development Monitor.

Currently, many market participants are taking a wait-and-see approach, observing the situation and postponing decisions on projects. Banks in particular are very cautious. Interest rate developments will once again shape the market in a more user-oriented and less capital market-oriented way.

The decline in trading development in the seven class A cities Berlin, Hamburg, Munich, Frankfurt, Cologne, Dusseldorf and Stuttgart does not come as a surprise, but has already become apparent in recent years, as the chart of the month shows. Migration to the suburbs of the metropolises, low land availability and correspondingly high land costs are having an effect.

In the seven class A cities of Berlin, Hamburg, Cologne, Düsseldorf, Stuttgart, Frankfurt and Munich, the trading development volume alone fell across all segments to 24.4 million sqm. Compared to the peak value of 2019, when 28.5 million sqm were still under development, this even corresponds to a decline of over 14 %. The market for trading developments continues to be dominated by residential project space - followed by offices and retail space - and primarily by project developers operating nationwide.

Incidentally, investor developments, i.e. developments for the company's own portfolio, have not declined; only growth has flattened out. Municipal housing companies in particular are continuing their construction activities despite increased costs and economic uncertainties.

Contact person: Sven Carstensen, Executive Board at bulwiengesa, carstensen@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

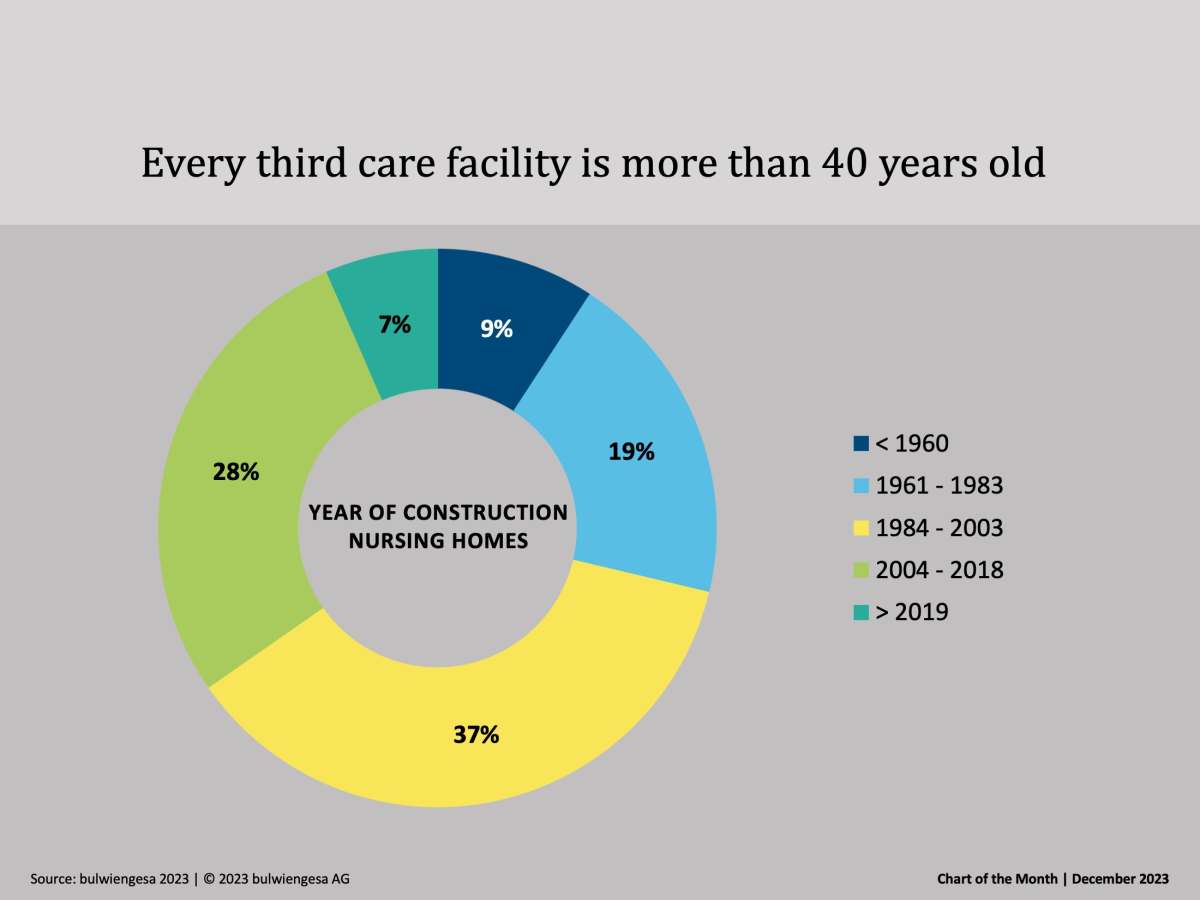

Chart of the month December: The country needs new care properties

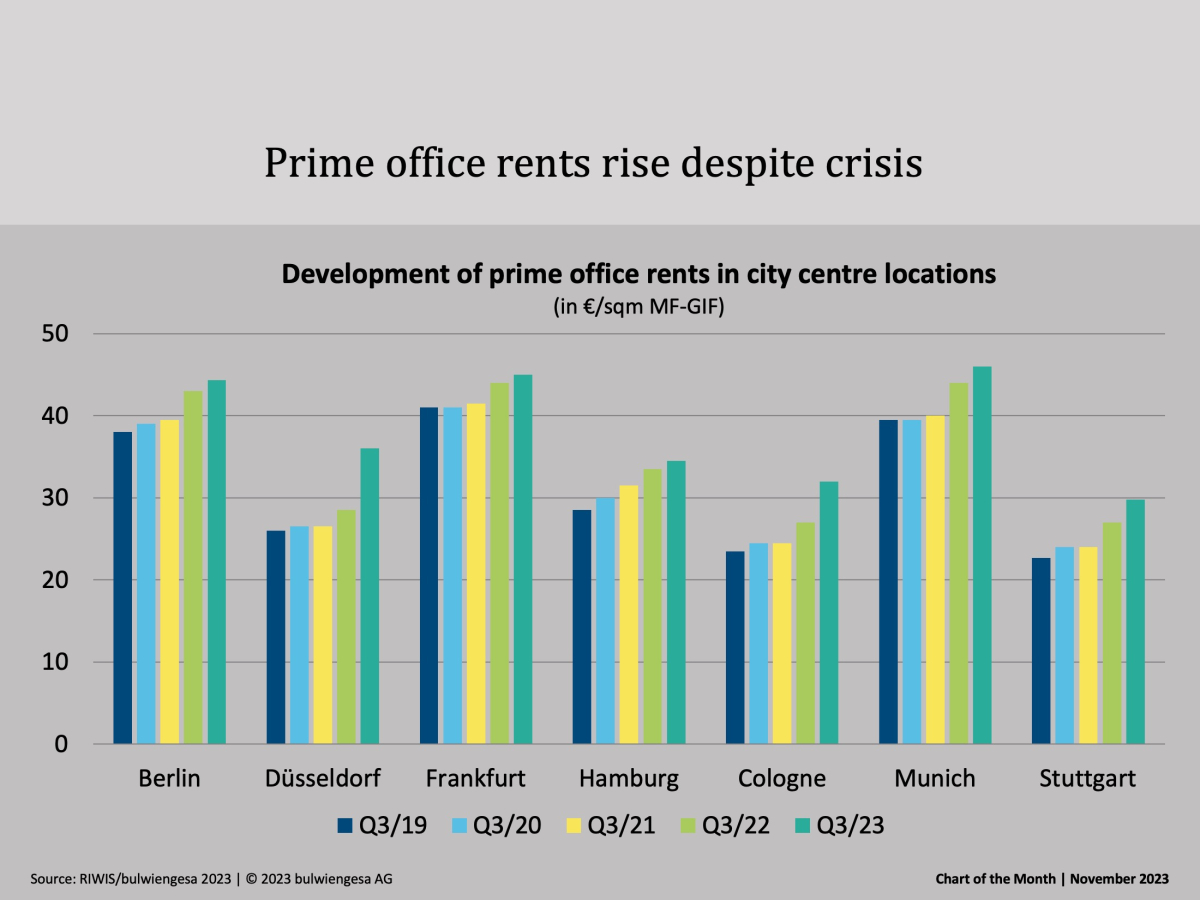

Many care homes are no longer up to date - no one wants "care centres" any more, and building standards have changed fundamentally. Therefore, when planning the care infrastructure, not only the additional need for care places, but also the need for substitution must be taken into account.Chart of the month November: Top offices are still in demand

Office vacancies are increasing in the seven class A cities. According to classic economic theory, rents should therefore be falling. But our quarterly figures show: Prime rents are still risingChart of the Month October: Boom in the peripheral locations

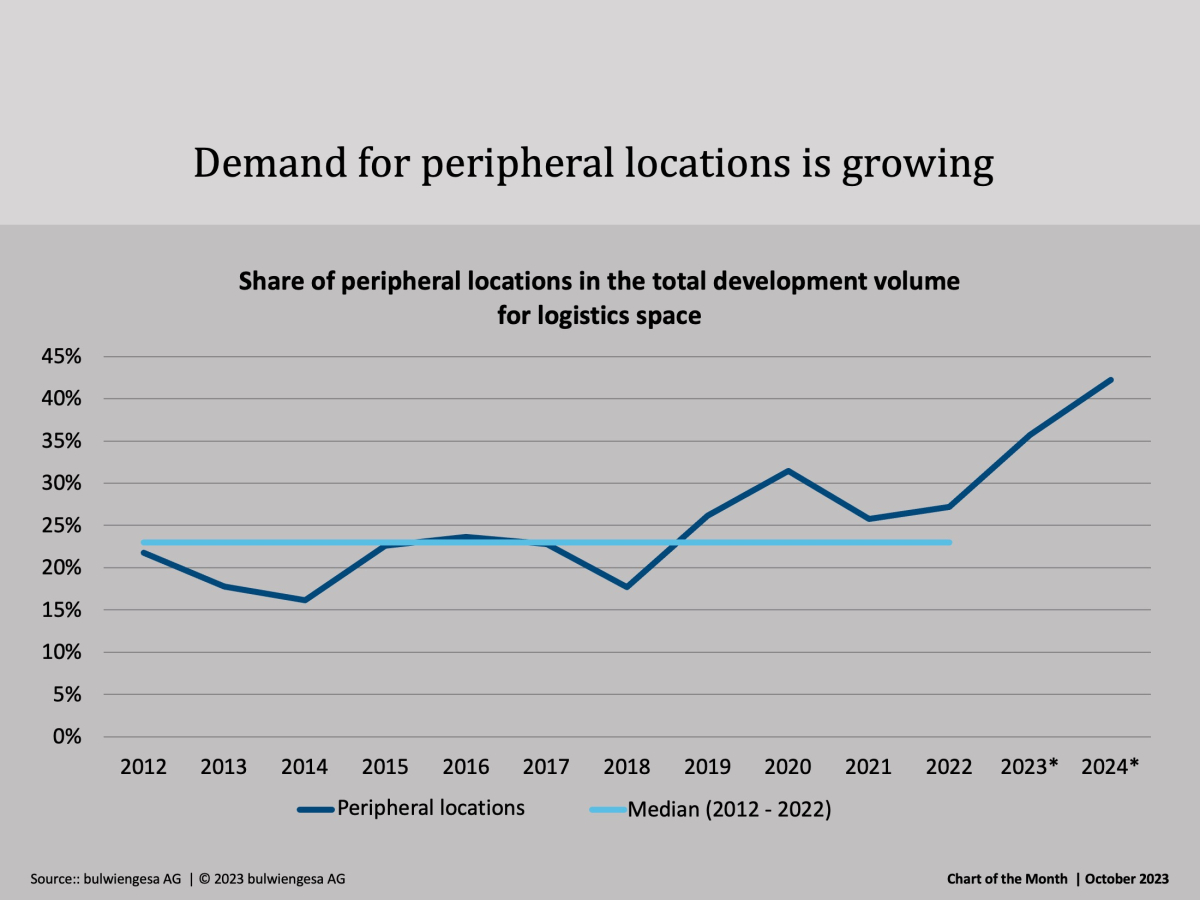

The recently published study "Logistics and Real Estate 2023" shows: former "second-tier" regions are increasingly in demand - even those outside the classic logistics regions. And the trend is continuingInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.