Magazine

Chart of the Month

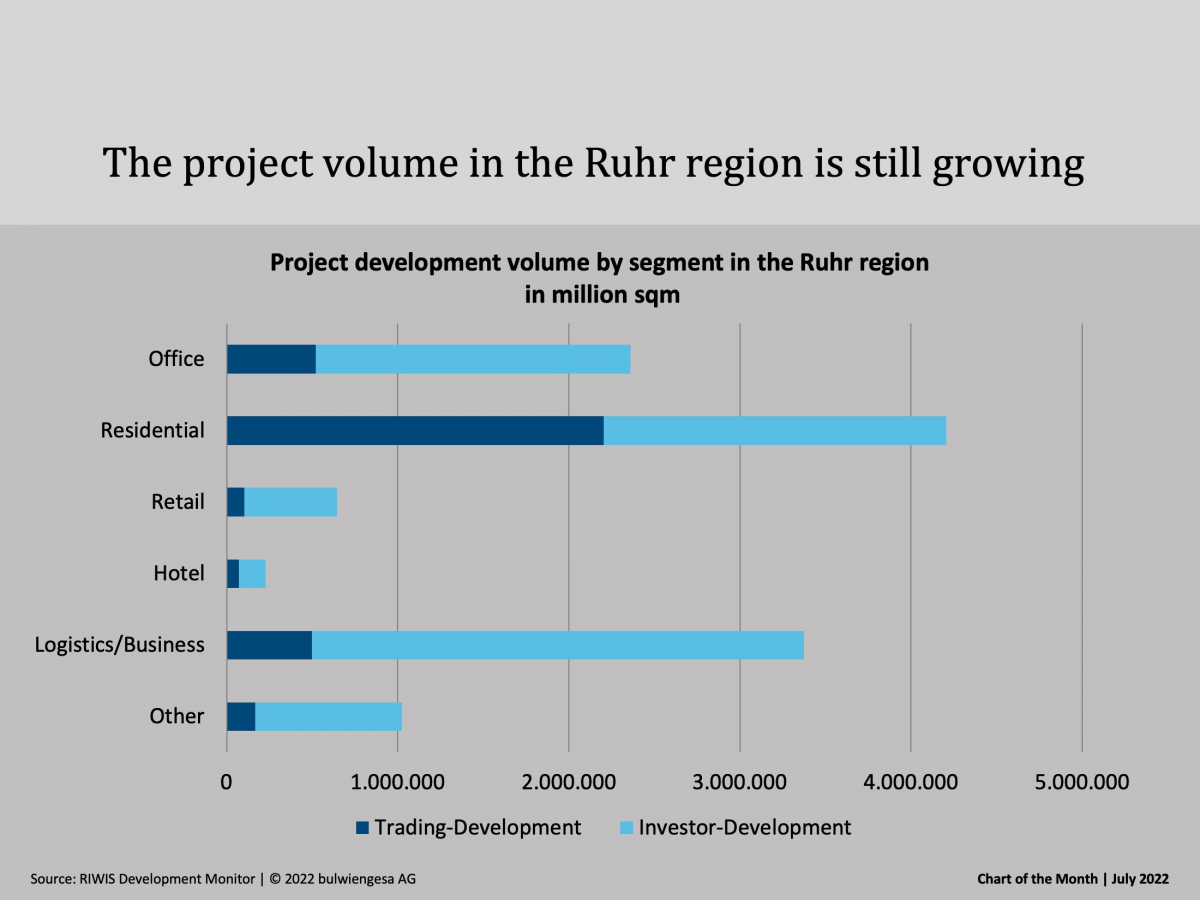

Chart of the Month July: Ruhr Area bucks the trend

Across Germany, the market for project developments is under scrutiny. Nevertheless, the project development volume in the Ruhr region will increase by around 7 % between 2020 and 2022 - and the pipelines are still full.

Residential

The smaller, the more lucrative

For the new report of the Micro-Housing Initiative, we interviewed the operators: for example, about the increased energy costs, their marketing efforts and the state of their business after Corona. The report also contains extensive best practice recommendations for the operation and construction of flats.

Background

No Panic!

The shocks in the global economy are having an impact on the real estate market. Inflation rates have been rising since the end of 2021 and it has become obvious that the lax monetary policy will have to come to an end quickly. However, we should beware of hastily constructed crash scenarios.

Background

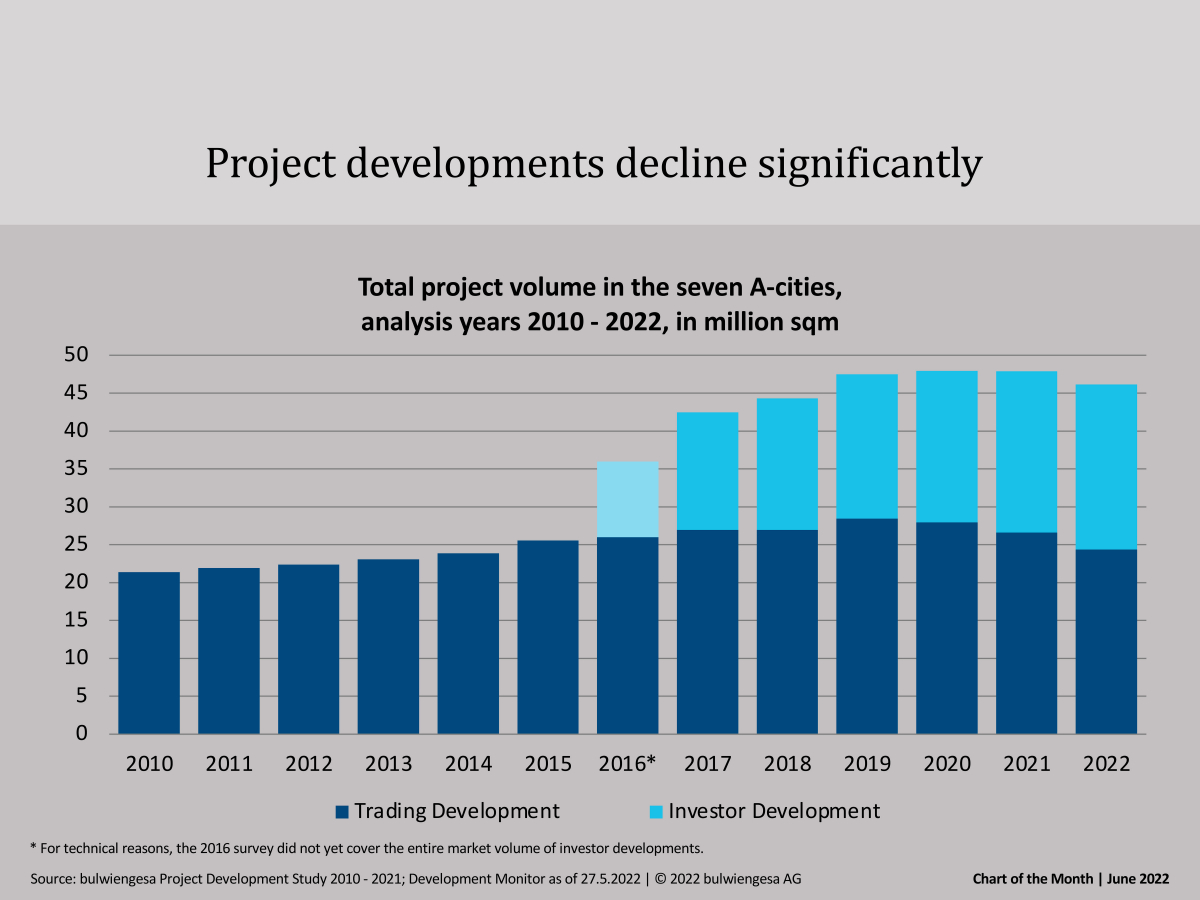

Project developer market 2022: Turnaround and change at the same time

Project developers find themselves in the grip of rising interest rates, inflation and the explosion of construction costs. After years of growth, the German project development market is faltering. Our current analyses show: The overall market in A-cities is declining significantly, especially in residential. This reinforces the suburban trend

Chart of the Month

Chart of the Month June: Fewer Project Developments

In the seven class A cities, the project volume now amounts to only 46.2 million sqm. This corresponds to a decline of 3.6 per cent compared to the first Corona year 2020. Trading development in particular is on the decline, while portfolio holders continue to build and plan diligently.

Chart of the Month

Chart of the Month May: Retail vacancy rates in German cities

How are retail vacancies developing? We have looked at the established retail locations in the metropolises of Berlin, Hamburg, Frankfurt, Munich and Cologne. We regularly survey the retail stock there and thus also the vacancy rate. The analysis shows: Vacancy rates have increased most significantly in the top retail locations.

Background, Residential

Update hotel real estate

After two years of emergency, the hotel market is still far from pre-crisis levels. Now the situation seems to be improving in slow steps, even if the industry is still wavering between hope and fear

Background

Six recommendations for commercial real estate

As "real estate wise men", we looked at office, corporate, logistics and hotel real estate for the Spring Report. And we made six recommendations for politics and business. Three of these recommendations have to do with sustainability

Chart of the Month

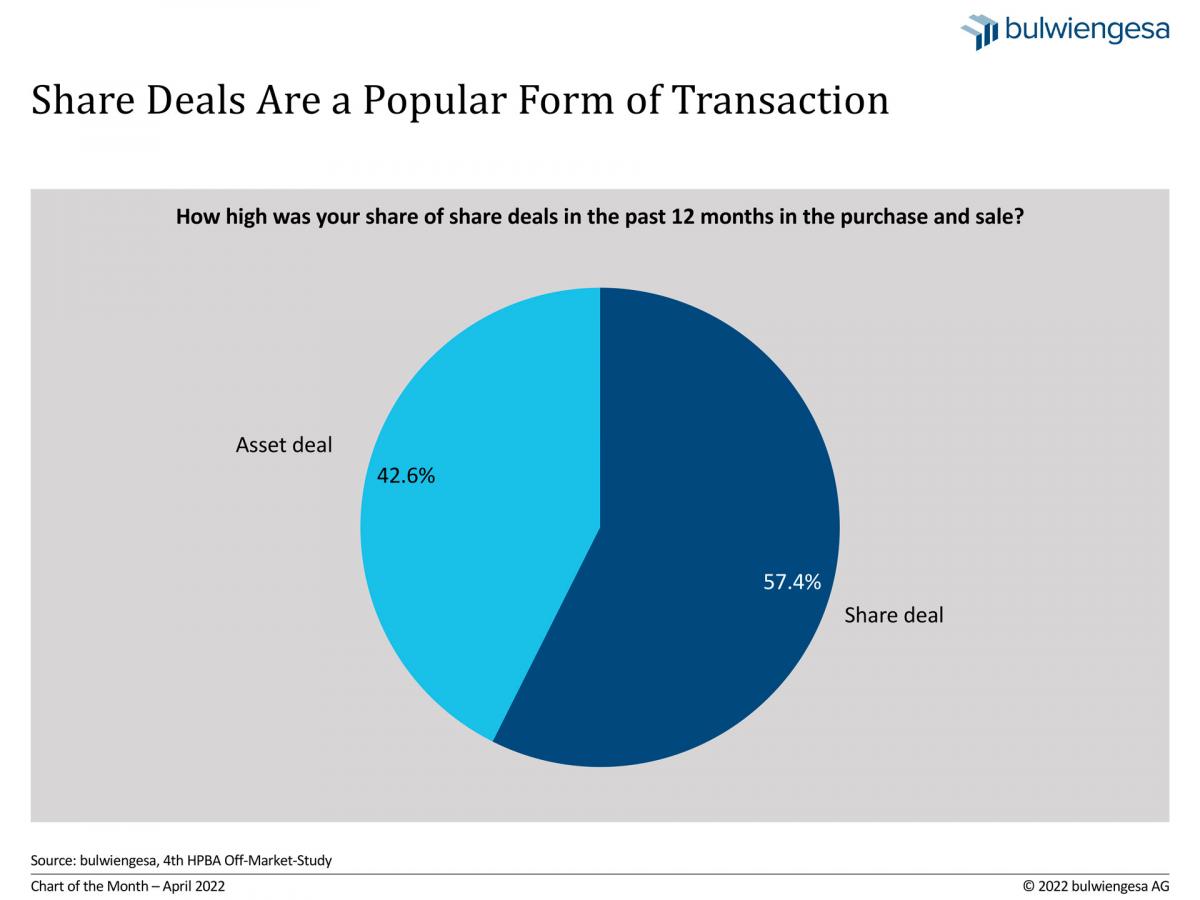

Chart of the month April: Share deals are the reality

Share deals are politically controversial, as no real estate transfer tax is payable on the purchase of large real estate portfolios. According to our off-market study for HPBA, about six out of ten transactions take the form of a share deal

Background, Residential