Double meaning: subsidised housing as an investment

For many years, investors gave subsidised housing and social housing a wide berth. But in the meantime, the turnaround in interest rates has made subsidised housing more attractive for them again, and transactions are increasing. For a joint study with INDUSTRIA, we analysed subsidised housing from an investment perspective

The creation of affordable housing is one of the biggest challenges for politics in the 2020s. This challenge has currently become much greater, as the rapid rise in interest rates and significantly increased construction costs have led to a considerable decline in new construction. At the same time, demand for affordable housing is high, all the more so due to sharp increases in heating and living costs. The federal government's target of building around 400,000 new dwellings per year also provides for 100,000 social housing units - a quarter. This ambitious goal cannot be achieved (if at all) with municipal housing associations alone. Private capital is also needed on a large scale.

Many investors who buy subsidised flats are insurance companies, pension funds and provident funds that invest their clients' retirement savings. In addition, subsidised flats are also part of special and housing funds, such as at INDUSTRIA. As a rule, investors are long-term oriented and often have an investment horizon of decades.

But subsidised housing is much more than just an investment: it can also be a contribution to solving a social problem: affordable housing is in short supply in Germany. In 2022 alone, 13 million German households - equivalent to 56 percent of all tenant households - were among the target group. Another problem with subsidised housing is that more flats fall out of the subsidy than new ones are created. In 2021, around 21,000 new subsidised flats were created, but at the same time the rent and occupancy commitments ended for almost 49,000 flats.

Transactions and pipeline

Within the last six years, transactions in the subsidised housing sector have steadily increased. A total of 358 transactions with 31,000 units of flats in new and existing buildings were traded between 2006 and the first half of 2022.

In total, a development pipeline of just under 86,000 social housing units can be defined in the 127 German RIWIS cities (A to D cities) from year of construction 2022. Berlin is the absolute front-runner with just under 20,600 subsidised housing units, followed by Munich with about

followed by Munich with about 8,200 units and Hamburg with about 5,300 rental flats.

Advantages and disadvantages of an investment in subsidised housing

Investments in subsidised housing do not offer the highest net initial yields; the aim is a calculable, long-term and low-risk commitment. Due to the commitment periods of up to 40 years, there is a great stability of value as well as a high level of security. The high demand for affordable housing offers above-average letting security with a low vacancy risk. The fluctuation rate is significantly lower than for privately financed flats. The risk of miscalculation is also lower and cash flow is more regular and predictable. One disadvantage is somewhat higher maintenance costs for the housing units if the quality of construction and fittings is simpler. Differences between subsidised and privately financed flats are hardly perceptible in current new construction projects. With long-term tenancies, the renovation potential is higher after moving out. In addition, the sometimes more difficult tenant structure can lead to higher administrative expenses.

Motives for buying subsidised housing units

Investments in subsidised housing are made for various motives. On the one hand, there is social pressure and political regulations. Binding quotas for socially subsidised housing in urban land use planning procedures are imposed motives for investment. More and more building land models in the cities are increasing the available investment volume in subsidised housing, making it easier to mix in portfolios.

The gradual improvement of the subsidy programmes - although the subsidy landscape has been extremely fragmented up to now - increases the incentive to invest. With significantly higher interest rates of currently 3-4 %, low-interest loans, usually the main element of a subsidy programme, again offer a cost advantage. Repayment subsidies, low-interest loans and other non-repayable subsidies are much more important than before the turnaround in interest rates. As a result, a distribution yield of up to 4.0 percent can be achieved. Generally, distribution yields are possible that are 30 to 100 basis points above those of privately financed housing.

In recent years, environmental, social and governance (ESG) criteria have become a significant factor of investment funds. The provision of subsidised housing is assigned to the social criteria. Accordingly, real estate should more strongly comply with sustainability goals as well as social responsibility; image cultivation is also an aspect that should not be underestimated.

Another motive for investing in subsidised housing is risk diversification and cash flow stabilisation of a portfolio. In summary, the higher significance of sustainability criteria, more defensive investment strategies and distribution yields, which can also be significantly higher than those in privately financed housing due to the interest rate turnaround in subsidised housing, are important motives for private buyers of subsidised housing.

Conclusion: Ideas are there, but policy must act

Housing projects with publicly subsidised rental flats are likely to have a significantly lower net return than privately financed flats. In view of the high demand for new construction, counteracting the decline in social housing can only be perceived as a joint task of the federal government, the federal states, local authorities and private investors. Public subsidised loans, also repayment subsidies and/or disbursed one-time subsidies offer an effective basis for attractive real estate investments, especially in high-interest phases. To this end, however, it is necessary to simplify the funding landscape for builders and first-time buyers across the Länder and to facilitate access to funding.

The targeted promotion of existing properties, for example with expiring rent control or also through changes of use, can make an important contribution to increasing the supply of social rented housing. The subsidy rates should be based on the land price level. In addition, a demand component should be incorporated so that construction tends to take place in cities in demand rather than in structurally weak rural regions.

At the same time, a paradigm shift from object to subject subsidies offers a solution to make housing affordable again for low-income households, especially in the big cities. To this end, the housing subsidy instrument must be significantly expanded. Last but not least, a consistent application of occupancy taxes is recommended in order to be able to make the many unoccupied flats available to tenants in real need.

In summary, we believe that there is considerable potential for optimisation in both object and subject promotion. Given the currently very difficult investment conditions for new buildings, these should be urgently addressed so that the current stock of approx. 1.1 million subsidised flats does not shrink even further.

Contact: Sabine Hirtreiter, Senior Consultant in the residential sector at bulwiengesa, hirtreiter@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

Little movement on the German real estate market

For the eleventh time, bulwiengesa presents its comprehensive analysis of the German real estate markets. The results of this year's 5% study, conducted in collaboration with ADVANT Beiten, show that the German real estate market is characterized by widespread stagnation. At the same time, niche segments are becoming increasingly attractive. The market is increasingly rewarding professional asset management and specialist knowledge—a trend that separates the wheat from the chaffFive per cent returns no longer illusory even for core properties

The ‘5% study - where investing is still worthwhile’ celebrates its tenth anniversary. Since the first edition was published, the German property market has tarnished its reputation as a safe investment haven. Higher yields are now within sight, even for prime properties, and even residential property is increasingly becoming a profitable asset class again. The market is more exciting than it has been for a long timeHow hot are the housing markets?

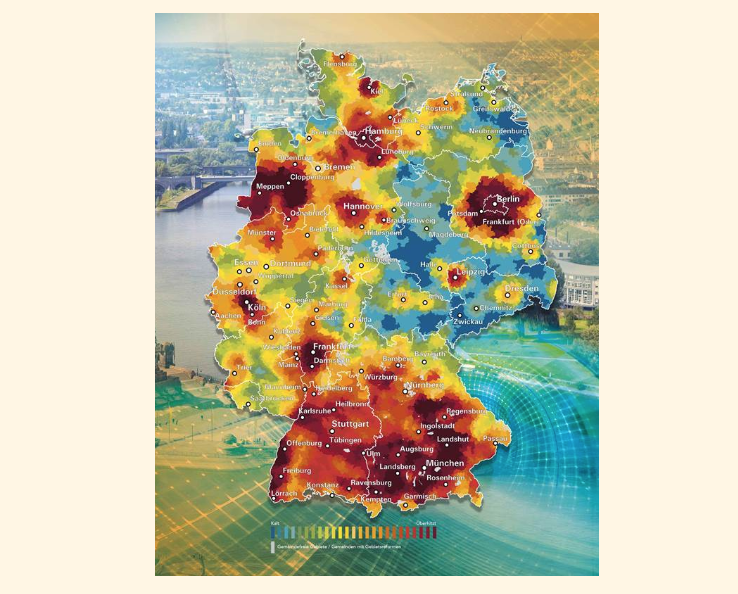

The rise in interest rates is putting a massive damper on residential construction. For the fifth time, we have analysed the relationship between supply and demand for each of the more than 11,000 German municipalities together with BPD for the "Housing Weather Map"Interesting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.