Little movement on the German real estate market

For the eleventh time, bulwiengesa presents its comprehensive analysis of the German real estate markets. The results of this year's 5% study, conducted in collaboration with ADVANT Beiten, show that the German real estate market is characterized by widespread stagnation. At the same time, niche segments are becoming increasingly attractive. The market is increasingly rewarding professional asset management and specialist knowledge—a trend that separates the wheat from the chaff

Key findings

- Commercial real estate market remains in a wait-and-see mode – uncertainty particularly prevalent in the office sector

- Industrial real estate leads the yield ranking

- Logistics reach the 5% mark for the first time with selective entry opportunities

- Residential real estate shows increased investor interest with stable yields

- Little market movement characterizes the overall picture for 2025

Commercial real estate: Uncertainty blocks the market

The commercial real estate market remains in a pronounced wait-and-see mode. Uncertainty persists, particularly in the office market.

“Questions remain regarding future demand for office space and CapEx requirements for existing properties due to increased energy renovation needs.”

Sven Carstensen, CEO of bulwiengesa

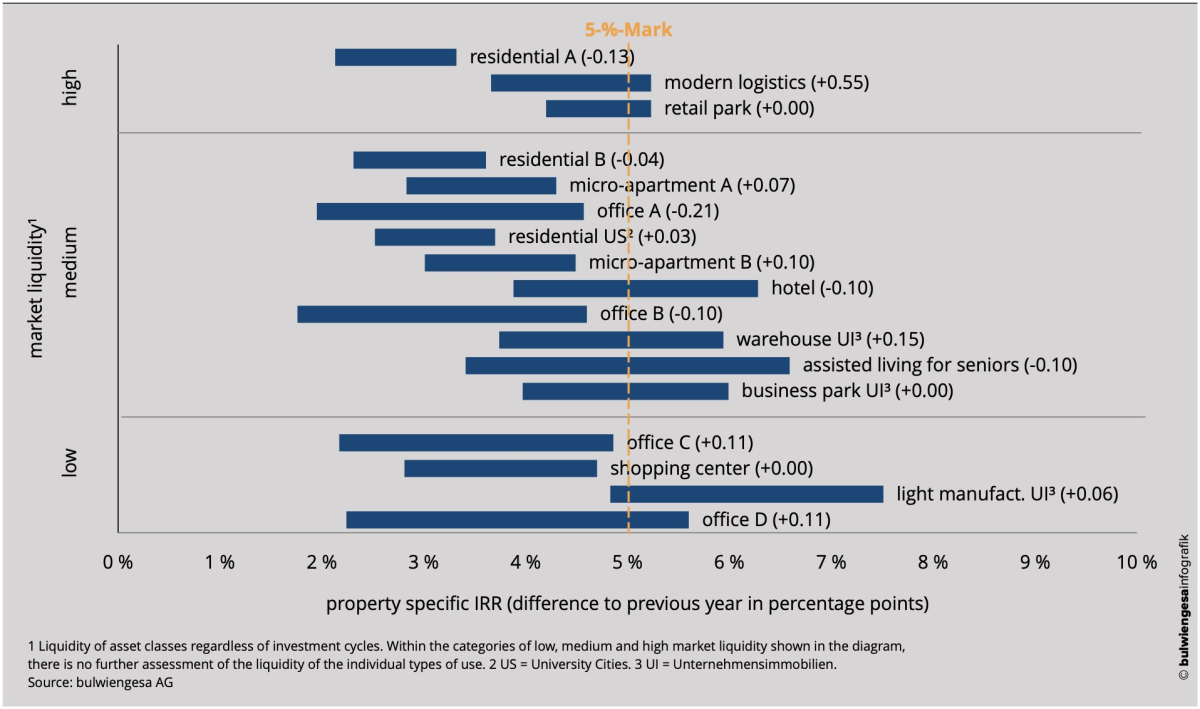

In A markets, office properties are showing a slight easing of 21 basis points to 3.91% IRR, but the transaction market remains fragmented. The price expectations of buyers and sellers often remain far apart.

Production properties lead the yield ranking

Production properties are once again at the top of the study's yield ranking. With a base IRR of 6.14%, they offer investors above-average prospects, but require specialized management expertise and are closely linked to economic fluctuations. The core range extends from 4.83% to 7.51%.

Logistics reaches 5% mark for the first time

Modern logistics properties exceeded the symbolic 5% threshold in 2025 and achieved a base IRR of 4.93% – a significant increase of around 60 basis points. Rent increases were slightly above the previous year's level, resulting in selectively good entry opportunities. The core range extends from 3.66% to 5.23%.

Despite the gloomy overall economic environment, demand for high-quality logistics real estate remains stable, with quality increasingly becoming the decisive factor.

Residential: Stable environment with increased investor interest

Residential real estate is showing stable returns without any dramatic movements. A markets recorded a slight decline of 15 basis points to 2.8% IRR, while B markets (3.01% IRR) and university cities (3.24% IRR) rose slightly.

“Interest in residential investments increased significantly in 2025, especially outside the A markets,” reports Carstensen. “This trend is likely to continue.”

With current inflation at 2-2.5%, residential real estate remains an attractive investment alternative, with investor interest increasingly expanding to secondary markets.

Microliving: Benefiting from the housing shortage

Furnished apartments are performing well, with IRR values of 4.11% in A cities and 4.32% in B cities. The ongoing housing shortage in German cities is creating continuous demand for these flexible living solutions.

Other asset classes in detail

Logistics real estate: Significant upturn

Modern logistics real estate recorded a significant increase of 50 basis points to 4.93% IRR. The core range extends from 3.66% to 5.23%. Despite the gloomy economic environment, demand for high-quality properties remains stable.

Hotel real estate: Continuous recovery

Hotels are showing positive development with base values between 4.49% and 4.87% for 2- to 4-star establishments. Occupancy rates and room prices have stabilized at a robust level, with performance depending heavily on the operator.

Retail: Food as an anchor of stability

Retail parks with a focus on food remain in constant demand at 4.34% IRR. Shopping centers are stable at 4.89%, but are mostly only traded with conversion options.

Non-core segment: Opportunities for specialists

Opportunities are increasingly opening up for yield-oriented investors in the distressed segment, while institutional investors are avoiding these properties due to a lack of ESG compliance.

“Return-oriented investors are finding increasingly attractive opportunities in the distressed real estate segment. The key challenge will be to identify which distressed properties can still be prepared for the institutional market.”

Klaus Beine and Florian Baumann, both Partners at ADVANT Beiten

Non-core office properties can achieve IRRs of up to 10%, but also carry the risk of total loss. Investors with strong technical management expertise are particularly successful in this area.

Corporate real estate: A stable alternative to traditional investments

Corporate real estate is establishing itself as a sustainable alternative:

- Industrial parks: 5.22% IRR (base), core range 3.97%–5.99%

- Warehouses: 4.59% IRR (base), core range 3.74% - 5.94%

- Production: 6.14% IRR (base), core range 4.83% - 7.51%

These management-intensive asset classes are characterized by stable cash flows and high flexibility of use.

Methodological basis

The study is based on a Monte Carlo simulation with 1,000 calculation runs and analyzes the internal rate of return (IRR) of various asset classes over an assumed holding period of ten years. A total of 127 office markets and 68 residential markets in Germany were examined.

Core real estate is defined as investments with a stable rental situation and sustainable location parameters, while non-core investments have an increased risk profile with correspondingly higher performance potential.

Conclusion: Differentiation as the key to success

The 5% Study 2025 makes it clear: the German real estate market has come of age. Blanket market assessments no longer do justice to the current reality. Successful real estate investments today require a differentiated approach, specialized know-how, and a willingness to invest outside the established paths.

The market rewards quality and professional management—a development that strengthens Germany as an investment location in the long term and creates new opportunities for specialized players.

Contact: Anna Wolfgarten, consultant at bulwiengesa, anna.wolfgarten@bulwiengesa.de, and Sven Carstensen, CEO, sven.carstensen@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

Five per cent returns no longer illusory even for core properties

The ‘5% study - where investing is still worthwhile’ celebrates its tenth anniversary. Since the first edition was published, the German property market has tarnished its reputation as a safe investment haven. Higher yields are now within sight, even for prime properties, and even residential property is increasingly becoming a profitable asset class again. The market is more exciting than it has been for a long timeValuation for corporate insolvencies

In turbulent times, more companies than ever are facing insolvency. According to our data alone, this affects around 400 project developments and countless existing properties. Ideally, valuations for insolvency administrations show more than the actual valueProject developments: Few in planning, many postponed

The crisis is now clearly visible among project developers. The market in the seven class A cities is declining, and the traditional project developers in particular are withdrawing from the market. Residential projects, of all things, are significantly affected. And: Many projects are being completed later than plannedInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.