Constant to desperate

Apparently nothing can shake the domestic real estate market - Germany is and remains the place to be for investors. Especially flats, logistics properties and offices in top locations are in constant to almost desperate demand. In other segments, however, risk premiums have continued to rise. The current 5 % study shows potential returns.

Since 2015, the 5% Study has offered a compact market overview and provides a new approach to describing real estate markets. Using a dynamic model, the study determines the probable internal rate of return (IRR) of an investment for an assumed holding period of ten years. This makes it possible to calculate annual returns on investments and compare the earnings prospects of different asset classes.

On 2 November 2021, we presented the current study together with Klaus Beine, lawyer and notary at the long-standing study partner ADVANT Beiten, Karin Groß, Head of Portfolio Management at Ärzteversorgung Westfalen-Lippe, and Ellen Heinrich, Project Manager and ESG Officer at bulwiengesa.

The most important results

Housing market

The housing market remains stable, but is characterised by some uncertainties. Even though the rent cap in Berlin has failed for the time being, the new federal government will probably supplement or extend the existing federal laws in order to further regulate the rental market. In addition, a turnaround in interest rates is to be expected in the medium term. Despite high investment demand, bulwiengesa expects a slight decline in purchase price factors for existing multi-family houses due to rising interest rates. Nevertheless, the level will not fall below the values of 2020, and the market remains very vital.

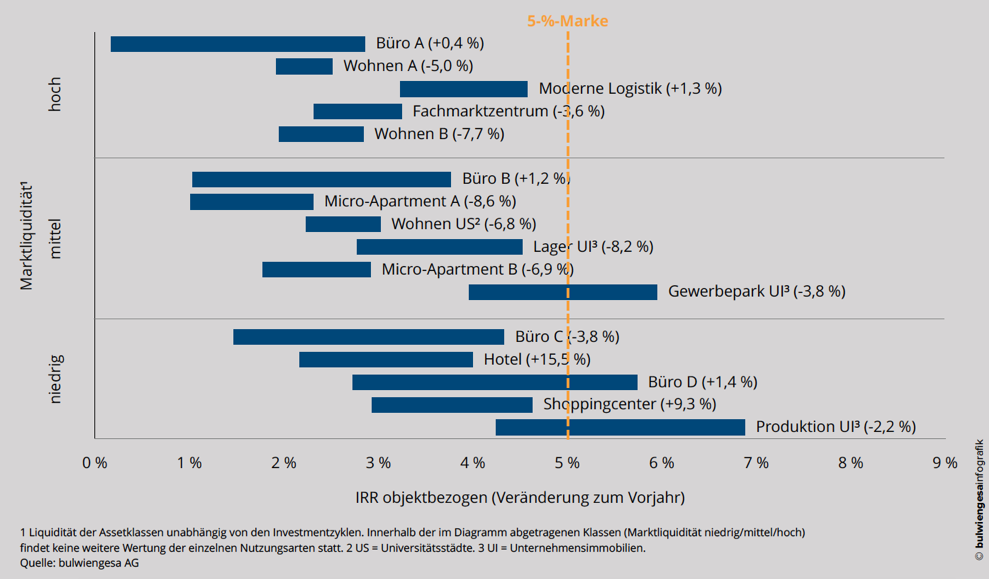

The IRR ranges in the current study have been calculated on the basis of the existing legal conditions - should there be further tightening, this will have a negative effect on the achievable returns. For residential properties in A-markets, the range is 1.9% to 2.5%.

In the medium term, we estimate that the risks for residential properties will be somewhat higher than in the past years due to increasing rent rates for age-related investments. In addition, the rent increase rate has become lower. Regulatory measures such as the reduction of the modernisation levy, the restrictions on the conversion of rented to owner-occupied residential units and the anticipated reduction in the CO2 levy are contributing to this.

Logistics

Logistics equipment is one of the asset classes that benefited strongly from the corona crisis and the changing consumer habits. Logistic properties remain the darlings of investors. Increasing demand is also expected here in the medium to long term, which will have a positive effect on rental development if the supply is limited. They have also established themselves as an independent asset class. This means that there is a high demand for transactions even in weak market phases. They are currently proving their robustness.

In the case of performance management, increased inflation rates and rent increase potentials are offset by decreasing initial yields. The return potential is therefore comparatively high. For modern logistics properties, the IRR range is 3.2 to 4.6%, almost unchanged from the previous year.

Figure: Core-Matrix

Retail

The gap in investment demand for retail properties is widening further: properties with a focus on periodal demand continue to be very popular, and purchase prices have increased again. Stable to rising rental income, generally long-term leases and consumer demand, which has proven to be very robust, especially in the corona lockdown, speak in favour of this asset class. At 2.3% to 3.2%, secure returns are achievable for retail parks; compared to the last study, this is a decline.

On the other hand, the demand for investments in shopping centres had already fallen sharply well before the Corona pandemia. In many properties, it is not yet clear whether there will be further rent reductions - this applies in particular to the areas beyond the ground floor. The rent range for shop premises is currently between 2.9% and 4.6% and has risen again compared to the previous year (2.5% to 4.3%).

Office market

Despite the crisis, the commercial investment market proved to be robust, and offices continued to be a rather sought-after asset class. The average net initial rents across all A-cities were again 2.8%. Because the general conditions on the capital and investment markets as well as the office markets are good, yields will remain under pressure in 2021.

The core area - i.e. long-term leased properties in sought-after locations - in the office segment is very popular with investors. Here they are prepared to invest even with low to very low IRRs - the range is 0.2% to 2.9%. Despite the higher inflation rates, which lead to a dynamic development of the portfolio rents, there are hardly any increases to be seen here compared to the last study.

The pressure on rents remains enormously high. Therefore, even the smaller office markets have not lost any of their attractiveness. IRRs of 2.7 % to 5.7 % are achievable in core class D cities. However, investors need very good regional knowledge. The number of offers in these cities is also rather low. On the other hand, price reductions are to be expected for opposing investments, which have become increasingly important in recent years due to their pension benefits.

Note: You can download the study from the bulwiengesa website.

Contact persons: Sven Carstensen, Member of the Board at bulwiengesa, carstensen@bulwiengesa.de and Anna Wolfgarten, Junior Consultant at bulwiengesa, wolfgarten@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

Little movement on the German real estate market

For the eleventh time, bulwiengesa presents its comprehensive analysis of the German real estate markets. The results of this year's 5% study, conducted in collaboration with ADVANT Beiten, show that the German real estate market is characterized by widespread stagnation. At the same time, niche segments are becoming increasingly attractive. The market is increasingly rewarding professional asset management and specialist knowledge—a trend that separates the wheat from the chaffFive per cent returns no longer illusory even for core properties

The ‘5% study - where investing is still worthwhile’ celebrates its tenth anniversary. Since the first edition was published, the German property market has tarnished its reputation as a safe investment haven. Higher yields are now within sight, even for prime properties, and even residential property is increasingly becoming a profitable asset class again. The market is more exciting than it has been for a long timeRefurbishment of offices - what is the status?

Around a third of office space in the seven A cities is in need of refurbishment. But things are happening - especially where rents are high. This is shown by the first apoprojekt stock compassInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.