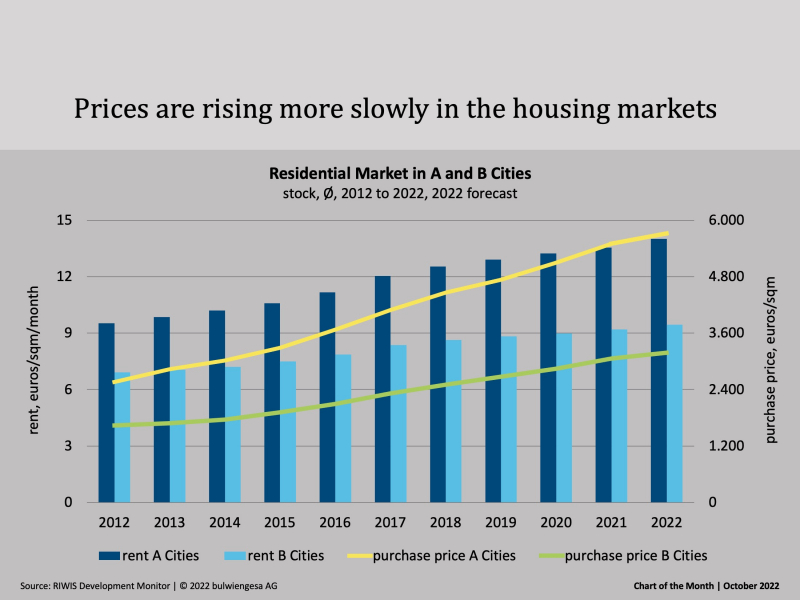

Chart of the Month October: Excess Demand and Buying Restraint

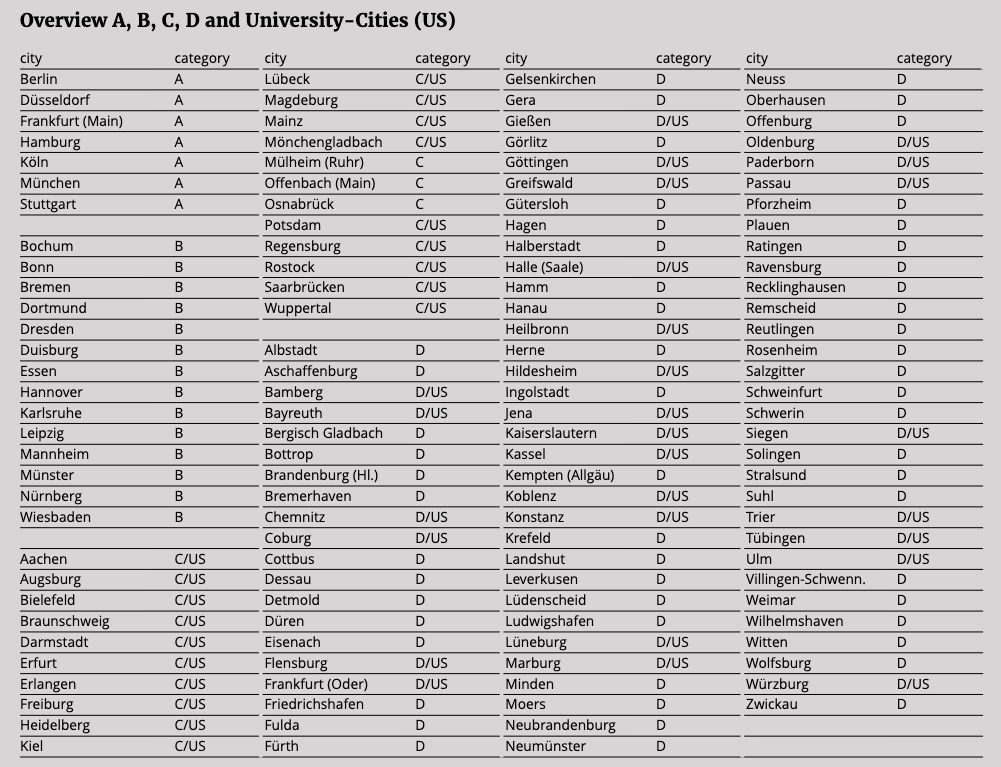

The fundamentals for the German housing market remain positive. However, it is hardly possible for investors to obtain inflation protection any more. The 5 % Study 2022 shows how different market opportunities and returns are.

In many cities, there has been excess demand for years, which has recently been exacerbated by insufficient construction activity. Nevertheless, affordability has continued to decline. The current sharp rise in energy prices is leading to a further increase in housing costs. The supply shortage will continue to determine the market in the medium term. This is characterised by supply bottlenecks, rising construction costs and a shortage of skilled workers. In addition, the current interest rate development affects both the supply and the demand side.

Even if the demand for residential property is currently still present in many places, an increasing uncertainty can be felt here as well when making purchase decisions. Nevertheless - as the chart of the month also shows - slight price increases for new flats are still to be expected, as developers pass on the cost increases to the end customers.

A decline in demand on the buyer side in turn leads us to expect an increase in rental demand, which may also result in rent increases in a still problematic environment for the realisation of housing. Basically, an increase in the attractiveness of the rental market can be assumed, which consequently leads to higher demand. At the same time, the basic market opportunities are very different: While prosperous locations have theoretical potential for rent increases above the rate of inflation, in other regions demographic change is hitting harder, so that existing flats here should grow below inflation and incomes.

The current interest rate environment will continue to shape the investment market in the medium term. The long-lasting phase of ever-increasing yield compression is thus likely to be over. The IRR ranges for residential in A markets are 1.6% to 2.8%, in B markets 1.9% to 3.1%.

Note: The 5 % Study 2022 and the press release can be found here.

Contact persons: Anna Wolfgarten, Consultant in commercial real estate, wolfgarten@bulwiengesa.de and Sven Carstensen, Board of Directors, carstensen@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

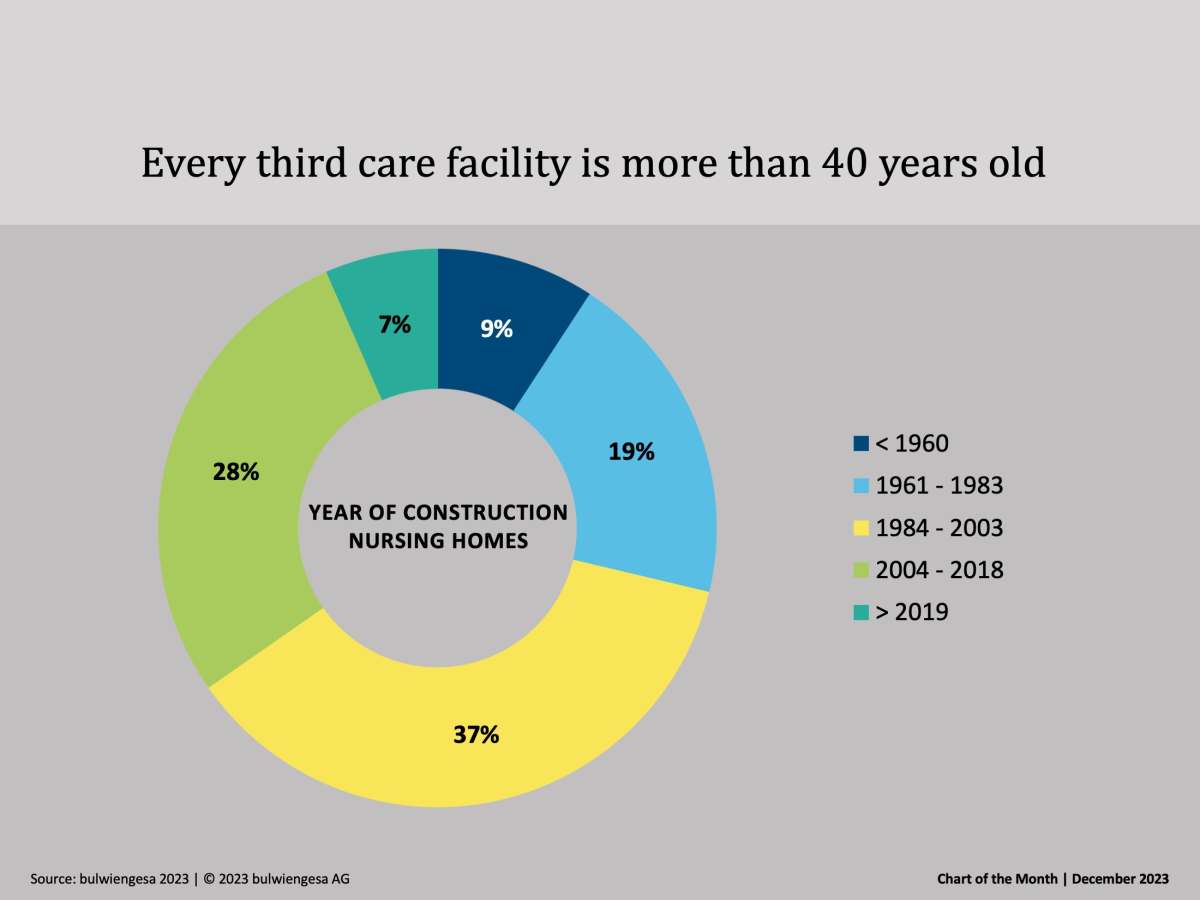

Chart of the month December: The country needs new care properties

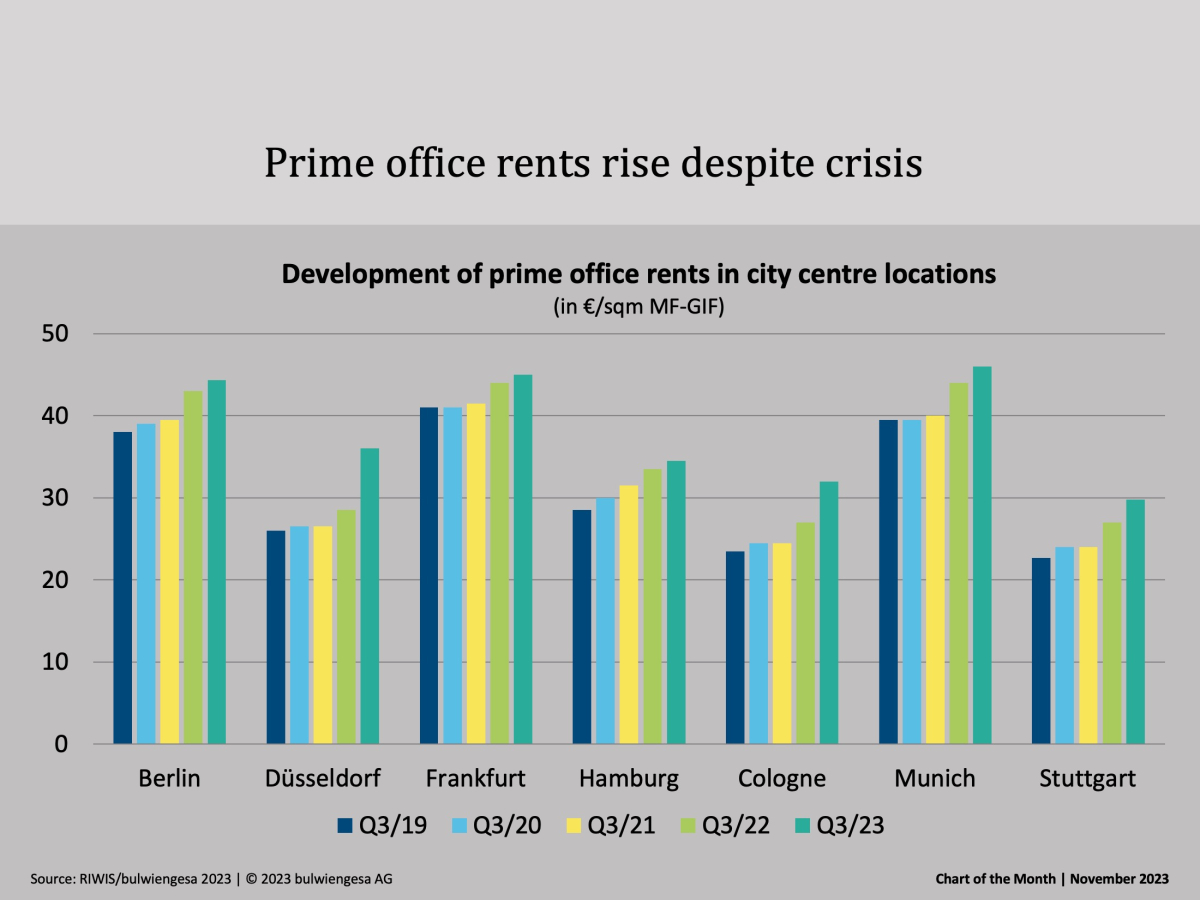

Many care homes are no longer up to date - no one wants "care centres" any more, and building standards have changed fundamentally. Therefore, when planning the care infrastructure, not only the additional need for care places, but also the need for substitution must be taken into account.Chart of the month November: Top offices are still in demand

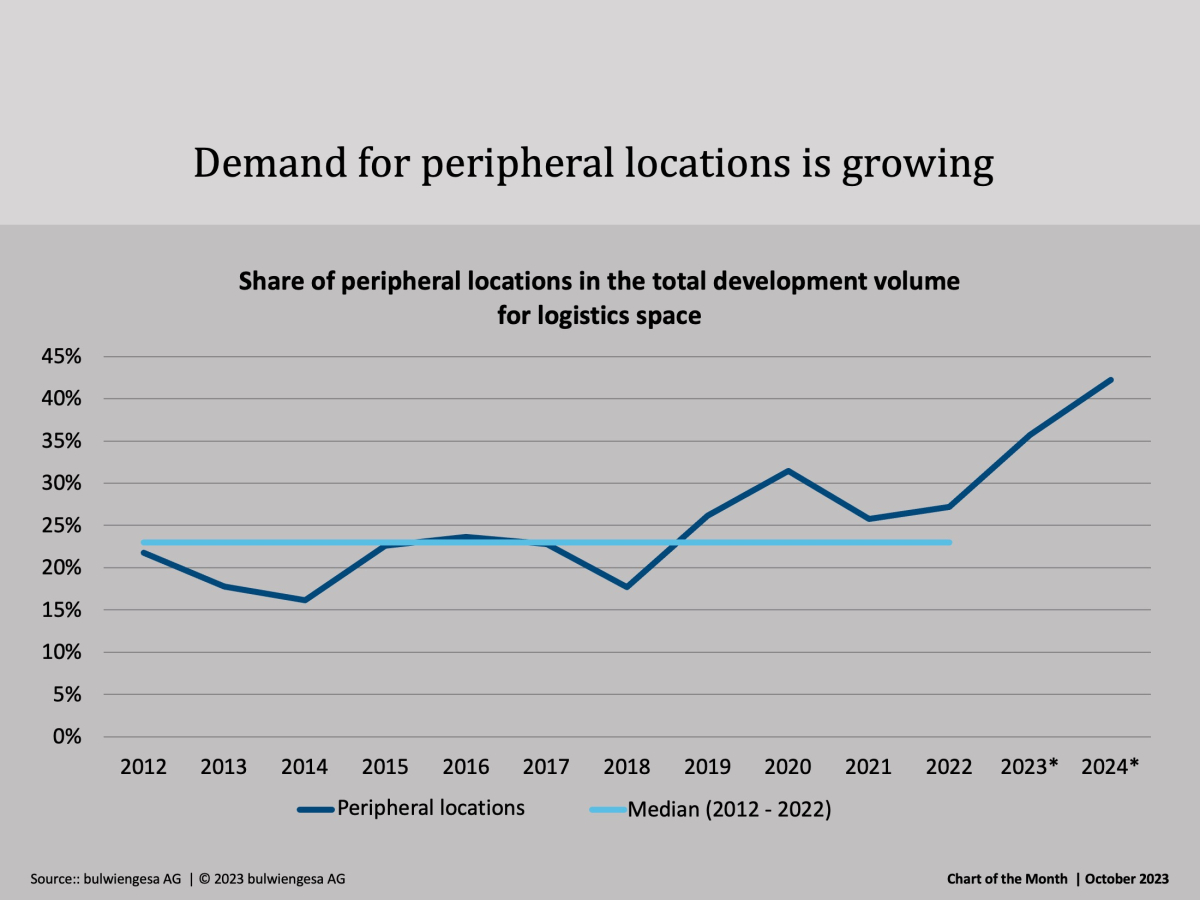

Office vacancies are increasing in the seven class A cities. According to classic economic theory, rents should therefore be falling. But our quarterly figures show: Prime rents are still risingChart of the Month October: Boom in the peripheral locations

The recently published study "Logistics and Real Estate 2023" shows: former "second-tier" regions are increasingly in demand - even those outside the classic logistics regions. And the trend is continuingInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.