The 5-second price

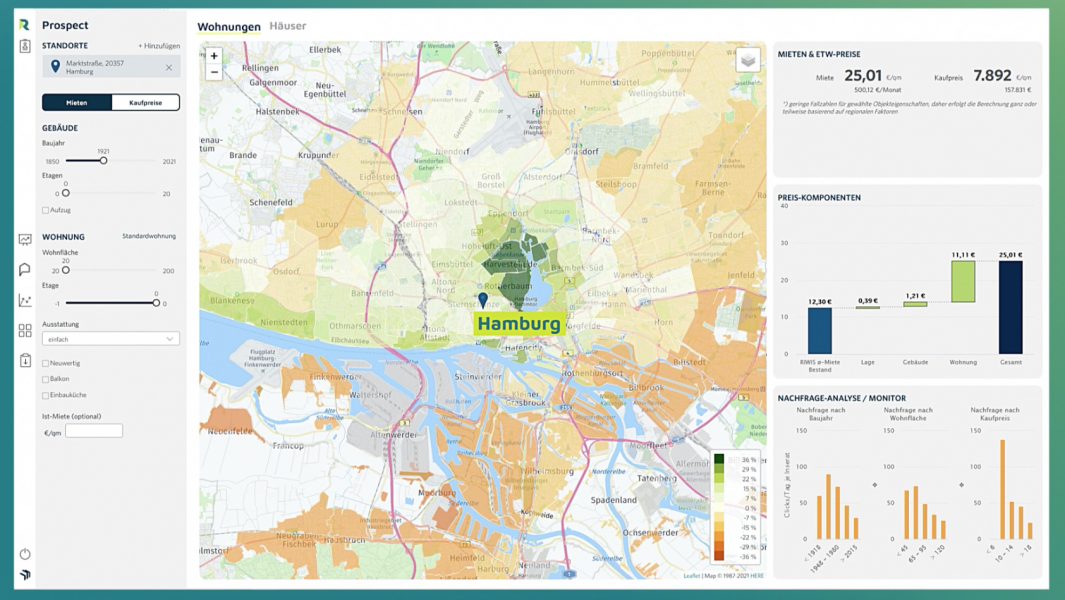

Whether an unrenovated old building in Leipzig, a detached house in Miesbach or an entire residential portfolio - our new tool "RIWIS Prospect" determines rental and purchase prices in just a few seconds. The algorithm is based on almost 10 million offer data that we have been evaluating since 2009. In many countries, by the way, such hedonic price models have long been established and recognised as a valuation method. Test it.

RIWIS Prospect is used by our clients to very simply determine the earnings potential for flats. The pricing model is based on data from property portals and additional market and location information from our RIWIS database. In addition to countless individual values, we have now also issued prices for portfolios with more than 20,000 residential units.

The core component of the application is a hedonic pricing model. This is an established method for determining the influences of individual properties on the value of a good. For residential properties, these are, for example, the price level of a market, the quality of the micro-location and its neighbourhood, essential building features and, of course, equipment features and qualities of the actual residential unit. As a result, the calculated purchase price as well as the rent can be output in five individual components: Market level, value of the location, quality of the property, equipment of the flat and, of course, the resulting total value. Outputted rents and prices always apply in the event of a new letting or sale at the current time.

Due to the complexity of the market, bulwiengesa does not rely solely on Big Data and complex algorithms, but combines data-based models with its many years of market expertise. In our experience, this is the best way to take regional and market-specific information and particularities into account.

Contact: Björn Bordscheck, Division Manager Data at bulwiengesa, bordscheck@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

Little movement on the German real estate market

For the eleventh time, bulwiengesa presents its comprehensive analysis of the German real estate markets. The results of this year's 5% study, conducted in collaboration with ADVANT Beiten, show that the German real estate market is characterized by widespread stagnation. At the same time, niche segments are becoming increasingly attractive. The market is increasingly rewarding professional asset management and specialist knowledge—a trend that separates the wheat from the chaffFive per cent returns no longer illusory even for core properties

The ‘5% study - where investing is still worthwhile’ celebrates its tenth anniversary. Since the first edition was published, the German property market has tarnished its reputation as a safe investment haven. Higher yields are now within sight, even for prime properties, and even residential property is increasingly becoming a profitable asset class again. The market is more exciting than it has been for a long timeValuation for corporate insolvencies

In turbulent times, more companies than ever are facing insolvency. According to our data alone, this affects around 400 project developments and countless existing properties. Ideally, valuations for insolvency administrations show more than the actual valueInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.