Retailers need to rethink - but in which direction?

The Hahn Group's new ‘Retail Real Estate Report’ has been published - a classic for anyone involved in retail property. We have been contributing to it since 2018 and have once again presented the most important retail sectors, economic developments, forecasts and trends.

New retail sales records, but not in real terms. The retail sector cannot escape the challenging environment. Keywords such as urbanisation, supply chains, mobile working, migration, digitalisation and energy efficiency require retailers to constantly adapt to new framework conditions under high cost pressure. Nothing new, really. The slogan ‘Retail is change’ has always been true. But one thing is new: the expansion of the last two decades seems to be over. Cities are losing a massive number of retail outlets, entire shopping centres are shifting or being abandoned.

The large chain stores are optimising their store network and concentrating on what they consider to be the best, good locations. At the same time, they are rethinking their space requirements. Large chain stores have had to file for insolvency or are in insolvency proceedings. Owner-managed businesses are going out of business, partly because there is no succession plan. Overall, demand for retail space is falling, which is increasing the pressure on rent levels. This presents local authorities with new, far-reaching challenges. Formerly well-functioning shopping streets are characterised by high vacancy rates. Property values are falling. As a result, many cities are also losing their appeal. And the retail parks and retail park locations? They seem almost immune to this.

Speciality stores and retail warehouse locations with positive signs

While administrators, politicians, urban planners, city managers and many other stakeholders are looking for solutions that are not yet in sight, retail parks and retail warehouse locations with their food anchors appear to have a solution in store. In particular, food retailers, drugstores, DIY stores and non-food discount stores non-food discount stores in particular are focussing on bricks-and-mortar retail and are stable consumers of space, as the retailer survey in this report once again shows.

Urban shopping centres face challenges

The many advantages that numerous city centres have enjoyed as a result of expansive retail are suddenly being reversed. Many stakeholders say that a rethink is needed, although it is completely unclear how and where. One thing is clear, the situation will probably never be the same again as it was with retail-led urban development. Something else must now follow. Residential and catering-based development components will become more important, but it will be a slow and difficult path that will require a lot of patience from all stakeholders.

The effects of the coronavirus pandemic are diminishing, dealing with an increased inflation rate is becoming more routine and new challenges are coming into focus.

As always, trade will also master this phase, despite temporary stagnation.

Note: We can also send you a printed version of the report on request. Please do not hesitate to contact us. Further information is also available on the Website der Hahn AG.

Contact: Dr Joseph Frechen, Head of Retail and Branch Manager Hamburg, frechen@bulwiengesa.de and Andrea Back-Ihrig, Partner, back@bulwiengesa.de.

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

Little movement on the German real estate market

For the eleventh time, bulwiengesa presents its comprehensive analysis of the German real estate markets. The results of this year's 5% study, conducted in collaboration with ADVANT Beiten, show that the German real estate market is characterized by widespread stagnation. At the same time, niche segments are becoming increasingly attractive. The market is increasingly rewarding professional asset management and specialist knowledge—a trend that separates the wheat from the chaffFive per cent returns no longer illusory even for core properties

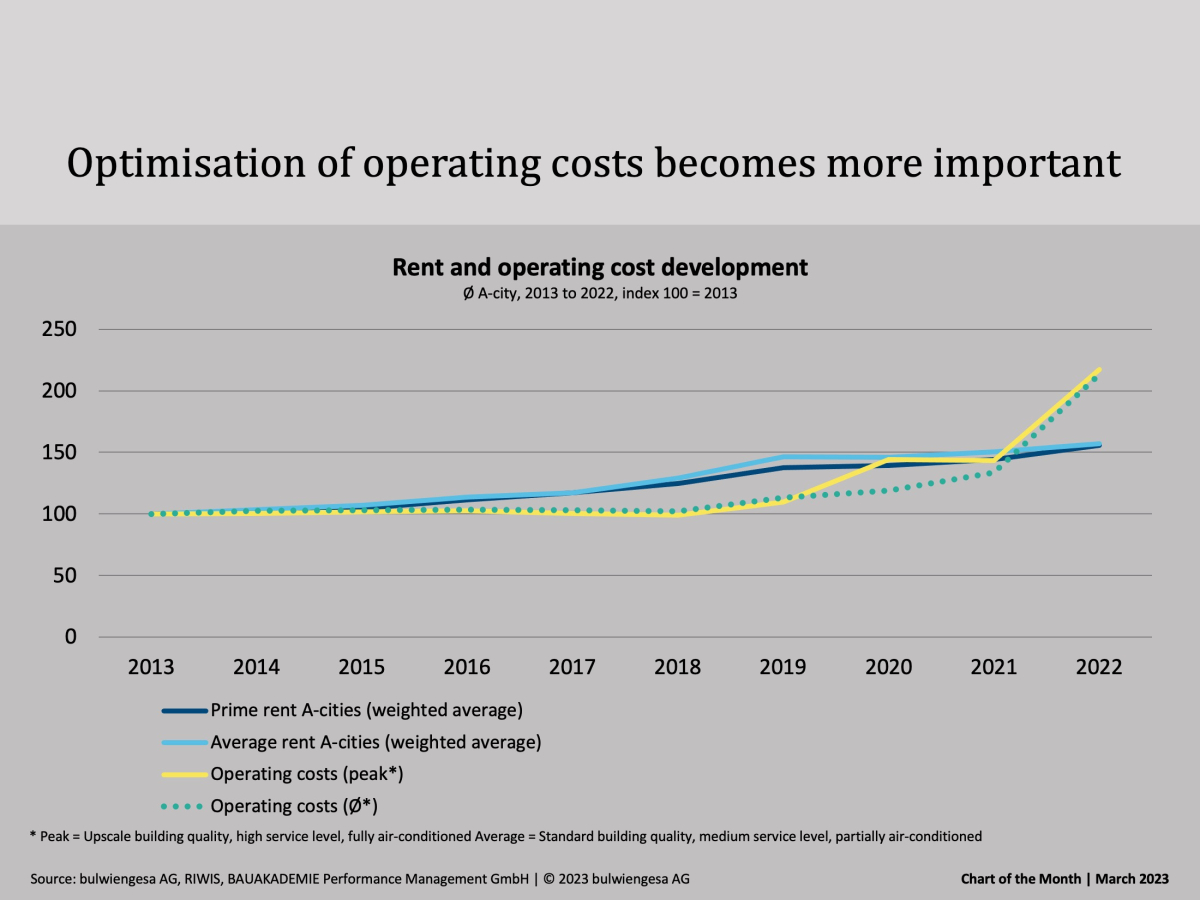

The ‘5% study - where investing is still worthwhile’ celebrates its tenth anniversary. Since the first edition was published, the German property market has tarnished its reputation as a safe investment haven. Higher yields are now within sight, even for prime properties, and even residential property is increasingly becoming a profitable asset class again. The market is more exciting than it has been for a long timeClone of Clone of Chart of the Month March: Increased rents and operating costs burden office tenants

The increase in rents and operating costs affects all real estate segments. For example, the operating costs for offices in A-cities alone have increased by 63 % since 2021. This is the result of the first joint study "Overall Rental Analysis - Office Market Germany" with BAUAKADEMIE.Interesting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.